Our analysis reveals a bearish outlook for gold over the next 3 months based on the following fundamental and technical factors:

The above comments, and those below, have been edited by munKNEE.com (Your Key to Making Money!) for the sake of clarity [] and brevity (…) to provide a fast and easy read and have been excerpted from an article* by Ati Ranjan & Rohit Nagraj (aranca.com) which was originally entitled Gold – Will It Shine In The Near Term? and which can be read in its unabridged format HERE.

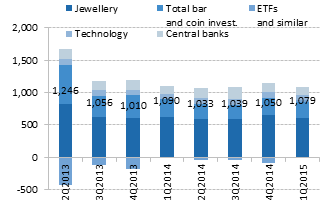

1. Lackluster gold demand in Q1 2015

The recent gold demand trend suggests that demand has been relatively weak in the last few quarters. In addition, gold demand has been declining on a year-on-year (YoY) basis since 2011. This is attributable to low demand from key markets such as China and India. Nonetheless, gold demand:

- in India increased 15% YoY and could increase in the future due to falling global prices. The Indian rupee-US dollar exchange rate would need to be watched out for simultaneously, however.

- in China declined 7% YoY in Q1 2015 and the substantial fall in the Chinese stock market in H1 2015 is expected to keep demand for gold weak in the near term.

Fundamental Commentary

An analysis of the demand side indicates weak near-term gold demand, keeping the prices at bay.

| Gold demand stable in recent quarters (tonnes) | Gold demand stable in recent quarters (tonnes) |

|

|

Source: gold.org

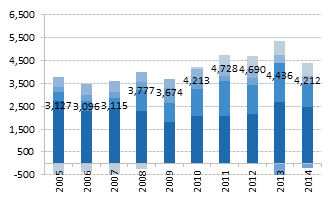

2. Falling net long positions on CFTC

On the CFTC, gold net long positions currently (week ending July 14, 2015) stand at 47,824, the lowest since January 2014. This indicates investors being averse to gold trading-related risks. Even overall long positions have been hovering in a narrow band, thereby indicating low interest from investors.

|

Source: CFTC

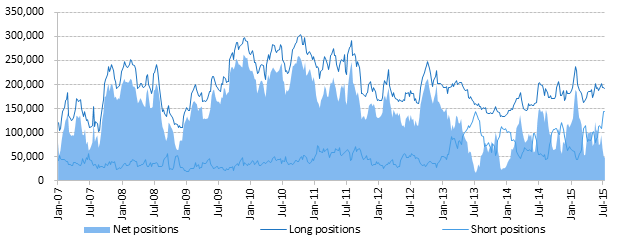

3. Strong U.S. dollar

The gold and U.S. dollar indices had a negative correlation between 2000 and YTD 2015. The negative correlation, which currently stands at -0.7, indicates that a strong U.S. Dollar Index would be unfavorable for gold and vice versa. Recent comments from the U.S. Fed suggest that the U.S. Fed is likely to raise interest rates in H2 2015, which would limit uptrend in gold prices in the near term.

|

Source: Thomson Reuters

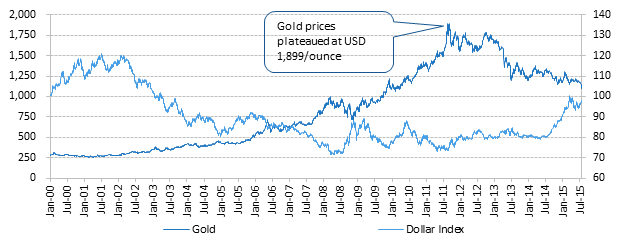

Gold to lose sheen temporarily

Broader data on gold demand, CFTC positions, and the U.S. Dollar Index indicate that the near-term outlook for gold would remain challenging. Gold demand has picked up in India. Meanwhile, the slump in the Chinese stock market would impact demand for the yellow metal in China. We believe that fundamental factors are currently unfavorable for gold and, thus, its prices are likely to remain low in the near term.

Technical Commentary

As evident from the chart below, gold has been trading in a downward sloping trend channel, experiencing selling on each rise. The theme of strong U.S. dollar and weak commodities is playing well. However, the factor that aids in betting on a weak gold is that although gold is a safe haven, it did not gain any visible strength amid Grexit fears. Rather each rise has been sold off into. On the monthly charts, RSI continues to hover in the negative territory, supporting the bearish outlook on the commodity. It has currently breached the support of the 61.8% retracement of the rise experienced since 2008. This indicates sustained downward pressure on the commodity.

The trend remains bearish. An immediate decline towards the lower channel support looks likely from here.

Key support/ resistance levels

| (USD/ ounce) | R1 |

R2 |

R3 | R4 |

| Gold | 1,144.1 | 1,208.6 | 1,046.1 | 1,012.6 |

Source: Thomson Reuters

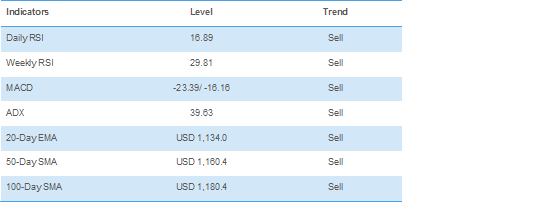

Technical indicators

Source: Thomson Reuters

Related Articles from the munKNEE Vault:

1. Analysts: Gold Will Bottom Somewhere Between $725 & $1,000/ozt.

Much has been written over the past few months as to just where gold (and silver) is headed. In light of the recent significant drop in price below is substantiation for such a decline and several projections as to where the price correction will bottom out and the timeframe for such price action.

2. I See Gold Dipping To – Dare I Say – $880ozt. Here’s Why

Several signs have been flashing for the past year that gold has become too big for its britches and will eventually adjust to a lower price which could push the yellow metal off the edge of a cliff to – dare I say – not just below $1100 or $1000 per troy ounce, but to $880ozt.

3. New Update: Gold & Silver Will Plummet In 1st Qtr. of 2016 – Then Go Parabolic!

My new analyses of gold & silver indicates they will both continue to show weakness throughout the balance of 2015, plummet to $725ozt. & $12ozt. respectively, during the 1st. Qtr. of 2016 and then go absolutely parabolic in price by the end of 2016/early 2017. Below are the specific details of my forecasts (with charts) to help you reap substantial financial rewards should you wish to avail yourself of my insightful analyses.

4. Gold & Silver Going BELOW $1,000 & $15 Respectively Say These Analysts

“Told you so!” I’m sure that is what the analysts who have projected such a dramatic decline are saying with the recent major correction in the prices of gold and silver. Read why they have come to their conclusions in this catch-all article.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money