Based on past massive monetary pumping, and using the time lag of 36 months which it normally takes before changes in money supply generate a visible effect on the prices of goods in general, we forecast that the yearly rate of growth of the CPI based inflation could rise to 2.4 percent by September of this year before jumping to 4.4 percent by December. Year on year, the rate of growth of the CPI less food and energy is forecast to climb to 1.5 percent by September before climbing to 2.7 percent in December. Let me explain. Words: 1670

Read More »Global Money Printing Is A Recipe For A Global Economic Nightmare (+2K Views)

If the U.S. dollar is being devalued so rapidly, then why does it sometimes increase in value against other global currencies? It is because there are times when one particular global currency will fall faster than the others but the reality is that they are all being rapidly devalued. As the 6 charts below illustrate, the UK, the EU, Japan, China and India, as well as the U.S., have all been printing money like there is no tomorrow. Unfortunately, this is a recipe for a global economic nightmare. Words: 1102

Read More »Get Ready: Egypt’s Inflation-sparked "Unrest" Will Likely Spread to U.S. by 2015! (+2K Views)

The rioting and looting currently taking place in Egypt is primarily a result of massive food inflation and shows what all major cities in the U. S. will likely look like come year 2015 due to the Federal Reserve's zero percent interest rates and quantitative easing to infinity... Words: 1891

Read More »Will This Be The USA in 2012?

The economic condition of the country continues to decline toward its rendezvous with an, as yet, unknowable catastrophe. Here is... a look (not a prediction) at a series of not improbable events that could develop [and which] would change our economic world overnight. Words: 1550

Read More »Rampant Inflation is Coming – As Soon As 2011!!

Are you ready for rampant inflation? Well, unfortunately it looks like it might be headed our way. The U.S. monetary base has absolutely exploded over the last couple of years, and all that money is starting to filter through into the hands of consumers. Commodity prices are absolutely skyrocketing, and it is inevitable that those price increases will show up in our stores at some point soon. The U.S. dollar has already been slipping substantially, and now there is every indication that the Fed is hungry to start printing even more money. All of these things are going to cause a rise in inflation. The only real question is how far down the road are we going to get before it happens. Words: 1096

Read More »Are Glenn Beck's Continual Warnings of Imminent Rampant Inflation To Be Taken Seriously?

Fox News' Glenn Beck has repeatedly stoked fears that the U.S. would see "massive inflation," stating, as far back as 2008, that inflation would go "through the roof" in the "next year." In fact, inflation remained low in 2009 and 2010 and looks to remain the same in 2011. Let's review Beck's prognostications one by one and come to our own conclusion. Words: 1764

Read More »Washington Politicians Will Cause Rampant Inflation With Their In-Action and Mis-Action! (+2K Views)

The National Inflation Association (NIA) believes it is very unlikely that our representatives in Washington will have the political backbone and courage to implement any of the National Commission on Fiscal Responsibility and Reform's proposed cuts in domestic and defense expenditures and increases in tax revenues. [Instead, as the NIA sees it,] the U.S. is on a path towards exploding budget deficits in the years ahead that could cause an outbreak of hyperinflation by the end of calendar year 2015. Words: 887

Read More »Remedies to Fiscal Gap Guarantee Hyperinflation! (+3K Views)

Boston University economist, Prof. Kotlikoff, maintains that the U.S. cannot end its fiscal crisis by doubling taxes, as the International Monetary Fund suggests, or further stimulus spending [as Bernanke is doing] because it will simply increase the debt. [Instead he has some radical proposals of his own.] Words: 704

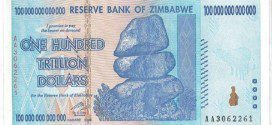

Read More »Coming Hyperinflation Will Make You A Billionaire By 2020! (+4K Views)

The National Inflation Association (NIA) believes that if the Federal Reserve doesn't reverse course immediately, we are on a direct path to all Americans becoming billionaires by the year 2020, if not much sooner. Being a billionaire in dollars won't mean anything. The wealth of Americans later this decade will be calculated based on how much gold and silver they own. We are at the beginning stages of a massive worldwide rush out of the U.S. dollar and into gold and silver. Words: 1021

Read More »News Flash! The Fed Has Declared That It MUST Create Inflation! Got Gold?

In... September's Federal Open Market Committee minutes, the Fed officially announced that ... "Unless ... underlying inflation moved back toward a level consistent with the Committee's mandate, they would consider it appropriate to take action soon" and take "... possible steps to affect inflation expectations." That's Fed-speak for a MANDATE TO CREATE INFLATION! Words: 694

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money