The Sustainable Withdrawal Rate (SWR) strategy is based on the work of William Bengen whose research revealed that the order of market losses is more important than the average return sequence of returns risk. With all due respect to Bengen, though, I consider this strategy irrational and believe that it probably makes sense only for households with so much savings that they don’t need it. This article substantiates my conclusion.

The original article has been edited here for length (…) and clarity ([ ]) by munKNEE.com – A Site For Sore Eyes & Inquisitive Minds – to provide a fast & easy read.

Bengen found that the safe withdrawal percentage rate in the U.S. was historically 4% to 4.5% over rolling 30-year periods of market returns, hence the “4% rule.”…More recent work by Wade Pfau suggests that the number at present is perhaps 3% to 3.5% which, while it may sound small, is the difference between a safe spending amount of $30,000 and $45,000 a year per $1M of savings.

The basic process for implementing this strategy is for a retiree to calculate 4% (or 3% or 4.5%, depending upon who you choose to believe — I’d go with Pfau) of her total investment portfolio value the day she retires and to spend that dollar amount (not percentage) for the rest of retirement, increasing it annually by inflation. A retiree with a million dollar portfolio who agrees with Pfau’s 3.5% could spend $35,000 the first year of retirement. If inflation ran 2% that year, he could spend $35,700 the following year.

The SWR strategy will result in two possible outcomes when simulated, though actual retirees might not behave this way. The strategy will produce a constant, inflation-adjusted income amount from the portfolio:

- until the retiree dies

- or the portfolio is depleted, whichever comes first…

With all due respect to Bengen, whose research exposed sequence risk — an important contribution — I consider this strategy irrational and believe that it probably makes sense only for households with so much savings that they don’t need it. The idea that we can spend an amount calculated at the beginning of retirement and continue spending it regardless of what happens to our financial situation over perhaps 30 years is not only risky but irrational. As retirement progresses, our finances and life expectancy will change, our finances for better and for worse. Life expectancy constantly declines. Constant-dollar spending is a strategy to ignore any of this new information after the original spending amount is calculated.

…Here are some considerations I have learned by running a gazillion retirement simulations that you probably won’t find elsewhere without a lot of digging.

- SWR strategies are based on the assumption that future market returns will be similar to historical returns but there is a lot of reason to believe they will be lower in the future. Even if they are similar, we don’t know the expected market return, whether it changes over time or even the distribution of those returns. We pretend they are normally distributed, largely because it makes the math easier, but empirical evidence shows that there are far more extreme market events than a normal distribution would predict. That’s a lot of uncertainty on which to bet one’s retirement.

- Many retirees who like this strategy believe that they are creating their own annuity without committing a large sum of money to an insurance company.

- There is a specious similarity to an annuity in that both provide constant income but SWR is like an annuity from an insurance company with a 5% to 10% chance of going out of business.

- Further, annuities provide maximum lifetime consumption while SWR strategies are economically inefficient. It’s expensive to tie up 96% of your wealth so you can safely spend 4% of it.

- Self-annuitizers may expect that have more liquidity with a SWR strategy than they actually have. Spending from an SWR portfolio to meet large, unanticipated expenses means spending income you were counting on for the future…

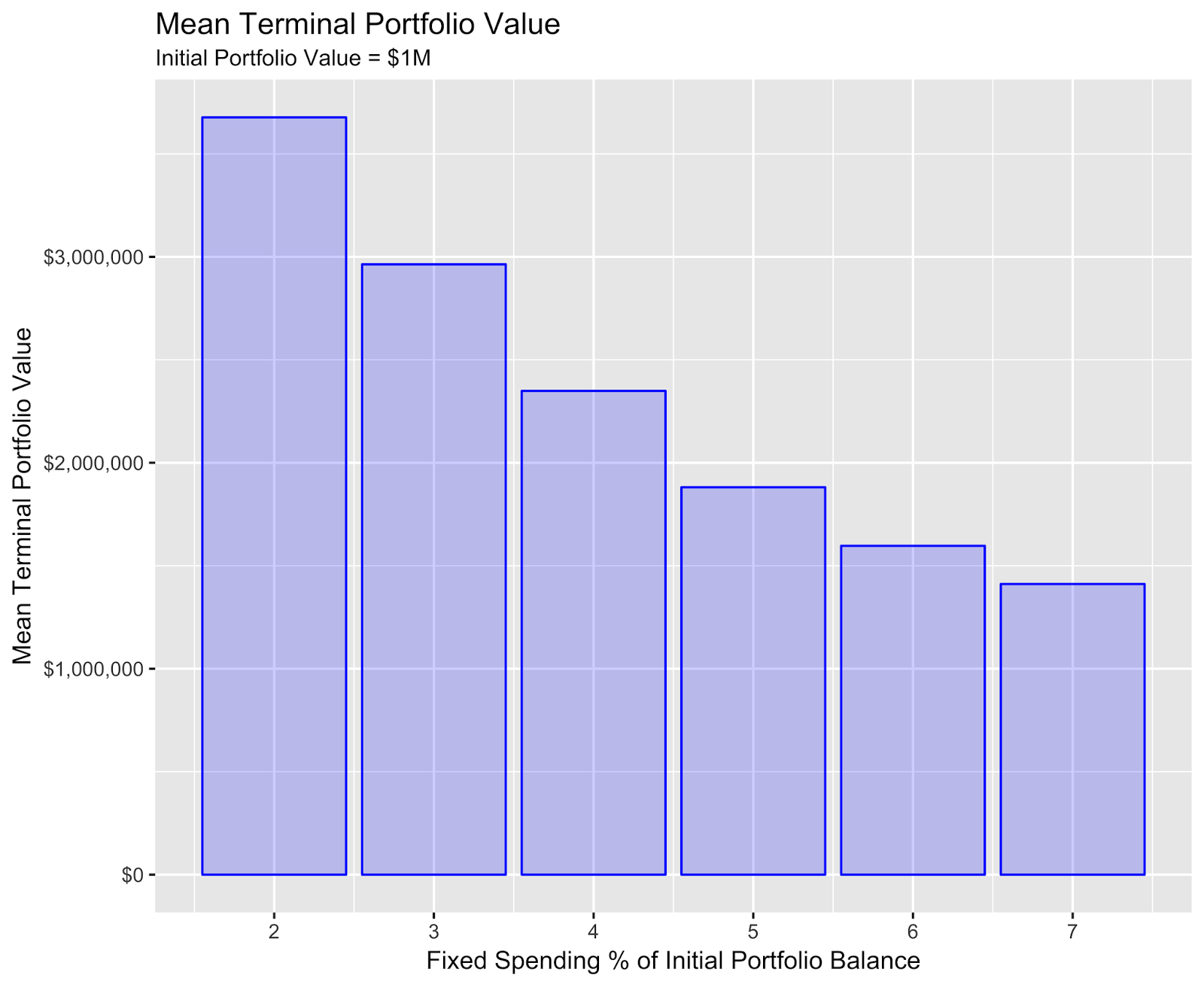

- A high spending percentage increases the probability of outliving the portfolio and reduces the expected terminal portfolio value, which is often part of a planned bequest.

- A low spending percentage decreases the odds of portfolio depletion but increases the expected terminal portfolio value. This has some interesting implications. The following charts show the relationship.

- Retirees with limited wealth relative to their spending needs may need to spend a larger percentage and accept a greater…[likelihood] of outliving their savings. They are less likely to accumulate a large terminal portfolio.

- Retirees with adequate savings can play it safe with a low withdrawal rate but they are more likely to die with a large portfolio. This is a good thing for households with a strong bequest motive but not so good for those without. Without a bequest motive, a retiree who plays it safe with a low withdrawal rate may find late in retirement that she has an extra million bucks she could have spent to enhance her life. This may be ideal for a household with so much wealth that they can easily afford their desired standard of living and still expect a large portfolio to leave to heirs but then one must ask why a household this wealthy needs a SWR strategy, at all.

- Constant-dollar spending strategies are quite unpopular among economists and most of the researchers I know. They are sometimes popular among planners who charge fees based on assets under management and retirees who see them as an annuity alternative.

Summary:

I am not a proponent of constant-dollar spending strategies. I have many reasons, but the most basic are that it is irrational to ignore new information that comes available as retirement progresses and financially unsound to attempt to derive constant income from a volatile portfolio. The strategy is risky for retirees who are not wealthy and unnecessary for those who are.

Related Articles from the munKNEE Vault:

1. Is $1,000,000 Enough to Provide for a Successful 30-year Retirement?

Withdrawing from a $1,000,000 nest egg upon retirement using the familiar 4% rule to generate a successful 30-year inflation-adjusted (3% per annum) retirement proved to be totally inadequate as per the retirement withdrawal strategy that I put forth in a previous article (1). In fact, it crashed and burned in year 25 of the 30-year plan! In fact, as I show in this article, it will only succeed if your portfolio outperforms the S&P 500 by 5% every year for 30 straight years – and what is the likelihood of that?

2. Relax! Here’s How to Cover Your Retirement Expenses Every Single Year

Below is an analysis of the past and present retirement scenarios and specific ways to offset the income gap of today.

3. Here’s How To Set Up A Risk Averse Retirement Plan

One of the most difficult challenges of transitioning to retirement from the working world is a complete change in mindset with regards to an investment portfolio. You go from being a saver to a spender. There’s no future income or nearly as much time to soften the blow from bear markets. Growth is still necessary but you have to be cognizant of the fact that you’ll need to protect some of your assets for spending purposes. Here’s an interesting case study in how to approach this change in mindset.

4. Stock Market Volatility Could Ruin Your Retirement – Here’s Why

With markets so calm, it’s easy to become complacent about the corrosive effects that volatility can have on long-term investment success. If you don’t need the money for a long time, you can ride out the inevitable market squalls but if you’re close to or already drawing from those funds, volatility can be costly…Let me explain further.

5. How Much Investment Income Do You Need to Retire? Here Are Some Guidelines

Here’s an interesting rule of thumb that most retirees and would-be retirees would do well to adopt.

As with most financial habits, knowing what you need to do is the easy part. Following through with it is where most people run into trouble. To help you in that regard HERE are the 4 most important factors that help determine whether or not you’ll have a large enough nest egg to cover your living expenses during retirement.

7. The Financial Impact Of Living Longer

People are living longer. The double-edged sword version is that people have a much longer time horizon to plan for financially, which could make things tricky for those who aren’t thoughtful about the potential ramifications.

8. Here’s How Not To Compromise Your Nest Egg In Retirement

Transitioning to retired life on a fixed income will undoubtedly have a few bumps in the road. This is a brand-new chapter of life for you, and it’s reasonable to expect some challenges ahead. The last thing you want to do, however, is compromise your nest egg with costly, easily avoidable mistakes. After all, you need that money to get you through the rest of your life. As such, consider these costly mistakes of the newly retired so you don’t follow suit.

For all the latest – and best – financial articles sign up (in the top right corner) for your free bi-weekly Market Intelligence Report newsletter (see sample here) or visit our Facebook page.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money