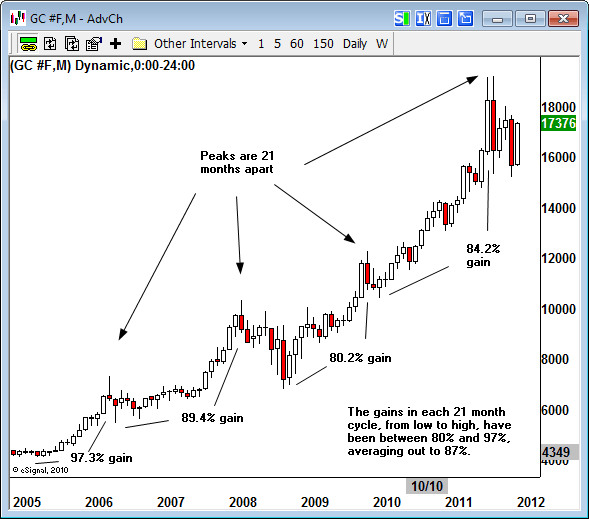

The interim peaks in gold have been spaced 21 months apart over the past 6 years and have seen gains from 80.2% to 97.3%. As such, given the fact that the low of this last correction came in at $1,524 four months ago, we can expect gold to reach a new peak price of $2,750 to $3,000 in 17 months time (i.e. June/July 2013). [Let me explain in more detail.] Words: 976

years and have seen gains from 80.2% to 97.3%. As such, given the fact that the low of this last correction came in at $1,524 four months ago, we can expect gold to reach a new peak price of $2,750 to $3,000 in 17 months time (i.e. June/July 2013). [Let me explain in more detail.] Words: 976

So says David Nichols (www.fractalgoldreport.com/) in paraphrased remarks from his original article*.

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) has edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Nichols goes on to say, in part:

The last recession in 2008, with its accompanying financial crisis, caused a massive bout of deflation, which slaughtered gold and other financial assets, while triggering a major run up in the dollar so it’s critical to know if a similar bout of deflation is coming now. And gold is a highly sensitive barometer on this. If we pay careful attention, gold will give us the accurate forecast.

I want to take a minute to briefly discuss deflation and de-leveraging, because these are terms that are bandied about a lot, but perhaps not with optimal clarity, as there is a certain glaze-over factor with this type of economic jargon.

The main idea is that when a debt is written down — or “marked to market” — it tightens the money supply, which in turn causes deflation. For example, if your neighbor has an $800,000 mortgage, and because of declining real estate values he negotiates to have it lowered to $600,000, that is $200,000 wiped from the money supply. [As such,] if a recession triggers another round of debt write-downs – because people and companies don’t have the cash-flow to cover debt payments – it can cause a massive contraction in the money supply. This type of deflation makes the value of the dollar skyrocket, because suddenly there are fewer dollars floating around, and the scarcer something becomes, the more valuable it gets. This is what happened during the financial debacle in 2008.

It’s absolutely critical for gold bulls to realize that this type of de-leveraging, with the accompanying deflation, is just terrible for gold. Gold gets creamed in this macro-environment, along with just about everything else.

It’s also important to understand how this relates to the Fed, and its efforts to re-flate the economy. The reality is the beleaguered Fed can’t create new dollars quickly enough to keep up with the dollars being wiped out by bad debts. This is why the Fed can pump trillions of dollars into the economy and not cause hyper-inflation – [and why] it’s a big deal when the Fed tells us it’s going to keep fighting deflation into “late 2014.” That’s nearly 3 years from now. There are a lot of trillions between now and then.

Essentially, the Fed just [said] that they – along with every other politician and central banker out there, in…[North America], Europe and Asia – will continue to make the easiest, most expedient policy decisions that carry the least amount of potential “blowback” on their own careers and future earnings. The fix-it-as-best-you-can macro-environment will continue, as it always does.

[True,] there are “Black Swans” and “Derivative Risks” and a bunch of scenarios that could cause another bad crisis, but here’s the thing: the gold market is not sensing any black swans – and it always gives plenty of warning if it does.This is a long-winded way of establishing that gold is free to soar right now. In fact, if this latest correction is over, then there is a juicy 17-month window of opportunity for gold to really, really soar…because the interim peaks in gold are spaced 21 months apart [as can be seen in the graph below].

21 is a very important number for market timing cycles, in every time-frame. I won’t go into the details on why right here, but I do discuss the cycles in depth in my daily reports. It’s a simple thing to do the arithmetic on the size of each move up during these 21-month cycles, measuring from the corrective low to the Month 21 peak.

These 21-month cycles took gold up:

- 97.3%

- 89.4%

- 80.2%

- 84.2%

The low of this last correction came in at $1,524, so that is the starting point for the forward projection on the next 21-month peak.

If we go ahead and make the not-so-difficult assumption that gold is launching into another 21-month cycle to the upside — thank you Fed, thank you ECB — the target for this move is $2,750 to $3,000, with the next peak scheduled to arrive in June 2013, [early July at the latest]… (These projections…are subject to revision as real-time data comes in to confirm or refute. The key is to remain aware of the big road-map, but flexible if events don’t unfold as expected.)

*http://seekingalpha.com/article/333272-the-next-17-months-for-gold

Related Articles:

1. Leeb: Gold Going to $3,000 Before the End of 2012!

The Fed is [going to] keep interest rates at zero until the end of 2014 [and that] is as aggressive as it gets and as bullish as it gets for gold. Inflation will be let out of the bag, maybe for the next three to four years. In this environment gold and silver are the best investments around…We are really talking about the next leg higher in this bull market…This is the leg I expect to take gold to $3,000 before the end of 2012.

2. Goldrunner Called $1,920 Gold High Exactly; Now Expects $3,000 – $3,500 by Mid-Year

Short-term volatile moves in Gold, as we have seen over the past few months, do not affect our projections for the future price of Gold based on our fractal (pattern) “model” off the late 70′s Gold Bull. Just as we correctly projected the $1,920 high in our April article entitled Goldrunner: Gold on track to Reach $1860 to $,920 by Mid-year (gold reached $1,917.20 in late August and $1,923.70 in early September, 2011), our current analysis indicates that Gold will enter a range between $3,000 and $3,500 by mid-year 2012. Words: 975

3. Contracting Fibonacci Spiral Puts Gold Near $4,000 by 2013 and $7-10,000 by 2020

Gold is operating on a smaller Contracting Fibonacci Spiral Cycle that is in synch with the larger Contracting Fibonacci Spiral the markets are in. Adding together the sum of parts… the price of gold will move up in price in 2013, 2016, 2018, 2019 and 2020, with each subsequent leg moving less in percentage terms than the prior move. Gold advanced 4 foldish from 1999 until 2008 ($252/ounce to $1046/ounce) suggesting that gold should top out below $4000/troy ounce by the end of January, 2013…[on its way] to $7,000 and $10,000 per troy ounce by 2020. [Let me explain.] Words: 834

4. These 8 Analysts See Gold Going to $3,000 – $10,000 in 2012! Here’s Why

Back in 2009 I began keeping track of those financial analysts, economists, academics and commentators who were of the opinion that it was just a matter of time before gold reached a parabolic peak price well in excess of the prevailing price. As time passed the list grew dramatically and at last count numbered 140 such individuals who have gone on record as saying that gold will go to at least $3,000 – and as high as $20,000 – before the gold bubble finally pops. Of more immediate interest, however, is that 8 of those individuals believe gold will reach its parabolic peak price in the next 12 months – even as early as February, 2012. This article identifies those 8 and outlines their rationale for reaching their individual price expectations. Words:1450

5. New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money