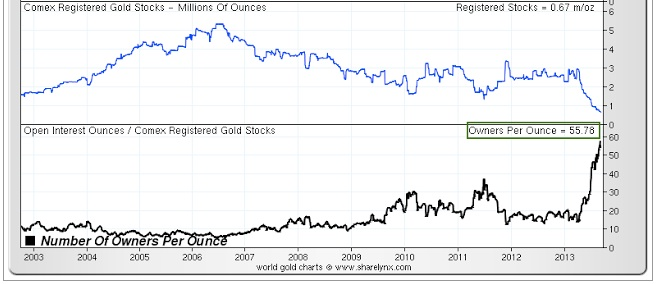

So you think you own some gold because you own a gold ETF. Right? Think again! At best you share your gold with 55 other supposed “owners”. What a sham the gold market is. An utter sham! Here’s why.

best you share your gold with 55 other supposed “owners”. What a sham the gold market is. An utter sham! Here’s why.

By Lorimer Wilson, editor of www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here ).

It should come as no surprise to anyone that the gold that is claimed to exist in Fort Knox or any of the other gold depositories around the world does not exist to the extent claimed. Why? Because when Germany’s representatives came to New York and politely asked (and I paraphrase):

“We would like to physically see our gold before making arrangements to have it returned.”

they were rebuffed with the reply,

“Sorry, no one is allowed access to the vaults to inspect/verify their holdings. As for having it returned, no problem. We are prepared to return 50% of it to you over the next 7 years. We realize that you are one of the major economic powers in the world with major political clout and major financial resources at your disposal but, sorry, that’s the best we can do.”

If that is not enough to convince you that your paper gold holdings, supposedly backed up with an equivalent amount of physical gold, do not exist then take a look at the 2 graphs below which clearly show the discrepancy – a 56 to 1 discrepancy – between what is purported to be in the coffers of COMEX and the actual number of owners per troy ounce.

The bottom line is that you do NOT own much, if any, gold if you own paper gold in the form of a gold ETF. You only really own gold if you have it in your physical personal possession.

Got gold? Really??

Related Articles:

1. Where Does Your Country Rank in Gold Reserves per Person?

The country with the biggest reserves in the world is, not surprisingly, America, with 8,134 tonnes but, expressed in terms of reserves per person, the picture looks very different. Take a look. You’ll be surprised. Read More »

2. United States Gold Bullion Depository: Fort Knox or Fort NOT?

If you believe the government routinely lies or covers up its actions, we can’t simply laugh off the idea that there’s no gold in Fort Knox. Until an audit is done, the facts provide more questions than answers. [This article explores the situation, implications and possible ramifications.] Words: 892 Read More »

3. 10 Largest Gold Reserves By Country

Gold definitely has caught the public’s attention; for proof, just look at the number of cash for gold ads. Gold has been rising since 2001 and its near vertical rise over the last two years helps explain some of the recent fascination, but political actions have helped as well. In the United States, Rep. Ron Paul and others have called for a return to the gold standard. Elsewhere, Venezuelan President Hugo Chávez recently nationalized his country’s gold industries, and some analysts have said countries should dip into their gold reserves to alleviate the sovereign debt crisis. With all these recent stories, we wanted to see which countries actually have the most gold in their reserves, based on information from the World Gold Council. [Take a look at the list below.] Words: 565 Read More »

4. A “Troy” Ounce of Gold is 10% Greater Than a Regular Ounce – True or False?

When the price of gold is mentioned as costing “x dollars per troy ounce” do you fully appreciate the significance of the term “troy”? When looking to buy gold jewellery do you fully understand what the difference is between an item that is 10 “karat” gold and another item stamped 18 “karat” gold (other than that it is much more expensive)? Let me explain. Words: 587 Read More »

5. So Little Gold: Why So Cheap?

Gold, the precious metal most often thought of as money, is in short supply. In fact, the existing above ground horde is so small one has to question whether it is realistic to think of it as having a serious role as money in the future. The fact is there just isn’t enough of it and – once institutional and private investors realize that the supply is so disarmingly and alarmingly insignificant – prices are likely to go parabolic. Words: 1119 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money