A basic understanding of gold price phases throughout the year [provides the answer to the question:] “What’s next for the price of gold?” Let me explain. Words: 758

answer to the question:] “What’s next for the price of gold?” Let me explain. Words: 758

So says Marco G. (http://goombarhsedge.blogspot.com/) in an article* which Lorimer Wilson, editor of www.munKNEE.com, has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Marco goes on to say:

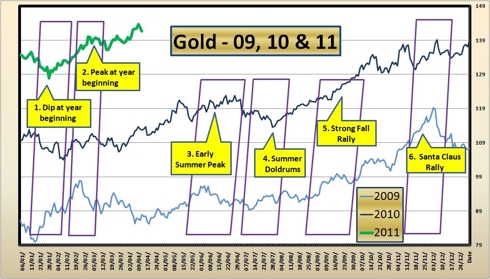

A review of [recent] history…. [shows that] there seems to be 6 definite phases that…gold prices move through during the year… [according to] the following chart [over the past] two years of daily closing prices:

(The author did not use 2008, as the economic disruptions at that time may give unreliable data. Also the years prior to 2008 were not used as the author believes the world changes with time and the economic drivers back then may have changed too much for any relevance to 2011.)

The 6 Phases in The Annual Movement in the Price of Gold

Examining the chart [above], one can definitely pick out the phases that the gold price seems to go through during a yearly cycle. Following are the ascertained phases with a brief description for each:

Phase #1: Dip at Beginning of Year

After the gains in the usual strong fall season gold prices seem to take a dip at the beginning of the new year. Perhaps it is just to take a breather or to consolidate a while before starting to rise again, possibly in conjunction with the coming of the lunar New Year for Asian countries. Note that the phases do not have a definite start and end date but [, rather,] a loose correlation from year to year.

Phase #2: Early Year Peak

After the dip at the start of the new year there appears to be a gold price peak that follows relatively soon (within one month of the dip). Then there is indecision, as the gold price meanders up and down, akin to what is happening currently. Some pundits are calling for a fall and others for a further rise. There is no definitive action.

Phase #3: Early Summer Peak

Then a bit later, toward the end of spring, the gold price seems to take a final push upward before resting for the summer. This peak is not very strong and may not be a long period of advance – it may not even be higher than the previous peak as in 2009. It is merely a last push upward before the summer’s onset.

Phase #4: Summer Doldrums

Summer is usually when the gold price takes a rest. In 2009, the rest for gold was almost 3 months long. In 2010, Gold did not take barely a month’s rest, before in late July, it started rising in the annual fall rally.

Phase #5: Strong Fall Rally

Fall is the strong season for the gold price. The price rises are long and strong, lasting almost until the new year. In both 2009 and 2010, major gains for the gold price were made in this fall rally. Toward the end of October and early November, there may be a small dip in the Gold price. This may be attributed to the annual portfolio rebalancing that major funds perform.

Phase #6: Santa Claus Rally

Finally in late November and early December, there is usually a Santa Claus rally. This caps the year for the gold price rises making gold investors a jolly ol’ group.

My Prediction of Gold Price Gains for 2011

Using the above information on the chart and examining the historical data that gives percentage gains of about 25% in 2009 and 29% for 2010, the author calls for between a 30% to 35% gain this year for the gold price. This will equate to a range for the gold price to end 2011 at from $1847 to $1918 in USD. This forecast is nowhere near scientific and it is merely an educated guess [but, surprisingly, it is right in the ballpark according to the fractal technical analysis of Goldrunner as discussed here ($1860) and here ($1975)].

*http://seekingalpha.com/article/263491-timing-is-everything-assessing-the-price-of-gold?source=email_macro_view

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money