The 4 mining stocks on our list today have exposure to silver. In addition, they have the best free cash flow figures compared to their competitors during the last 12 months.

The comments above and below are excerpts from an article from SmallCapPower.com which has been edited ([ ]) and abridged (…) to provide a faster and easier read.

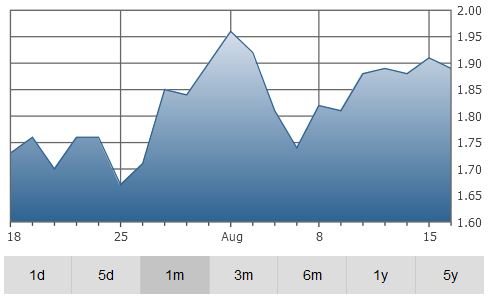

1. Great Panther Silver Ltd (TSE:GPR) – $1.91 – Mining Support Services & Equipment

Great Panther Silver Limited (Great Panther) is a silver mining, and precious metals producer and exploration company. The Company holds interests in the Topia Mine and the Guanajuato Mine Complex (GMC). The Topia operations produce silver, gold, lead and zinc. The GMC operation includes Guanajuato Mine, Cata processing plant and the San Ignacio Mine, and produces silver and gold.

- Market Cap: 317,019,345

- Revenues: 77,970,000

- Operating Income: – 2,401,000

- FCF (LTM): 1,251,000

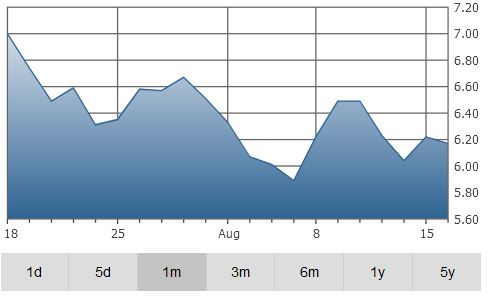

2. HudBay Minerals Inc. (TSE:HBM) – $6.22 – Diversified Mining

HudBay Minerals Inc. is a Canada-based mining company engaged in the production of copper concentrate, consisting of copper, gold and silver, as well as zinc metal. The Company is focused on the discovery, production and marketing of base and precious metals. Through its subsidiaries, the Company owns approximately four polymetallic mines, four ore concentrators and a zinc production facility in northern Manitoba and Saskatchewan (Canada) and Cusco (Peru), and a copper project in Arizona (the United States). The Company owns Constancia mine, an open pit copper mine in Peru. It owns 777 mine, an underground copper, zinc, gold and silver mine in Flin Flon, Manitoba.

- Market Cap: 1,463,141,099

- Revenues: 1,474,025,632

- Operating Income: – 348,877,849

- FCF (LTM): 73,406,851

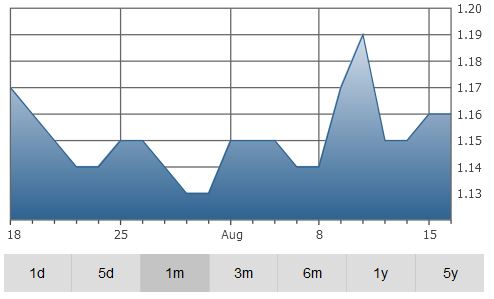

3. Mandalay Resources Corp. (TSE:MND) – $1.16- Diversified Mining

Mandalay Resources Corporation is a Canada-based mining company engaged in the business of exploration, development and mining of natural resource properties. It holds interest in properties, such as Costerfield, Australia; Cerro Bayo, Chile, and Bjorkdal, Sweden. In addition, the Company owns and develops Challacollo, which is a silver-gold project located in Region I (Tarapaca) of Chile, approximately 130 kilometers southeast of the port city of Iquique. Its Cerro Bayo is a producer of silver (Ag) and gold (Au), located in the Cerro Bayo district, Region XI, Chile. Its Bjorkdal project is a gold mine located in northern Sweden. Its Costerfield is a gold-antimony mine, located approximately 100 kilometers northwest of Melbourne, Victoria.

- Market Cap: 215,285,203.21

- Revenues: 318,798,393

- Operating Income: 13,200,000

- FCF (LTM): 8,562,115

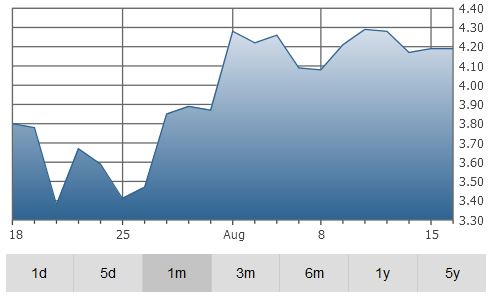

4. Silvercorp Metals Inc. (TSE:SVM) – $4.19 – Non-Gold Precious Metals & Minerals

Silvercorp Metals Inc. (Silvercorp) is a silver-producing Canadian mining company engaged in the acquisition, exploration, development, and mining of silver-related mineral properties in China. The Company is the primary silver producer in China through the operation of over four silver-lead-zinc mines in the Ying Mining District in Henan Province, China, including SGX, HZG, TLP, Haopinggou (HPG) and the LM mines. The Company also has commercial production at its Gaocheng (GC) silver-lead-zinc project in Guangdong Province.

- Market Cap: 114,570,744.63

- Revenues: 147,313,425

- Operating Income: 22,856,439

- FCF (LTM): 3,576,054

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Related Articles from the munKNEE Vault:

1. Silver Penny Stocks That Should Continue To Shine

Silver’s performance since April 1, 2016, has more than doubled that of gold. That being said, the silver names on our list today should continue to shine as all have undertaken significant debt, using that as leverage to enhance production initiatives and sell more silver at these elevated prices.

2. Any 1 Of These 20 Stocks Could Be A 10-Bagger At Higher Gold & Silver Prices

The list of stocks provided in this post are what I consider “must own”stocks if you want big returns. Why? Because most of them are potential 10-baggers at higher gold & silver prices. These are the cream of crop when it comes to risk/reward for large returns. They all have solid projects and growth potential. They all have the “goods” and are extremely undervalued. Take a look.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money