The fundamentals supporting a mania in gold and gold stocks are such that I think a strong case can be made [to support my contention] that the current bull market in gold is far stronger than the one from the 1970s. [I present below] the major observations I feel…support such a thesis. Words: 700

think a strong case can be made [to support my contention] that the current bull market in gold is far stronger than the one from the 1970s. [I present below] the major observations I feel…support such a thesis. Words: 700

So says Simit Patel (www.informedtrades.com) in edited excerpts from his original article* which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Patel goes on to say, in part:

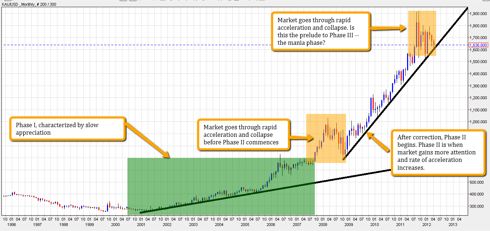

According to Dow Theory, secular bull markets have three phases:

- slow appreciation of insiders and professionals;

- more rapid appreciation, mainstream media coverage, and an increase in mass market investors;

- a parabolic mania.

As the chart below illustrates, a case can be made that gold is about to enter phase three — the mania phase.

Click to enlarge all images.

The fundamentals supporting a mania in gold and gold stocks remain intact, as the world is still awash in debt. Considerable weakness remains in the European and U.S. bond markets likely as a result of bond investors losing faith as $7.6 trillion in sovereign debt is maturing this year.

Based on these factors, I thought it would be a good time to revisit the bull market in gold from the 1970s in order to see how history may repeat, as well as differences investors should be aware of. [Let’s take a look:]

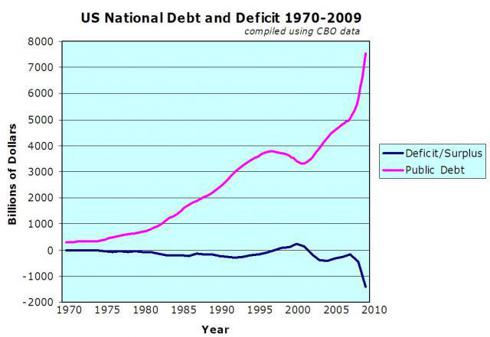

1. More Debt Now Than Before. Gold is a function of debt; its economic purpose is to balance debt when nothing else can, when politicians refuse to restructure out of their own will, and when the monetary system does nothing but create more debt. The chart below tells the story of U.S. public debt; it is clearly much larger now than it was during gold’s bull market in the 1970s.

The above is, of course, just a snapshot of U.S. public debt; it does not include U.S. private debt, nor does it look at the situation around the world. As we are in a fiat monetary system in which all money is loaned into existence, the natural tendency of such a system is to create more and more debt. Gold’s bull market in the 1970s was just a warning sign of the inherent instability in the design of the monetary system. However, with debt levels where they are now, it is clear the warning has been ignored and the system is insolvent. Because the debt problem is so much greater now, I think the current bull market in gold will far outperform the one of the 1970s.

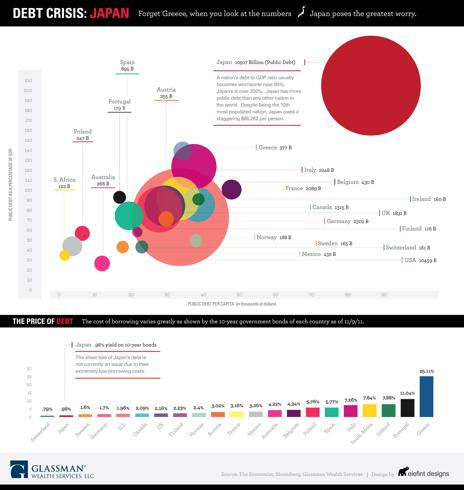

2. The Current Crisis Is Global. Unlike during gold’s bull run in the 1970s, the current crisis is global. Europe, Japan, Britain, and the U.S. are all mired in debt. In fact, a strong case could be made that the next big crisis could come from Japan, and could send an influx of capital into U.S. equity markets and gold. The infographic below, created by Glassman Wealth Services, tells the story.

In the 1970s, the crisis was just about the U.S. [This time round] the current debt crisis is a global one [and] that means capital from all around the world will go rushing into gold. Therefore, the current bull market is going to be even more spectacular.

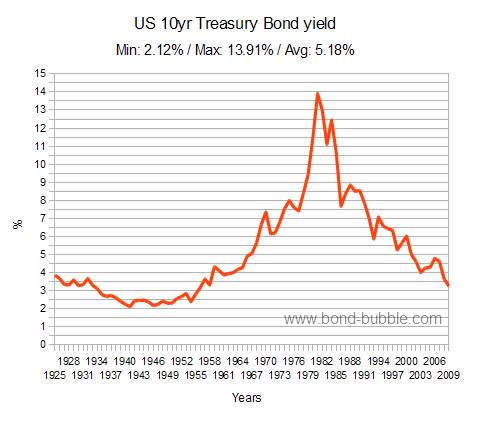

3. Bond Yields Are Currently Very Low. Perhaps the biggest difference between the current gold bull market and the one from the 1970s is that bond yields are currently very, very low. Contrast this with the 1970s, a time during which the yield on the 10-year Treasury bond consistently rose, as the chart below illustrates.

Low yields means that the bond market is increasingly incapable of competing with gold for capital. Given that these countries are still engaging in rampant deficit spending, raising rates would prove to be a dangerous strategy as it would increase the interest burden from governments, which would make them more insolvent and less capable of funding their programs. Low yields also make it more likely that capital-chasing income streams will find their way into high dividend stocks, and as the price of gold rises, many gold miners will be well-positioned to increase their dividends. Indeed, Newmont Mining (NEM) is the role model here, as the company has established a policy of pegging its dividend rate to the price of gold. As investors become increasingly disillusioned with bonds that have no real yield, gold stocks such as Newmont will be there to receive the capital.

For all of the above reasons, I think the bull market in gold will go much, much further than it did in the 1970s. In those days, gold ran from $35 to $850 — an increase of 24 times. If we identify the start of the current gold bull market as 2001 at a price of $250, a 24 times move would put the price of gold at $6,000. In light of how severe the debt problem currently is, a higher price is certainly feasible; the only question is when the parabolic move will truly start. Given the debt coupons that are due this year, and that much of the bullish sentiment in gold has subsided in the wake of the selloff after gold’s run up past $1,900 this past September, I think the stage is being set for the mania to start soon — perhaps by summertime.

Home Delivery Available! If you enjoy this site and would like to have every article sent automatically to you then go HERE and sign up to receive Your Daily Intelligence Report. We provide an easy “unsubscribe” feature should you decide to opt out at any time.

Pass it ON! Tell your friends and co-workers about us. We think munKNEE.com is one of the highest quality (content and presentation) financial sites on the internet and our current readers seem to be confirming that. Visits have been doubling yearly and pages-per-visit and time-on-site continue to reach record highs.

Spread the word. munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

Potential Spoilers

There are two potential spoilers to my thesis here:

- debt cancellation, such as the kind that Iceland has already conducted, could make the debt problem go away — and thus make the need for gold go away. I find widespread debt cancellation to be extraordinarily unlikely, as there are no real signs that the monetary authorities of the world see debt as the problem; in fact, their prescription for the sluggish economy involves greater stimulus in the form of cheap credit and deficit spending. This only magnifies the debt problem, and thus is bullish for gold.

- silver could compete with gold for what the market will remonetize. Silver has served as a form of money through much of history; in fact, the U.S. was on a bimetallic standard for much of the early part of its history. Silver, nevertheless, has had trouble serving as money when the government does not officially acknowledge it as such. For this reason, I think gold is a much better play and is more likely to be remonetized if governments do choose to return to some type of commodity standard. In the interest of being aware of potential spoilers, however, the price action in silver and government policy toward it is worth watching.

Conclusion

In light of all these factors, I think owning gold and gold stocks in anticipation of a parabolic mania is prudent. The challenge will be to preserve one’s discipline and poise if a mania does in fact emerge.

*http://seekingalpha.com/article/486851-why-the-current-bull-market-in-gold-is-bigger-than-the-one-in-the-1970s?source=email_macro_view&ifp=0 (To access the article please copy the URL and paste it into your browser.)

Editor’s Note: The above article has been has edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. New Analysis Suggests Gold Going to $3,495 in 2013, $6,233 in 2014 and Peaking at $31,672 in 2015!

Nick Laird has put together an Elliott Wave theory prediction using ‘The Golden Mean’ & ‘Fibonacci Sequences’ to arrive at future prices for gold…which he is hopeful will serve as ‘a roadmap which gold may take as it climbs to new highs’. See the chart below. Words: 625

2. Richard Russell: NOW is the Time to Begin Amassing Your Future Fortune – Here’s Why and How

Great fortunes are made at super-bear market lows but you must have the money at the lows. [That is precisely] why gold is so singular and valuable. If you have gold at the bottom of the next bear market, you can exchange it for a collection of great common stocks or funds, and then sit back and relax.

3. Sprott: Current HUI Level Spells O-P-P-O-R-T-U-N-I-T-Y

Before we end the year we will hit new highs in both [gold and silver]. Then the mining stocks [will] react. The big problem has been [to date has been that] there is not this momentum in the prices of bullion, which is keeping people away from the gold stocks. If we can get the price of gold and silver going back up, I’m sure people will come back into the mining stocks.

4. Alf Field: Correction in Gold is OVER and on Way to $4,500+!

There is a strong probability that the correction in the price of gold [down to $1,523] has been completed. The up move just starting should be…the longest and strongest portion of the bull market…at least a 200% gain… [to] a price over $4,500. The largest corrections on the way to this target, of which there should be two, should be in the 12% to 14% range. [Let me explain how I came to the above conclusions.] Words: 760

5. Gold: $3,000? $5,000? $10,000? These 151 Analysts Think So!

151 analysts maintain that gold will eventually reach a parabolic peak price of at least $3,000/ozt. before the bubble bursts of which 101 see gold reaching at least $5,000/ozt., 17 predict a parabolic peak price of as much as $10,000 per troy ounce and a further 13 are on record as saying gold could go even higher than that. Take a look here at who is projecting what, by when and why. Words: 844

6. Will Gold Peak at $2,500, $8,890 or $15,000?

When considering that the conditions which propelled gold and silver to their 1980 highs are much worse today, I predict both metals will easily eclipse those previous highs. That means $2,500 gold and $150 silver at the very minimum, but more likely a parabolic ascent to $8,890 gold and $517 silver before all is said and done. Words: 1063

7. New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

8. Deja Vu? Is Gold Just in a Correcting Phase on Its Way to Parabolic Peak of $4,294?

The current volatility in the precious metals market doesn’t necessarily indicate a change in secular direction. [In fact,] if today’s gold price was to rise by the same degree over the next 14 months [as it did from the beginning of 1979 into 1980, it would hit $4294/ozt. by Jan 2013! Let me explain.] Words: 420

9. Contracting Fibonacci Spiral Puts Gold Near $4,000 by 2013 and $7-10,000 by 2020

Gold is operating on a smaller Contracting Fibonacci Spiral Cycle that is in synch with the larger Contracting Fibonacci Spiral the markets are in. Adding together the sum of parts… the price of gold will move up in price in 2013, 2016, 2018, 2019 and 2020, with each subsequent leg moving less in percentage terms than the prior move. Gold advanced 4 foldish from 1999 until 2008 ($252/ounce to $1046/ounce) suggesting that gold should top out below $4000/troy ounce by the end of January, 2013…[on its way] to $7,000 and $10,000 per troy ounce by 2020. [Let me explain.] Words: 834

10. Nick Barisheff: $10,000 Gold is Coming! Here’s Why

This is not a typical bull market. Gold is not rising in value, but instead, currencies are losing purchasing power against gold and, therefore, gold can rise as high as currencies can fall. Since currencies are falling because of increasing debt, gold can rise as high as government debt can grow. Based on official estimates, America’s debt is projected to reach $23 trillion in 2015 and, if its correlation with the price of gold remains the same, the indicated gold price would be $2,600 per ounce. However, if history is any example, it’s a safe bet that government expenditure estimates will be greatly exceeded, and [this] rising debt will cause the price of gold to rise to $10,000…over the next five years. (Let me explain further.] Words: 1767

From questions whether gold is in a bubble to predictions that soaring prices are just around the corner, one thing is clear: a new phase of awareness for gold is upon us. How far might it move before these troubling times are over? [Let’s take a close look at a variety of factors and scenarios before coming to a conclusion.] Words: 5717

12. Gold Will Reach $3,000/$4,000/$5,000 Before This Bull Market Is Over! Here are 12 Factors Why

I believe that the price of gold will… reach… $3,000, $4,000, and even $5,000 [per troy] ounce…during the course of this long-lasting bull market, a bull market that still has years of life left to it…[although] prices will remain extremely volatile – with big swings both up and down along a rising trend…The future price of gold is a function of past and prospective world economic, demographic, and political developments [and in this article] I review some of these developments and trends – so that you can come to your own “golden” conclusions. Words: 3800

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money