When considering that the conditions which propelled gold and silver to their 1980 highs are much worse today, I predict both metals will easily eclipse those previous highs. That means $2,500 gold and $150 silver at the very minimum, but more likely a parabolic ascent to $8,890 gold and $517 silver before all is said and done. Words: 1063

highs are much worse today, I predict both metals will easily eclipse those previous highs. That means $2,500 gold and $150 silver at the very minimum, but more likely a parabolic ascent to $8,890 gold and $517 silver before all is said and done. Words: 1063

So says Jason Hamlin in edited excerpts from the original article* as posted on Seeking Alpha which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited below for length and clarity – see Editor’s Note at the bottom of the page. (This paragraph must be included in any article re-posting to avoid copyright infringement.)

Hamlin goes on to say, in part:

There are many ways to judge if an asset class is in a bubble. One of the key measures is investor participation, or in our case, the percentage of global assets invested in gold or gold mining shares. While this percentage has historically been above 20%, it is currently estimated to be around 2%. There is no widespread public participation in the gold market, and plenty of naysayers that argue against gold as an investment at every opportunity. I’d be upset too if I was sitting on negative real gains in the stock market over the past decade while the gold price has quadrupled! The bottom line is that with participation this thin, any talk of gold being in a bubble is premature. For those of you that are more visual in nature, this graph should help:

Gold to Reach $2,500 and Silver $150?

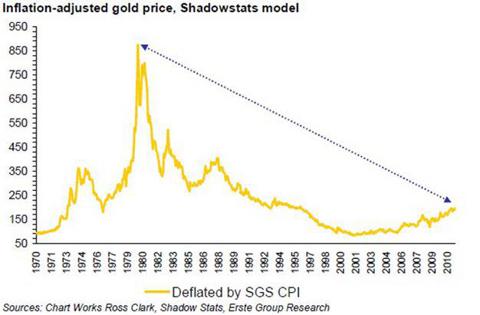

Another easy way to demonstrate that gold is not in a bubble is to look at the inflation-adjusted highs. The nominal highs for gold and silver occurred during January of 1980, when gold topped out at $850 and silver at $49.45. Official government inflation statistics tell us that in today’s dollar terms, gold would need to reach $2,500 and silver $150 before matching their true 1980 highs.

Are $8,890 Gold and $517 Silver More Realistic Peak Prices?

It is well known, however, that the government significantly understates the inflation rate in order to mask the impact of their fiscal policies and John Williams, the economist behind the website Shadow Stats, has done us the favor of stripping out the government gimmicks in order to derive the true inflation rate over the past thirty years. Using his SGS-Alternate Consumer Inflation Measure, gold would need to reach $8,890 per troy ounce and silver would need to reach $517 per troy ounce to match the highs from January of 1980.

Where’s the Bubble?

It seems rather absurd then to talk about the precious metals bull market being over at this juncture. With gold trading in $1,725 to $1,775 range it still needs to advance 41% to 45% to reach $2,500 and more than 400% to reach the true inflation-adjusted high of $8,890.

Even more dramatic is the potential return for silver between now and the final parabolic top. With silver trading in the $33 to $36 range, it would need to climb 317% to 355% to reach its official inflation-adjusted high [of $150] and a whopping 1336% to 1467% to reach its true inflation-adjusted high [of $517]! [For an interesting analysis of what prices silver might achieve in the future based on historical gold to silver ratios read:

Unless you believe that governments worldwide are suddenly going to get their debt situations under control and immediately return to being fiscally prudent, investing in precious metals seem as close as you can get to a sure thing. A huge amount of wealth is going to be transferred from those holding fiat paper to those holding real money. It has already been an immensely profitable ride over the past 10 years, but I am convinced it is not too late to jump on board for the next major upleg.

Might We See $15,000 Gold?

If gold reaching $8,890 is still a difficult pill for you to swallow, consider that gold expert Mike Maloney has run calculations showing that if history repeats and gold covers the same portion of the currency supply that it did in 1934 and 1980, we should see prices of at least $15,000 per ounce. Furthermore, he believes this will occur within the next 3 to 5 years, suddenly making the inflation-adjusted target of $8,890 seem rather tame.

[In fact, 151 gold analysts have gone on record as saying that gold will reach at least $3,000 per troy ounce, and as high as $20,000, before it reaches its parabolic peak price. The complete list of names with live hyperlinks to the articles in which they put forth their respective rationales can be read in this article:No matter which measure you use, it is easy to conclude that gold and silver have much higher to go before their bubble is fully inflated and ready to pop. When your family, your neighbors, the coffee barista, the taxi driver and most financial advisors are suddenly talking about the premium to spot price for silver eagles or the high grade intercepts of their favorite Canadian junior, it might be time to consider exiting your position but until then, it is nothing more than hot air when these so called analysts get on CNBC and claim the bull market in gold and silver is over.

Junior Mining Companies Offer Even Greater Returns!

While I advocate owning physical metal in your possession first, some of the greatest gains can often be realized by investing in undervalued mining companies. Their profit margins shoot dramatically higher as the prices of gold and silver climb, often providing excellent leverage to the advance of the underlying metal. In particular, I believe that junior miners are significantly undervalued at the current moment and will produce some truly astronomical gains going forward. [For further insights in this regard read:

[Warrants of Gold and Silver Mining Companies Generate Even Greater Returns! Read these two articles for more information about warrants:- Interested in Buying Gold or Silver Mining Company Warrants? Here’s How and

- Gold Bugs: Here’s How to Make the Most of the Continuing Bull Market in Gold!]

Conclusion

The precious metals bull market still has a long way to go and the current consolidation is offering an excellent opportunity to load up the boat. [Read:

*http://seekingalpha.com/article/383451-gold-and-silver-way-off-inflation-adjusted-highs

Editor’s Note: The above article has been has edited ([ ]), abridged (…) and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Why spend time surfing the internet looking for informative and well-written articles when we do it for you. We assess hundreds of articles every day, identify the best and then post edited excerpts of them to provide you with a fast and easy read. Sign-up for Automatic Receipt of Articles in your Inbox and follow us on

FACEBOOK | and/or

TWITTER .

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money