We have to be very careful with past performance. It’s nice to have a historical record of how certain asset classes have performed in the past, but it’s always dangerous to assume that the future will necessarily look like the past…That said, we do have some evidence to work with and it would be equally naive to totally ignore past performance so let’s actually put these historical figures in some perspective.

record of how certain asset classes have performed in the past, but it’s always dangerous to assume that the future will necessarily look like the past…That said, we do have some evidence to work with and it would be equally naive to totally ignore past performance so let’s actually put these historical figures in some perspective.

The above introductory comments are edited excerpts from an article* by Cullen Roche (pragcap.com) entitled Putting the Performance of Gold in Perspective.

Roche goes on to say in further edited excerpts:

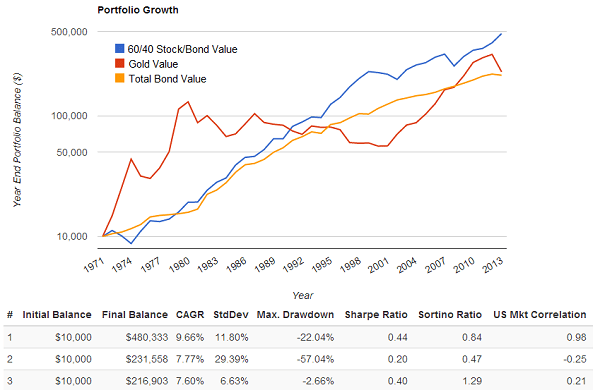

The price of gold was fixed before 1971 so we don’t have as much history as we might like, however, we can still make some sound conclusions based on this time period. As such, let’s compare gold with a standard 60/40 stock/bond portfolio and a bond aggregate. The results are pretty clear [as illustrated in the chart below]:

- The 60/40 portfolio has outperformed the other two portfolios in nominal returns.

- The bond portfolio has the most consistent risk adjusted returns….

- Gold

- has been an atrocious risk adjusted performer generating a compound annual growth rate that is the equivalent of the bond portfolio, but does so with over 4X the volatility! Even a pure stock portfolio had a standard deviation that was 40% lower over the same period…

- has provided some non-correlation to other asset classes which creates increased diversification and could boost the risk-adjusted returns of a broader portfolio by having this slice of non-correlation included…

- has performed fine in nominal terms since the price fix was removed but it has not been remotely stable. In fact, it has been so volatile that its risk adjusted returns are among the worst of all available asset classes over this period.

Conclusion

The past is not prologue and my rationale for disliking gold as a substantial holding in any portfolio [I Don’t Mean to Rant Against Gold BUT] has nothing to do with past performance, but rests in what I believe is the risk of a collapsing “faith put”. That is, there is a price premium in gold due to its perception as a currency. I personally believe this perception is flawed and I think technology will render it entirely false as time goes on.

The future of money is not in rocks, but in spreadsheets on computers. Therefore, it’s my opinion that this “faith put” will slowly be removed over time as this added demand for gold disappears and this is why the past data is even more dangerous than many people think.

If I am right about my views going forward then gold isn’t just risky based on past performance, but it could be even riskier in the future as the “faith put” subsides and the myth that “gold is money” disappears.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

* http://pragcap.com/putting-the-performance-of-gold-in-perspective (Copyright © 2014 All Rights Reserved; Subscribe to Pragmatic Capitalism)

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. I Don’t Mean to Rant Against Gold BUT

I don’t mean to rant against gold. I just think that there are some fundamental reasons to keep gold in the proper perspective when we consider its value as a portion of our asset holdings. In my view, it’s not the type of asset you want to build a portfolio around. Here’s why. Read More »

2. Gold, Stocks & Bonds: What % Should You Have of Each?

What would the optimal portfolio allocation in gold have been according to Modern Portfolio Theory over several different periods of time? This article has a look at how an investor could have combined gold and equities to enhance risk-adjusted returns. Read More »

3. The Merits of Using Gold as a Portfolio Diversifier

Although not perfect (nothing is), gold has a tendency to go up in the face of external shocks…[and] tends to have a low and sometimes negative correlation to US equities. As such, with stocks up, gold being down is not a terrible outcome for the investor using gold as a diversifier. Let me explain further below. Read More »

4. Your Portfolio Isn’t Adequately Diversified Without 7-15% in Precious Metals – Here’s Why

The traditional view of portfolio management is that three asset classes, stocks, bonds and cash, are sufficient to achieve diversification. This view is, quite simply, wrong because over the past 10 years gold, silver and platinum have singularly outperformed virtually all major widely accepted investment indexes. Precious metals should be considered an independent asset class and an allocation to precious metals, as the most uncorrelated asset group, is essential for proper portfolio diversification. [Let me explain.] Words: 2137

5. It is Imperative to Invest in Physical Gold and/or Silver NOW – Here’s Why

Asset allocation is one of the most crucial aspects of building a diversified and sustainable portfolio that not only preserves and grows wealth, but also weathers the twists and turns that ever-changing market conditions can throw at it. However, while the average [financial] advisor or investor spends a great deal of time carefully analyzing and picking the right stocks or sectors, the basic and primary task of asset allocation is often overlooked. [According to research by both Wainwright Economics and Ibbotson Associates and the current Dow:gold ratio, allocating a portion of one’s portfolio to gold and/or silver and/or platinum is imperative to protect and grow one’s financial assets. Let me explain.] Words: 1060

6. Physical Gold and Gold Stocks Should be in Your Portfolio – Here’s Why

Do you own enough gold and silver for what lies ahead? If 10% of your total investable assets (i.e., excluding equity in your primary residence) aren’t held in various forms of gold and silver, we…think your portfolio is at risk. Here’s why. Words: 625

7. Gold or Equities: Which Is More Volatile?

With the gold price in dollars breaking decisively the 200 day moving average but with volatility across a broad range of asset classes close to, or at, historic lows…this article looks at what patterns occur in equity and gold prices during both up and down trends and how to adjust your portfolio accordingly. Read More »

8. What Could Possibly Be A Better Safe Haven Than Gold? Read On

Some market commentators are touting gold as a great portfolio diversifier, convincing investors that the precious metal could benefit their portfolio but there may be better alternatives than gold if the motivation is to find a hedge for economic uncertainty or political unrest. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money