Every time someone tells me they are buying gold because of inflation  fears, I cringe. First, I don’t see a risk to higher inflation and, second, even if we have high inflation, don’t count on gold as a hedge…[Here’s why:]

fears, I cringe. First, I don’t see a risk to higher inflation and, second, even if we have high inflation, don’t count on gold as a hedge…[Here’s why:]

The above comments, and those below, have been edited by Lorimer Wilson, editor of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here – register here) for the sake of clarity ([ ]) and brevity (…) to provide a fast and easy read. The contents of this post have been excerpted from an article* by Michael Kerins, CFA, (robustwealth.com) originally posted on SeekingAlpha.com under the title Gold Is A Terrible Inflation Hedge: Looking At The Numbers and which can be read in its unabridged format HERE. (This paragraph must be included in any article re-posting to avoid copyright infringement.)

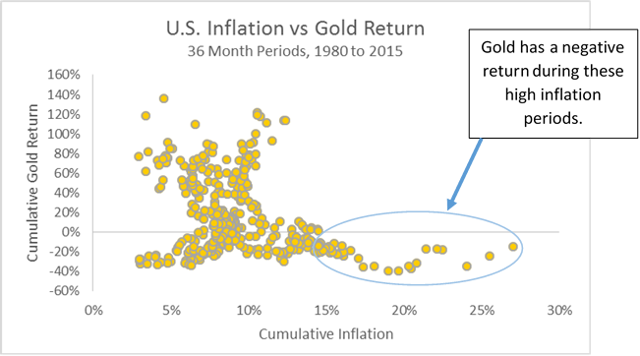

Scatter plots graphically show the relationship (or lack thereof) between two items. In the plot below, you can clearly see that the relationship between inflation and gold is inconsistent and negative during high inflation periods. The data shows that gold has historically been a poor and inconsistent inflation hedge.

(click to enlarge) If gold was a great inflation hedge, then I would expect it to have a return in line with inflation, [but it does not. In fact,] historical returns over the last 35 years point to cash as a better hedge to inflation.

If gold was a great inflation hedge, then I would expect it to have a return in line with inflation, [but it does not. In fact,] historical returns over the last 35 years point to cash as a better hedge to inflation.

| U.S. Cumulative Inflation | Gold Cumulative Return | Cash Cumulative Return | |

| 12/31/1979 to 8/31/2015 |

209% |

115% | 413% |

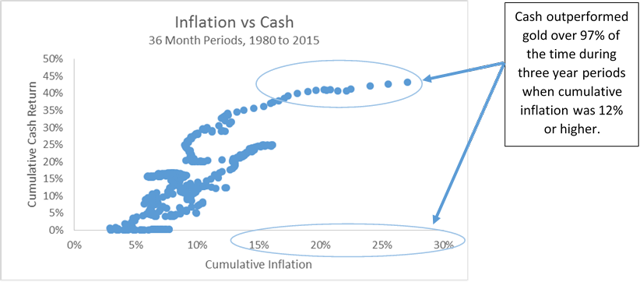

Three-year cash returns are also highly correlated to inflation. The scatter plot below shows that cash is correlated to inflation, especially during periods of high inflation.

You might be thinking the following:

- “We haven’t had high inflation in the last 35 years”…[but that’s] wrong. Inflation was high during the 1980s and early 1990s. In the last 35 years, the United States has experienced periods of rising inflation, falling inflation and steady inflation.

- “Everyone says gold is a great inflation hedge”…[but a] look at the data [shows that] gold has not historically been a great inflation hedge – cash has done better.

- “This time is different.” [Well,] I think you will be surprised at how poorly gold will perform when the Fed raises interest rates. The cost to own gold today is nothing (no lost opportunity cost), but as soon as cash rates increase, there is a cost to own gold (cash is the funding cost). As the Fed raises rates, I expect gold prices to fall 5-20%.

Conclusion:

Gold has historically been a terrible inflation hedge.

- Gold is not correlated with inflation over the long and short run,

- it has dramatically more risk than inflation and

- it has almost half of the return of inflation the last 35 years.

Going off of history, you are better off investing in cash as an inflation hedge…

*http://seekingalpha.com/article/3519846-gold-is-a-terrible-inflation-hedge-looking-at-the-numbers?ifp=0

Related Article from the munKNEE Vault:

1. Does gold really serve as an inflation hedge?

The traditional motive behind investing in gold is as a hedge against inflation but the hedge properties of gold are increasingly questioned. In fact, its role as an inflation hedge is perhaps the most debated and ambiguous issue in the financial press and academic literature. This article analyzes all the research and puts forth a convincing conclusion.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Your conclusion is based on how you analyze the data, the point from which you start calculating returns is too much important and must been taken seriously and not to support a specific statement.