Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) has edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Clark goes on to say, in part:

|

|

|

|

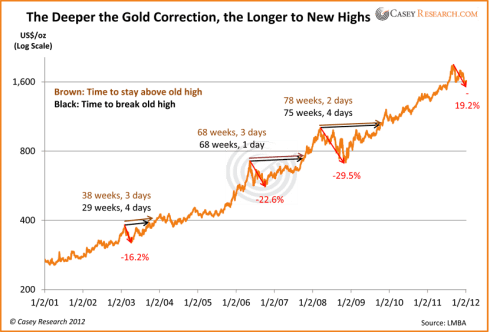

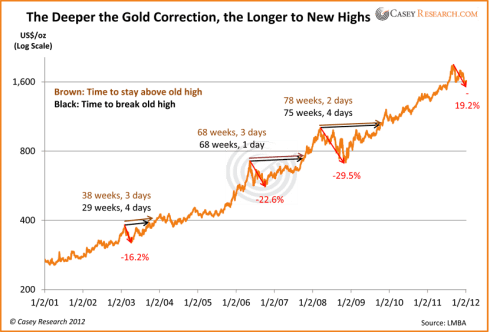

It makes sense that big corrections would take longer to reach new highs than small ones, but I wanted to confirm that assumption with the data. I also wanted to determine if there were any patterns in past recoveries that would give us some clues that we can apply to today. [As such,] I measured how long it took new highs to be mounted after big corrections in the past. The following chart details three large corrections since 2001, and calculates how many weeks it took the gold price to a) breach the old high, and b) stay above that level. As you can see, it took a significant amount of time for gold to forge new highs after big selloffs – and yes, the bigger the correction, the longer it took.In 2006, after a total fall of 22.6%, it took a year and four months for gold to surpass its old high. After the 2008 meltdown, it was a year and six months later before gold hit a new record [while] our recent correction more closely resembles the one in 2003. After a 16.2% drop, gold matched the old high seven months later. It took another two months to stay above it.So when do we reach a new high in the gold price? Let’s apply the same ratio from the 2003 correction and recovery: If it took 29 weeks and four days to reach a new high after a 16.2% correction, a 19.2% pullback would take 35 weeks and 0 days. That works out to Monday, May 7, 2012.An exact date is pure conjecture, of course. On one hand, gold could drop below the $1,531 low if the need for cash and liquidity forces large investors to resume selling. On the other hand, Europe and/or the US could resume money printing on a large scale and send gold soaring overnight. The point of the data is that it signals we shouldn’t be too surprised if we don’t hit $1,900 for another four months and if it takes another two months or so to stay above it.[If you ] think that is too long there are some important reasons to not let it discourage you: As you can see, it took a significant amount of time for gold to forge new highs after big selloffs – and yes, the bigger the correction, the longer it took.In 2006, after a total fall of 22.6%, it took a year and four months for gold to surpass its old high. After the 2008 meltdown, it was a year and six months later before gold hit a new record [while] our recent correction more closely resembles the one in 2003. After a 16.2% drop, gold matched the old high seven months later. It took another two months to stay above it.So when do we reach a new high in the gold price? Let’s apply the same ratio from the 2003 correction and recovery: If it took 29 weeks and four days to reach a new high after a 16.2% correction, a 19.2% pullback would take 35 weeks and 0 days. That works out to Monday, May 7, 2012.An exact date is pure conjecture, of course. On one hand, gold could drop below the $1,531 low if the need for cash and liquidity forces large investors to resume selling. On the other hand, Europe and/or the US could resume money printing on a large scale and send gold soaring overnight. The point of the data is that it signals we shouldn’t be too surprised if we don’t hit $1,900 for another four months and if it takes another two months or so to stay above it.[If you ] think that is too long there are some important reasons to not let it discourage you:

- If the “rebound ratio” is similar to the one in 2003, you have four months and counting to buy whatever gold you want before it’s no longer on sale…

- Once gold breaches its old high, you’ll probably never be able to buy it at current prices again…[Gold] will probably hit $2,000 or higher before the year’s over, never to visit the $1,600s again this cycle. If that turns out to be correct, the next four months will be the very last time you can buy at these levels. You’ll have to pay a higher price from then on.

- If gold doesn’t hit $1,900 until May, you’ll know this is simply normal price behavior… and when September rolls around – seasonally the strongest month of the year for gold – and the price is climbing relentlessly…you’ll already be well positioned [to take full advantage].

Conclusion

Regardless of the date, we’re confident that a new high in the gold price will come at some point, because many major currencies are unsound and overburdened with debt – and they’re all fiat and subject to government tinkering and mismanagement. Indeed, the ultimate high could be frighteningly higher than current levels.

As such, we suggest taking advantage of prices that won’t be available indefinitely. After all, you don’t want to be left without enough of nature’s cure for man’s monetary ills.

*http://www.caseyresearch.com/articles/when-will-gold-reach-new-high |

Why spend time surfing the internet looking for informative and well-written articles on the health of the economies of the U.S., Canada and Europe; the development and implications of the world’s financial crisis and the various investment opportunities that present themselves related to commodities (gold and silver in particular) and the stock market when we do it for you. We assess hundreds of articles every day, identify the best and then post edited excerpts of them to provide you with a fast and easy read.

Sign-up for Automatic Receipt of Articles in your Inbox or via  FACEBOOK | and/or FACEBOOK | and/or  TWITTER so as not to miss any of the best financial articles on the internet edited for clarity and brevity to ensure you a fast an easy read. TWITTER so as not to miss any of the best financial articles on the internet edited for clarity and brevity to ensure you a fast an easy read.

Related Articles:

1. Alf Field: Correction in Gold is OVER and on Way to $4,500+!

There is a strong probability that the correction in the price of gold [down to $1,523] has been completed. The up move just starting should be…the longest and strongest portion of the bull market…at least a 200% gain… [to] a price over $4,500. The largest corrections on the way to this target, of which there should be two, should be in the 12% to 14% range. [Let me explain how I came to the above conclusions.] Words: 760

2. Goldrunner Called $1,920 Gold High Exactly; Now Expects $3,000 – $3,500 by Mid-Year

Short-term volatile moves in Gold, as we have seen over the past few months, do not affect our projections for the future price of Gold based on our fractal (pattern) “model” off the late 70′s Gold Bull. Just as we correctly projected the $1,920 high in our April article entitled Goldrunner: Gold on track to Reach $1860 to $,920 by Mid-year (gold reached $1,917.20 in late August and $1,923.70 in early September, 2011), our current analysis indicates that Gold will enter a range between $3,000 and $3,500 by mid-year 2012. Words: 975 |

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

FACEBOOK

FACEBOOK TWITTER

TWITTER