One of the most fundamental relationships of the modern economy is the tie between the amount of energy a country consumes and their GDP and is an excellent way to predict a country’s economic productivity. [This article analysis the daily number of barrels of oil consumed for 20 countries relative to their PPP adjusted GDP. Germany has the largest residual of all developed countries followed closely by the U.K. while the U.S. has the poorest and Canada is not far behind. Read on to determine just how efficient your country actually is in its crude oil utilization.] Words: 470

tie between the amount of energy a country consumes and their GDP and is an excellent way to predict a country’s economic productivity. [This article analysis the daily number of barrels of oil consumed for 20 countries relative to their PPP adjusted GDP. Germany has the largest residual of all developed countries followed closely by the U.K. while the U.S. has the poorest and Canada is not far behind. Read on to determine just how efficient your country actually is in its crude oil utilization.] Words: 470

So says Tom Guttenberger in edited excerpts from his original article* as posted on Seeking Alpha.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Guttenberger goes on to say, in part:

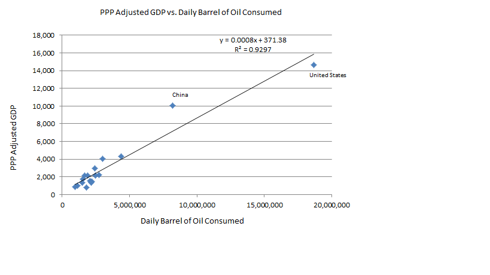

Shown below is a linear regression of PPP-adjusted GDP against the number of barrels of oil consumed daily. For the regression I used countries that ranked in the top 20 for both statistics.

As illustrated by the ~.93 R-squared figure, the amount of oil consumed by a country is an excellent way to predict their economic productivity….

(click to enlarge)

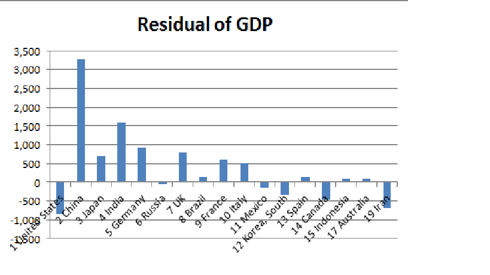

An examination of the residuals [in the graph below shows that] the United States underperformed the prediction by the largest nominal figure and China outperformed by the greatest.

Before going any further, I would like to add [the following] caveat to the above results:

- The PPP adjustment of GDP would tend to favor developing countries in this type of analysis. (By adjusting for PPP, goods purchased domestically in these developing countries are normalized to their worth globally, therefore increasing their impact to GDP.)

- What a PPP adjustment can overlook are the import/export dynamics that will be affected if the currency were revalued to the PPP-adjusted price. (For example, if workers in China were to require an adjusted wage to purchase the same basket of goods, producer prices would rise and the incentive to manufacture goods there would be diminished.) This is not to say that these countries have not been executing on their oil consumption well – they have – but the residuals for India and China are large enough to merit an explanation.

Most interestingly, the residuals of Germany, France, Italy, and even Spain are all positive. Germany has the largest residual of all developed countries and is a good sign of things to come for the country’s economy going forward. These positive residuals for EU nations highlight the superior infrastructure in these countries compared to the United States. Rather than a sprawling system of highways, the public transportation and higher relative population density of Europe helps position them to execute more efficiently on their resources….

* http://seekingalpha.com/article/620961-gdp-per-barrel-of-oil-consumed-which-countries-are-executing-efficiently (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. 10 Facts About Global Energy Sources & Consumption – You’ll Be Surprised

Coal, hydroelectric and oil are increasingly in high demand to meet the world’s growing appetite for power. In fact, global energy consumption grew 5.6 percent in 2010, the highest rate since 1973. Discover 10 other fascinating facts about worldwide consumption in this informative slide show.

2. The “Ins” and “Outs” of Investing in Commodities

Commodities have obvious appeal to active investors looking to generate profits from short-term price movements [but while] the volatility of this asset class is ideal for risk-tolerant individuals who actively monitor their positions…commodities may also have appeal to the long-term, buy-and-hold crowd…These potentially appealing attributes come with plenty of risk, [however, as] the path to commodity exposure is full of potential obstacles and pitfalls that can erode returns and lead to a less-than-optimal investing experience. Here are ten rules of thumb that will help you achieve a more successful experience investing in commodity markets. Words: 2871

3. 10 Questions You Need Answers to Before Investing in Oil & Gas Stocks

10 questions to ask before deciding whether or not to invest in an oil or gas company. Words: 820

4. More of What You Need to Know Before Investing in Oil & Gas Stocks

Here are 10 more questions potential investors should be asking oil and gas company management teams or searching for on the company website. Words: 1046

5. Shale Oil Stocks Are On The Rise – Here’s Why

World oil demand is…expected to surpass 115 million barrels per day in 2025 from only 91 million barrels per day today yet production in many countries is either waning or being consumed by the producing country. [In this article I identify those countries whose production is in decline, 2 countries who have increased production thanks to unique sources and how to invest accordingly.] Words: 595

Natural gas is increasingly becoming an important fuel in meeting the global energy needs. Let’s take a quick look at the largest natural gas fields in the world. Words: 300

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money