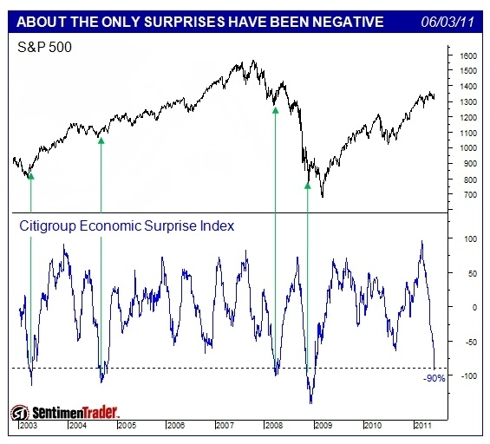

Economic Surprise Index Suggests Powerful Rally Coming Soon

A market is not built solely on fundamental realities, but how broadly those realities are expected by investors. So it goes without saying that it can be very insightful to compare market expectations to reality. When expectations are high there is the likelihood for disappointment. When expectations are low there is a potential for upside surprise. There is actually an index that measures the relationship between economic reality and crowd expectations. It is the Citigroup Economic Surprise Index (CESI). [Let’s take a look at what it is saying these days.] Words: 773

So says Brad McFadden (www.dailytradingreport.com/) in excerpts from an article* which Lorimer Wilson, editor of www.munKNEE.com (It’s all about Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. McFadden goes on to say:

Here is a clinical description:

The Citigroup Economic Surprise Indices are objective and quantitative measures of economic news. They are defined as weighted historical standard deviations of data surprises (actual releases vs Bloomberg survey median). A positive reading of the Economic Surprise Index suggests that economic releases have on balance beating consensus. The indices are calculated daily in a rolling three-month window. The weights of economic indicators are derived from relative high-frequency spot FX impacts of 1 standard deviaion data surprises. The indices also employ a time decay function to replicate the limited memory of markets.

As any avid market follower knows, economic numbers have been unusually disappointing as of late. According to the CESI the rise in data disappointment has been the strongest and deepest since the recession.

At current levels, Citi’s surprise index is the lowest it has been since January 2009, but as recently as March, the index was at a record high (since 2003). This means that, earlier this year, when economists were still worried about the second-half slowdown in 2010, data consistently surprised to the upside. Then, when economists started to get comfortable with the idea that the recovery was just fine, data consistently surprised to the downside. In short, economists became overly optimistic and now, just a few short weeks later, they are overly pessimistic!

Sign up for your FREE weekly “Top 100 Stock Index, Asset Ratio & Economic Indicators in Review”

A top in a bull market is characterized by a general unwillingness by the bulls to throw in the towel in light of negative news. Given how rapidly the Economic Surprise Index has fallen over the last 6 weeks or so and how the Dow has only fallen by some 6%, the latest round of weakness in US equity markets has all the hallmarks of being just another “conventional” market correction rather than being a long-term cyclical top in the major market equity indices.

Now add to the previous discussion the fact that:

- Many large caps US stocks are trading with P/Es and forward P/Es below 10x

- Bottom up analysts have not downgraded earnings projections on the S&P 500

- Credit conditions remain robust and liquidity is not contracting

- Other market sentiment indicators such as the AAII survey etc are suggesting that sentiment is either equal to, or at least not far off from, the lows reached after last year’s flash crash.

Who in the world is currently reading this article along with you? Click here to find out.

A very powerful case can be made for there being limited downside in major market US equity indices. I continue to say to clients that one should see any weakness in large cap US stocks as a buying opportunity rather than reason to panic and sell.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

*http://seekingalpha.com/article/274926-extreme-bearish-economic-expectations-hint-of-a-powerful-rally?source=email_macro_view

Related Articles:

- A Violent Correction Is Coming For the S&P 500! Here’s Why https://munknee.com/2011/06/a-violent-correction-is-coming-for-the-sp-500-heres-why/

- Stock Market is Due for a 15-20% Correction – Here’s Why https://munknee.com/2011/06/stock-market-is-due-for-a-15-20-correction-heres-why/

- Today’s Market Breadth is Bad Breath for Tomorrow’s Market – Here’s Why https://munknee.com/2011/05/todays-market-breadth-is-bad-breath-for-tomorrows-market-heres-why/

- Why a Major Stock Market Correction is Imminent https://munknee.com/2011/05/why-and-how-best-to-play-a-major-stock-market-correction-is-imminent/

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

- Sign up to receive every article posted via Twitter, Facebook, RSS Feed or our FREE Weekly Newsletter.

Stock Market

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money