So says Jordan Roy-Byrne (thedailygold.com) in edited excerpts from his original article* entitled Junior Mining Stocks Have Bottomed.

[The following is presented by Lorimer Wilson, editor of www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]Roy-Byrne goes on to say in further edited excerpts:

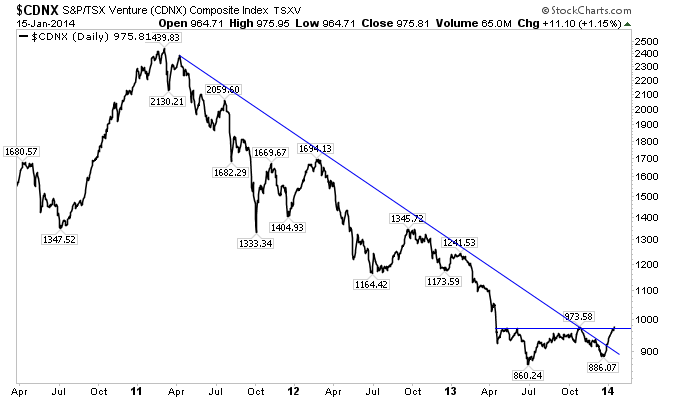

The TSX Venture (CDNX) is the market for juniors in Canada. The market consists of exploration companies focused on precious metals and other minerals, energy companies and some technology companies. It’s not a perfect indicator for the junior mining industry but it’s good enough for the experts. On Thursday the CDNX closed at a nine month high. No, that is not a misprint. The junior market reached a nine month high. It bottomed in late June, made a higher low in December and has surged 10% since.

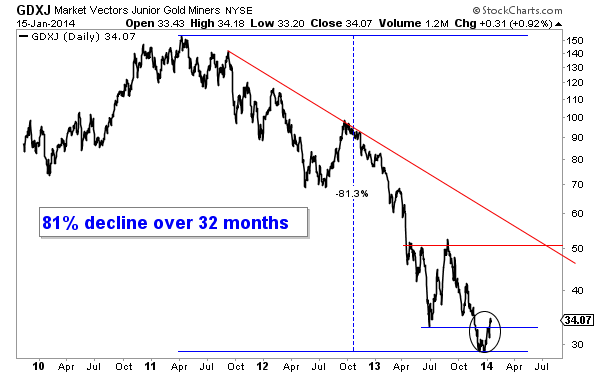

For an American, GDXJ is the proxy for junior gold stocks or junior miners. I like to think of GDXJ as the “senior” or established juniors. The CDNX consists of many stocks trading under $1 and a $100M market cap while GDXJ is mostly comprised of companies in the $100M to $500M market cap range.

GDXJ declined 81% from its April 2011 peak to its December 2013 bottom. As we noted several weeks ago, GDXJ tried to penetrate its December low three times and failed. The market has since rallied back above the previous (June) low. Given the severity of the bear in terms of price and time, extreme negative sentiment and recent bullish price action I believe it is highly likely that the bottom is in.

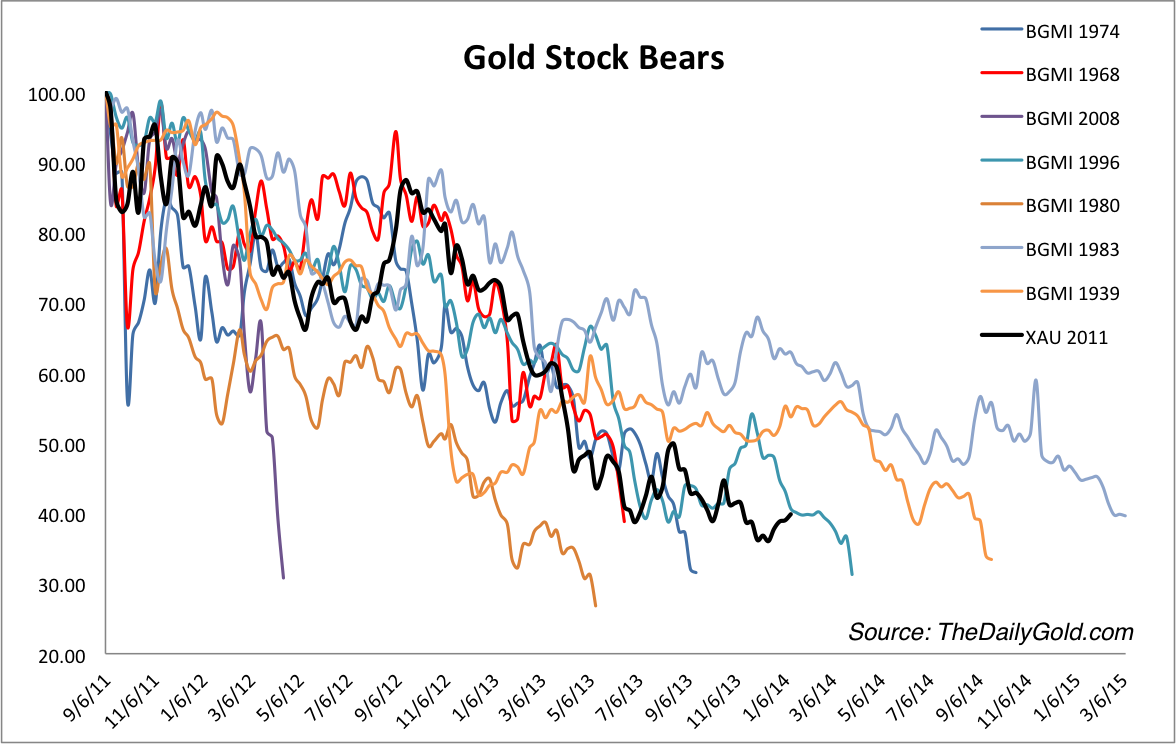

Our frame of reference for the bear, the gold stock bear analogs chart continues to suggest that the bear market in senior gold stocks is all but over.

The juniors (both CDNX and GDXJ) peaked in April or five months before the senior gold producers. Hence, it makes sense that the juniors would bottom first. The assertion from the analogs chart (that the seniors may have bottomed or are very close) gives us further confidence that the juniors have bottomed.

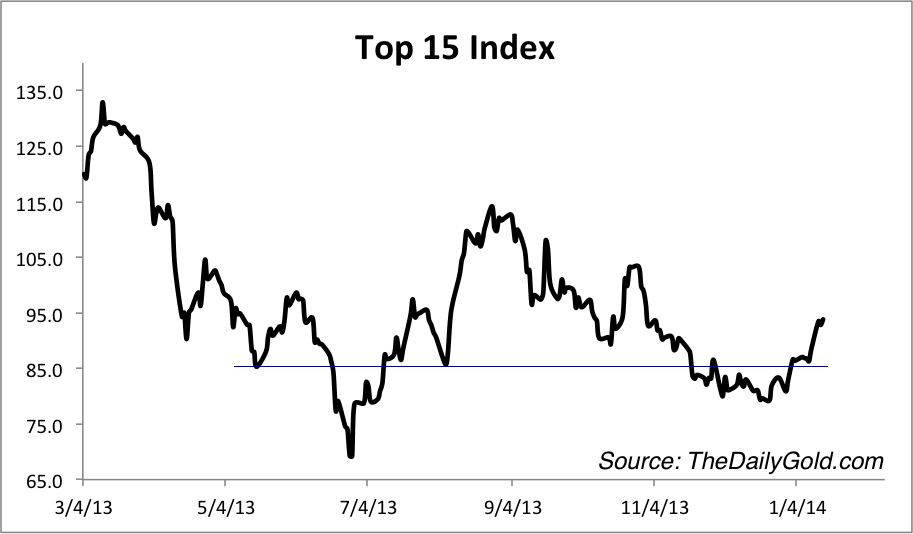

Most of the stocks that we follow bottomed in June. The following chart, which was sent to premium subscribers is an equal weighted index of 15 of our favorite gold and silver stocks. The index bottomed in late June 2013 and made a strong higher low in December. It would have to decline 26% to test the June low.

Extremely bearish sentiment, compelling valuations and an extreme oversold condition can create a compelling contrarian opportunity. However, that opportunity can remain far fetched without some positive price action. We now have the positive price action that allows us to call a bottom in the mining stocks and strongly so in the junior gold stocks.

The risk has shifted from getting caught in a final plunge to missing out on the rebound.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://thedailygold.com/junior-mining-stocks-bottomed/ (© 2014 The Daily Gold. All Rights Reserved, If you’d be interested in learning about the companies poised to rocket out of this bottom then we invite you to go here to learn more about our premium service.)

Related Articles: (The articles posted on munKNEE.com deliberately present a diverse perspective on subjects discussed. Below are links, with introductory paragraphs, to a variety of related articles designed to help you become truly informed regarding both sides of the issues so that you can assess the merits of all points of view and come to your own conclusion.)

1. It’s Time to Go Bottom-Fishing & Buy Gold Miners! Here’s Why

Following a brutal year for bullion in 2013 and an even worse year for gold miners, those bullish on the yellow metal and the companies that extract it from the earth may finally have something to hang their hats on. Read More »

2. Gold Stocks: What Can We Expect in 2014?

After three years of pain, can gold stocks break their losing streak and see a gain in 2014? History says the chances are good. Here’s why that is the case. Read More »

3. Gold Stocks: Likelihood of Making Breathtaking Returns Has Never Been Greater! Here’s Why

We all think the price of gold, the metal, is depressed and is about equal to the total cost of production but when one compares the price of precious metals mining companies to the price of gold bullion, their prices are at historical lows. It seems that the mining shares can only go in one direction…up…but when and by how much? This article suggests it presents the greatest opportunity in 30 years. Look at the charts! Absolutely unbelievable. Read More »

4. Here’s How to Choose Gold & Silver Stocks With the GREATEST Chance of Major Returns

Which gold/silver mining companies own quality undeveloped gold and silver deposits in safe stable countries – and are extremely well managed? Such companies offer exceptional value in that they provide the best exposure to a rising precious metals price environment. Below are a number of things to look for when considering an investment in such companies. Read More »

5. Gold Producer Stocks Dramatically Undervalued: Don’t Miss This Blood-in-the-Streets Opportunity

While the waterfall decline in gold stocks is painful for those of us already invested, the reality is that this is a setup we get a shot at only a few times in our investing life. It’s a cruel irony that those who are fully invested are now faced with the buying opportunity of a lifetime; however, it would be a shame for anyone to miss this blood-in-the-streets opportunity. Read More »

6. Huge Rebound in Gold & Silver Stocks Coming Soon – Here’s Why

It’s been a tough road for precious metals but the path ahead has strong potential of being significantly profitable and in a short period of time. The buying opportunity that we’ve spoken of for months could be days away. When precious metals equities rebound, they rebound violently. Read More »

7. Focus on Quality Junior Gold & Silver Companies to Maximize Returns – Here’s Why & How

The outlook for many junior resource companies in 2013 is grim so investors should focus on those who own quality undeveloped gold and silver deposits in safe stable countries. Such companies offer exceptional value in that they provide the best exposure to a rising precious metals price environment – and the assets the world’s mining companies desperately need. [Let me explain.] Words: 1328; Charts: 15 Read More »

The timing of this article may seem incongruous given the current weak performance of gold and gold stocks but that was the identical situation in each of the past manias – both the metal and the equities didn’t excel until the frenzy kicked in. The following documentation (exact returns from specific companies during this era are identified) is actually a fresh reminder of why we think you should hold on to your positions – or start accumulating them, if you haven’t already. (Words: 1987; Tables: 7)

9. Why Invest in Junior Miners?

Leverage is the simple answer. It is not uncommon for junior mining companies to experience huge gains (10x or more) very quickly as news of a discovery is made known to the public. Words: 893

The precious metals complex is arguably at its most bearish sentiment since the start of the bull market 12 years ago. Either the bull market is over or this will prove to be a tremendous buying opportunity. It’s clear that anyone who doesn’t believe in Gold for the long-term has sold and judging from the sentiment indicators, Gold is now in much stronger hands than when it was trading at these prices at the 2012 and 2011 lows. Despite all of the bearish sentiment, the panic and bad-mouthing, Gold (and Silver) has maintained its consolidation. Thus, if Gold is able to hold this support and turn higher, it should approach $1750 to $1800 faster than one would think. This year will go down in history as one of the best buying opportunities for both the metals and the stocks. Words: 675; Charts: 3

11. Gold Miners Have Hit Rock Bottom! Now’s the Ultimate Buying Opportunity

Looking at the recent Gold Miners price action and crash-like conditions, I cannot hide my excitement. As we judge the recent cyclical bear market within the longer term secular uptrend, we can see that Gold Miners are becoming very attractive. Whether it is the technically oversold levels that only occur a handful of times over a generation, the rock bottom valuations on nominal or relative basis, or the extreme sentiment that the overall sector is going through, all of these indicators point to one conclusion: we are fast approaching a major buying opportunity. [I support that contention below with the use of 8 charts and a full explanation of each.] Words: 1133; Charts: 8

12. Country Risk: ALWAYS Discount the Value of Companies Operating in Risky Jurisdictions – Here’s Why

There is enough risk in investing without the added risk of political instability so why does the investment community often use the same metrics to value the shares of exploration and production of resources companies regardless of their location in the world? This is so very wrong, yet it continues. Frankly, when investing in the stock market you should ALWAYS discount the value of the stock that you are considering buying if the jurisdiction is not historically safe, stable, and economically strong. [Let me explain further.] Words: 746

13. Focus on Quality Junior Gold & Silver Companies to Maximize Returns – Here’s Why & How

The outlook for many junior resource companies in 2013 is grim so investors should focus on those who own quality undeveloped gold and silver deposits in safe stable countries. Such companies offer exceptional value in that they provide the best exposure to a rising precious metals price environment – and the assets the world’s mining companies desperately need. [Let me explain.] Words: 1328; Charts: 15 Read More »

14. Gold & Silver Miners: What’s the Best Time to Invest in the Producers – and in the Juniors?

While juniors, mid-tiers and large producers will usually bottom around the same time, they each outperform at different times. In this missive we look at some charts to decipher when its time to buy [each category and when one or the other] should be avoided. Words: 470

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money