With the Presidential vote now just five months away on November 6, many investors are beginning to debate which candidate may be best for the stock market. Recent history serves as an instructive guide to determine whether a second Obama term or a new Romney presidency might be better for investment markets over the next four years. [Read on!] Words: 1400

investors are beginning to debate which candidate may be best for the stock market. Recent history serves as an instructive guide to determine whether a second Obama term or a new Romney presidency might be better for investment markets over the next four years. [Read on!] Words: 1400

So says Eric Parnell in edited excerpts from his original article* which is published on Seeking Alpha.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) is pleased to make this information available to you. This paragraph must be included in any article reposting to avoid copyright infringement.

Since World War II, the presidency has been generally split between the two parties.

- 12 Presidents have served in office over the last 67 years since the end of World War II.

- Democrats…held office for a total of 31 years, or 46% of the time….

- Republicans held office for a total of 36 years, or 54% of the time.

A first look at the data might imply a potential edge for the Democrats.

- During the 31 years with a Democrat in the White House the stock market, as measured by the S&P 500, posted an annualized return of +13.44%.

- The annualized return was +8.22% over the 36 years with a Republican President.

At first glance, this +5.22 percentage point advantage for Democratic Presidents might suggest that another Obama presidency might be better for the stock market but such a conclusion would be far too simplistic…[because]

- party identification does not clearly define the specific policy objectives of the individual holding the office at any given point in time and

- the President certainly does not lead the country alone, as Congress also plays a critical role by directing fiscal policy.

| Annualized Return: 1946-2012 | |||

| Democratic President | 13.44% | Democratic Congress | 10.39% |

| Republican President | 8.22% | Republican Congress | 12.30% |

In the last 67 years since WWII,

- Democrats have held a majority in Congress slightly less than two-thirds of the time, or 43 years. Under a Democratic controlled Congress, the stock market has generated an annualized return of +10.39%.

- During the 16 years over this time period that Congress was under Republican control, stocks posted an annualized return of +12.30% and, interestingly,

- during the 8 years that Congressional control was split between Democrats and Republicans, the market posted its best annualized performance of +13.15%.

Other more significant factors, beyond Presidential or Congressional control, must also be considered before any definitive conclusions may be drawn about which candidate or party might be best for the markets over the next four years.

Take Note: If you like what this site has to offer go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com. It’s FREE! An easy “unsubscribe” feature is provided should you decide to cancel at any time.

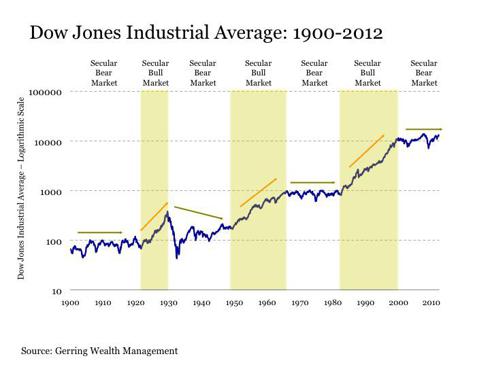

1. The stock market experiences long-term cycles that are largely beyond political influence.

- The stock market has historically moved in long-term secular cycles that generally last 17 years on average….Since 1900, the market has completed 7 secular market cycles and is currently in the 12th year of an 8th secular market cycle. Focusing on the time since World War II, the secular bull market from 1949 to 1968 was inspired by post war optimism, pent-up consumer demand and the “baby boom”.

- The secular bear market from 1968 to 1982 was marked by the aftermath of the speculative excesses of the Nifty 50, illicit conglomeration accounting activity in corporate America, two oil crises and rampant inflation.

- The more recent secular bull market from 1982 to 2000 was driven by the longest economic expansion in U.S. history and dramatic global technological innovation.

- The secular bear market since 2000 has been influenced by the collapse of the technology bubble, the September 11 terrorist attacks, corporate accounting scandals at Enron and WorldCom, the collapse of a speculative housing bubble, a major financial crisis and now the potential disintegration of the Euro Zone.

While fiscal policy and regulatory oversight (or lack thereof) may have influenced some of these bullish and bearish market outcomes along the way, many occurred outside of any direct political control. In other words, the stock market is a force in and of itself, and politicians only have so much influence on its overall course barring a major fiscal policy mistake.

2. Presidents have shown little differentiation by party in influencing the stock market when examined in this context. Before proceeding, it is worth noting that:

- Democratic Presidents have served mostly during secular bull markets. Of their 31 years in the presidency, 22 years (71%) occurred during such markets….

- Republican Presidents have served almost equally during secular bull markets (19)… and secular bear markets (17). This fact helps to explain the overall returns advantage enjoyed by Democratic Presidents discussed above.

When examining annualized stock returns during only secular bull markets under Democratic and Republican presidential administrations, it becomes a near wash, [as follows]:

- a +14.90% annualized returns under Democratic Presidents versus

- a +15.93% return under Republican Presidents.

During secular bear markets, the results are also inconclusive upon closer examination.

- While Democratic Presidents have a decisive annualized returns advantage of +9.93% versus the Republican result of +0.22%, Democrats have been in the White House for only 9 years during secular bear markets and when you remove the extreme market returns from the few months that immediately surrounded the transitions from Carter to Reagan and Bush to Obama, this performance gap quickly narrows to +3.81% for Democrats versus +2.98% for Republicans.

Thus, the stock market appears to be largely indifferent to whether the President is a Democrat or a Republican.

| Annualized Return: 1946-2012 | Secular Bull Market | Secular Bear Market |

| Democratic President | 14.90% | 9.93% |

| Republican President | 15.93% | 0.22% |

Returns under each President since WWII further supports this general stock market indifference. Whether the President was a Democrat or a Republican, the stock market:

- responded well during secular bull markets with annualized market returns ranging between +9% and +18% with an average return of roughly +14%.

- was a mixed bag during secular bear markets. Those Presidents with relatively shorter administrations such as Jimmy Carter, Gerald Ford and Barack Obama (at least thus far) have experienced positive stock market results. Those with longer stays in the White House such as Richard Nixon and George W. Bush saw negative annualized stock returns by the end of their administrations after experiencing positive returns along the way….

| President | Annualized Return | Secular Market |

| Bill Clinton | 17.59% | Secular Bull Market |

| Dwight Eisenhower | 15.92% | Secular Bull Market |

| Ronald Reagan | 15.85% | Secular Bull Market |

| Harry Truman | 15.45% | Secular Bull Market |

| Gerald Ford | 15.43% | Secular Bear Market |

| George H.W. Bush | 13.87% | Secular Bull Market |

| Barack Obama | 12.05% | Secular Bear Market |

| Jimmy Carter | 11.75% | Secular Bear Market |

| Lyndon Johnson | 10.22% | Secular Bull Market |

| John Kennedy | 9.76% | Secular Bull Market |

| Richard Nixon | -1.44% | Secular Bear Market |

| George W. Bush | -4.63% | Secular Bear Market |

The generally equivalent performance of the stock market under various administrations from both parties during both secular bull and secular bear markets highlights the fact that:

- the economy and the stock market are major forces that are not determined by a single individual or legislative body but are operating within the framework of long-term cycles that take years to play out.

- Thus, those candidates that promise decisive change to definitively change the course of the economy and markets are likely to fall well short of these expectations, as they are limited in their capabilities and can only do so much to affect the final outcome.

While candidates may be limited in their ability to direct the economy and markets, what they do have is the opportunity to realize a material impact on the margins. As a result, the candidate that prevails in November:

- may not be able to single-handedly cleanse the financial system,

- lift the global economy out of its sluggish malaise and

- resolve the ongoing crisis in Europe,

- but they can do a great deal in conjunction with Congress to make difficult circumstances less trying while taking positive developments that emerge along the way and extracting as much of the benefits as possible for the good of the economy and markets.

Conclusion

When evaluating who you believe is the best Presidential candidate for the U.S. economy in November:

- look past the grand posturing and bold promises, as these will likely go largely unfulfilled when it is all said and done and, instead,

- focus on the bottom line question of which candidate can do the most on the margins to incrementally improve what is still a challenging environment

Doing so will likely lead you to the best decision for your own circumstances and the broader economy in the end.

*http://seekingalpha.com/article/624901-stocks-assessing-the-impact-of-the-2012-presidential-election

Editor:s Note: According to the latest Intrade.com “vote” the liklihood of President Obama getting re-elected is 57%:

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Article:

1. What Do the Presidential and Decennial Cycles Infer Will Happen in 2012?

Should we jump into the market now? [Let’s take a look at the 178 year history of the 4-year Presidential Cycles and the Decennial (10-year) Cycles and see what they suggest might well unfold in 2012.] Words: 1174

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money