If you really want to be sure you’re keeping pace with inflation and own assets that can survive a crisis then forget gold. [A look at the evidence] tells us that over long periods of time, investors are better off holding stocks than gold. Words: 665; Table:1

Read More »The Stock Market Will NOT Rise Indefinitely So Here Are 10 Investment Rules To Live By

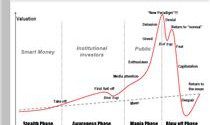

As the markets are propelled higher by the successive interventions of the Federal Reserve, it is hard not to think that the current rise will continue indefinitely, but the reality is that markets cycle from peaks to troughs as excesses built up during the up cycle are liquidated...This time...[will be no] different...[so what's an investor to do? Below] are 10 basic investment rules that have historically kept investors out of trouble over the long term [and hopefully will for you as well].

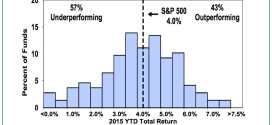

Read More »57% of Mutual Funds Have UNDER-performed the S&P 500 So Far In 2015 – Here’s Why

While 36% of mutual funds, on average, have outperformed their benchmarks (after fees) over the past 10 years, the truth of the matter is that only 43% of mutual funds have outperformed the S&P 500 so far in 2015. In other words, 57% of funds are still underperforming the market this year. Here's why.

Read More »Be Careful! Former Investment "Rules" Nolonger Work – Here’s Why

Investment “rules” that were relevant for a century are obsolete. They were based on a world where economies grew, people’s standard of living increased and outcomes tomorrow better than today. Arguably each of these conditions will not hold in the future but if they don't, neither do the rules of thumb that guided investing last century. These guiding principles developed and worked in a world that that no longer exists but applying them in the future will result in devastating financial outcomes. [Let me explain.] Words: 1261

Read More »Don’t Be Passive! Active Portfolio Management Has Major Benefits

We understand the appeal of passive investing. It offers lower fees and simplicity and many investors are skeptical about the ability of active managers to consistently beat a benchmark...yet there’s also a lot of evidence supporting the benefits of an active approach. Today, we see many risks that are hard to avoid by hugging a benchmark—and opportunities that simply cannot be captured by going passive. While not every point is relevant to every investor, in every market, we can think of ten good reasons to stay active in equities today.

Read More »Why – and How Much – Should One Invest In Gold & Silver?

No one can predict exactly what will rise up after the collapse of the current monetary system, but here is my take on how you can do your best to prepare yourself no matter what happens.

Read More »Both Stocks & Bonds Could Decline By 75% – Yes, 75%! – In Coming 10 Years – Here’s Why (2K Views)

The current credit-bubble boom in stocks and bonds is getting long in tooth after 34 years of relentless expansion, and the rise of securities to 400% of GDP is reaching extremes that are increasingly difficult to support, much less push higher. As such, a reversion to generational lows is inevitable, and a valuation level around 50% of GDP for stocks is a fair target. This implies a 75% decline in both stocks and bonds within the next decade, if not sooner.

Read More »Be Smart: Consider These Economic Indicators When Investing

Before placing trades, it’s good practice to review market-moving indicators such as jobless claims, housing starts and sales, consumer confidence, and inflation as they can help you make smarter investments and grow your wealth. Here's a look at each of the above mentioned indicators that you may want to become familiar with.

Read More »Make Better Investment Decisions By Applying This Checklist First

Have you ever made a spur of the moment trading decision without fully thinking things through and later come to regret it? Do you feel like your investment decision-making process could use some help? Here's an investing checklist you can use as a useful guide to develop a systematic, organized, and thorough approach to trading.

Read More »Curtains To Come Down 70% On Greatest Bull Market & Bubble In History By 2017 (2K Views)

Where does the Dow go from here? Maybe up a little higher but, more likely, it's all downhill from here though perhaps that statement is misleading. More like, down a cliff.

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money