There are four main macro issues shaping the investment climate:

- the tapering anticipation in the U.S.;

- the stabilization of the Chinese economy;

- a cyclical recovery in Europe and

- the long awaited Japanese purchases of foreign bonds.

So writes Marc Chandler (marctomarket.com) in edited excerpts from his original article* entitled New Week, Same Drivers.

[The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Chandler goes on to say in further edited (and perhaps in some places paraphrased) excerpts:

Last week’s news and the anticipated data stream this week are expected to either reinforce these issues, or at least not challenge them.

Here’s an update of the four current themes:

1. Fed Tapering

The only voting FOMC member to speak last week was Evans, who while seen as a dove, towed what appears to be the party line and that is tapering next month has not been ruled out. Bullard speaks this week. Recall that after dissenting in June because he did not think the Fed was show[ing] proper concern with falling prices, Bullard gave up his dissent in July as the FOMC statement was expanded to reflect his point [of view].

There is a full slate of high frequency economic reports , including both inflation measures, retail sales, industrial production, and the first regional surveys for the current month (Philadelphia Fed survey) [coming out this week but] none will change participants expectations for the Fed…

- Fed’s Tapering Plans Will Be Delayed For These 5 Reasons

- The Fed Is About to Turn Off the Monetary Spigot! Yeah, Sure

- Bernanke’s Latest Economic Outlook: An Interpretation, Analysis & Assessment

Judging from media reports, the salience of next months budget issues has increased. To some this issue is rivaling the Fed tapering story. The U.S. 10-year yield has largely been confined to a 2.46%-2.66% range since early July. A break of this range will be noteworthy, though this week’s data calendar makes it unlikely.

2. China Stabilizing:

The recent string of official data lends more support to our understanding that China’s economy stabilized in late Q2 and early Q3. The lending data shows that officials have been successful in reining in the shadow banking activity.

The yuan has been drifting slightly higher and, far from protesting, the PBOC has actually fixed it higher each day last week. Of the commonly traded and referenced currencies, the yuan is still among the strongest this year, appreciating about 1.8% against the dollar. Recent gains have turned the euro and the Danish krone higher (~1.1%). The Shanghai Composite has been range bound so far in Q3 between roughly 1950 and 2100. A break of this range will draw attention.

3. European recovery:

The euro area is expected to report a quarterly expansion in Q2 that ends the three-quarter contracting phase. The consensus calls for a 0.2-03% Q2 GDP, though the pre-weekend release of disappointing French industrial output figures, may warn of downside risks. Essentially, what has happened is that the periphery has shown a slower contraction, while the core, especially Germany and France strengthened. The consensus anticipates that Germany expanded by 0.8% and France half as much.

- It’s Time to Invest In Europe – Here’s Why & How

- European Debt Problems Continue to Escalate

- France is Eurozone’s Biggest Risk to Economic Recovery – Here’s Why

In the UK, this week’s data, which includes prices, employment and retail sales, are unlikely to change the general view that Q2 recovery has continued apace in Q3. As noted previously, the base effect works very much in the BOE’s favor, especially starting in August.

One point that has arisen from recent discussions, and suggested by the changes in the positioning in the futures market, is that the euro bears have not changed as much as the latest entrants have been playing with the short-term trend higher. In recent weeks, the gross long euro positions have grown twice as fast as the gross shorts have been covered. The issue now seems to be at what level will the euro shorts capitulate? We suspect it is above $1.35. Also at issue is what level will the bulls acknowledge the uptrend is over. We suspect that is near $1.3280 initially and maybe $1.3200 itself.

4. Japanese flows:

Japanese investors have bought foreign bonds for the past five consecutive weeks. On this run, MOF data shows net purchases of JPY3.6 trillion worth of foreign bonds. What this has done, is nearly offset the net sales of the prior five weeks (JPY4.1 trillion). On the other hand, foreign investors’ appetite for Japanese shares has waned. Although they have been net sellers over the past two weeks, it has been in small amounts. Rather, the pace of buying has slowed considerably. The four week average is now new JPY161 bln, down from JPY754 bln at the end of April and half of the end of May pace of JPY334 bln.

- Japan: A Country On the Brink of Fiscal & Economic Disaster!

- Japan’s Role in the U.S. Dollar’s Rise – and Gold’s Fall

- What Is “The Carry Trade” & Why Is It So Misunderstood?

Ironically, just as the portfolio flows are leaving Japan, the yen has strengthened to trade at its best level against the dollar since late June. The yen’s gains do not appear speculative in nature. The gross short positions, for example, in the futures market remain elevated at almost 100k contracts. The recent high was in late May near 118k contracts. Instead, the yen’s rise seems more linked to the stock market, where a statistically significant inverse correlation exists. Consider that over the past month, the Nikkei was off around 6%, but the yen appreciated by about 5% against the dollar, suggesting some investors likely found hedging to be disadvantageous.

The main report of the week is the first estimate of Q2 GDP early Monday in Tokyo. The consensus forecast is for a 0.9% quarterly expansion, and 3.8% annualized. This contrasts with 1.0% and 4.1% respectively in Q1.

There is some concern that the economy [has] lost some momentum at the end of Q2 and early Q3.

Conclusion

Participation has thinned and volatility has generally trended lower however, looking further down field, events next month promise to inject fresh volatility into the market, and we expect it to be in a dollar positive direction.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

* http://www.marctomarket.com/2013/08/new-week-same-drivers.html (Copyright 2012 Marc to Market.)

Related Articles:

1. It’s Time to Invest In Europe – Here’s Why & How

The Eurozone economy (and currency) – which was once on the brink of complete and utter disaster – is finally on the road to recovery….[Here is] a safe way for skittish investors (i.e. – the non-contrarians) to take advantage of the opportunity in Europe before it disappears. Words: 503; Charts: 1 Read More »

2. European Debt Problems Continue to Escalate

With stocks at record highs and the U.S. economy improving, the European debt crisis seems like a distant memory….[While] Europe is no longer the market’s focal point, however, that doesn’t mean the euro zone’s financial problems have gone away. Read More »

3. France is Eurozone’s Biggest Risk to Economic Recovery – Here’s Why

France continues to pose the biggest near-term risk to the euro area’s economic recovery. Why France some may ask? [Here’s why.] Read More »

4. Fed’s Tapering Plans Will Be Delayed For These 5 Reasons

The financial markets were in distress lately because of Fed Chairman Ben Bernanke’s suggestion that the Fed might taper off its quantitative easing programs starting at the end of this year and ending in 2015. Here are five reasons why markets shouldn’t worry too much about the Fed leaving the stage: Read More »

5. The Fed Is About to Turn Off the Monetary Spigot! Yeah, Sure

Fearing that the flow of nourishing mother milk from the Fed could dry up, a resolutely unweaned Wall Street threw a hissy fit and the dummy out of the pram last Thursday. The end of QE is seen as the beginning of the end of super-easy policy and potentially the first towards normalization. There is only one problem: it won’t happen. Here’s why. Read More »

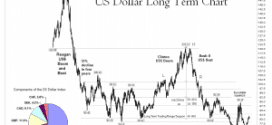

6. Japan’s Role in the U.S. Dollar’s Rise – and Gold’s Fall

Lately, the dollar has been making a comeback and, as usual, gold is tanking…[That being said,] however, the timing of the dollar’s resurgence is a bit curious. Perhaps not coincidentally, gold began tanking just as the dollar was advancing against the yen. [Why do I say “Perhaps not coincidentally”? Read on.] Read More »

7. Japan: A Country On the Brink of Fiscal & Economic Disaster!

I wrote several years ago that Japan is a bug in search of a windshield and in January I wrote that 2013 is the Year of the Windshield. Japan is a country that is on the brink of fiscal and economic disaster Read More »

I expect the eventual endgame to this whole Keynesian monetary experiment that has been going on ever since World War II [will] finally terminate in a global currency crisis. [That being said,] I’m starting to wonder if we aren’t seeing the first domino – the Japanese yen – start to topple…[It has] cut through not only the 2012 yearly cycle low, but also the 2011 yearly cycle low and never even blinked [and should it continue its steep decline] and break through the 2010 yearly cycle low [of 105.66] I think we have a serious currency crisis on our hands. Needless to say, if the world sees a major currency collapse… it’s going to spark a panic for protection – to gold and silver. Wouldn’t it be fitting that at a time when they are completely loathed by the market they are about to become most cherished? [This article analyzes the situation supported by 3 charts to make for a very interesting read.] Words: 620; Charts: 3

9. What Is “The Carry Trade” & Why Is It So Misunderstood?

These days any time anyone shorts the yen—or any currency with below average interest rates for that matter—it gets referred to by some strategist or equity investor as ‘the carry trade’ – but it is wrong. Below is a clear description of what a carry trade is – and isn’t – and why it is so pervasively misunderstood. Words: 714 Read More »

10. Bernanke’s Latest Economic Outlook: An Interpretation, Analysis & Assessment

U.S. Federal Reserve Chair Bernanke addressed the Joint Economic Committee of the U.S. Congress on The Economic Outlook [saying in a nutshell] “We clearly understand the game we are playing, but we are boxed in and have to stay with our current strategy. We hope for the best because we are out of options Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money