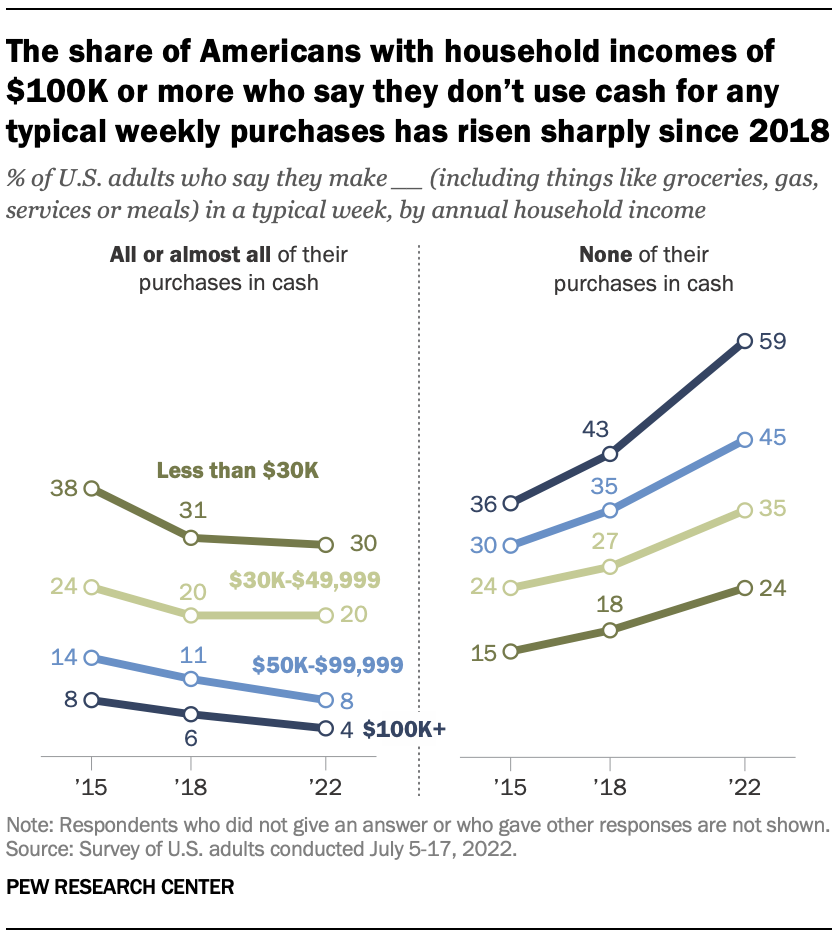

There are also differences by race and ethnicity in cash usage. Roughly a quarter of Black adults (26%) and 21% of Hispanic adults say that all or almost all of their purchases in a typical week are paid for using cash, compared with 12% of White adults who say the same…

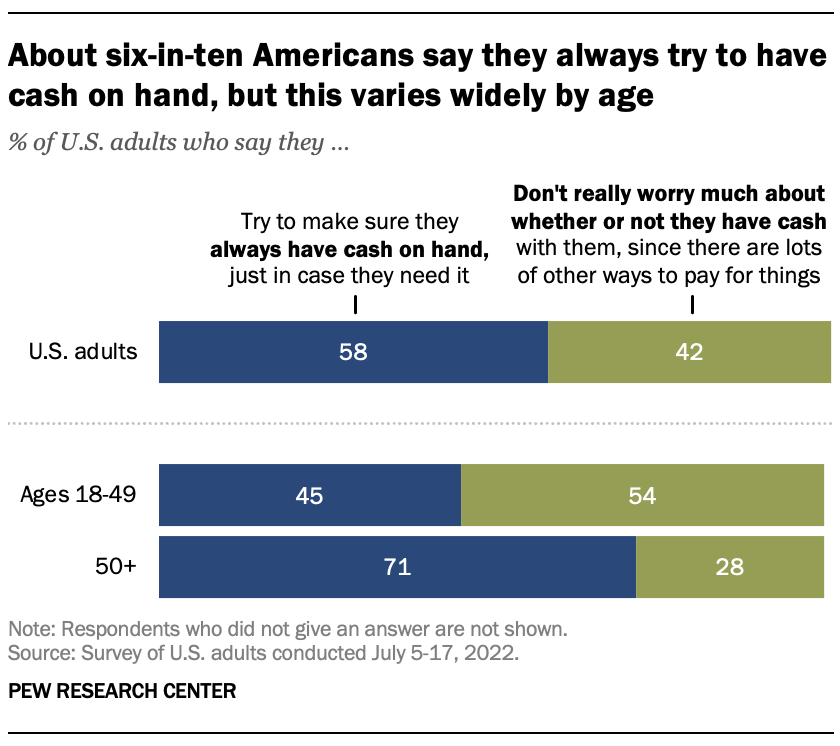

Even though cash is playing less of role in people’s weekly purchases, the survey also finds that a majority of Americans do try to have cash on hand and, as was true in previous surveys, Americans’ habits related to carrying cash vary by age…

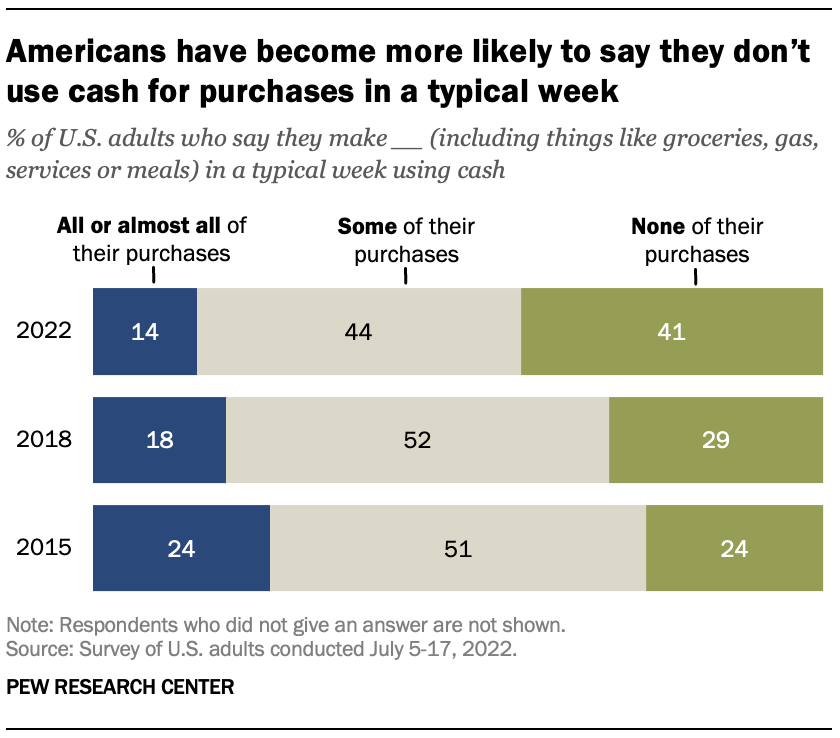

Cash payments accounted for 20% of purchases in 2021, down from 26% in 2019. The Fed says cash use dropped significantly from 2019 to 2020 due to the onset of the pandemic, and then in 2021, cash use was up slightly from 2020…

Americans expect that the shift away from cash purchasing will continue. Gallup reports that 64% of U.S. adults say it’s likely the U.S. will become a cashless society in their lifetimes. If that were to happen, 45% of people say they would be upset, 9% would be happy, and the rest are indifferent.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money