In the past we’ve been very bullish of gold and…less bullish on silver…with our biggest reason to own silver simply being its correlation with gold. We are starting to change our mind and believe that investors should begin to allocate more of their precious metals portfolio to silver over gold. We want to stress this isn’t because we’re bearish on gold (quite the contrary), but rather that we believe that the potential returns on silver are potentially much better than in gold.

simply being its correlation with gold. We are starting to change our mind and believe that investors should begin to allocate more of their precious metals portfolio to silver over gold. We want to stress this isn’t because we’re bearish on gold (quite the contrary), but rather that we believe that the potential returns on silver are potentially much better than in gold.

The above edited excerpts are from an article* by hebbainvestments.com as posted on SeekingAlpha.com under the title Why We Are Now Selling Our Gold Positions For Silver Positions.

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Further edited excerpts from the article are as follows:

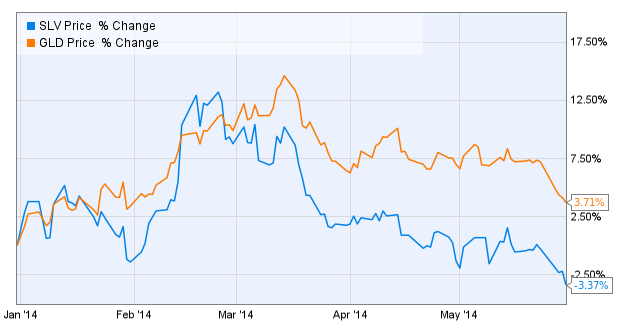

Year-to-date silver (represented by the SLV ETF as illustrated in the graph below) has fallen over 3%, while gold has actually gained almost 4% YTD…

Why are we bullish on silver? Below are our reasons:

1. Silver Recyclables Plummeting

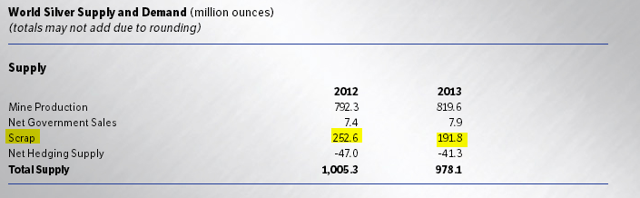

A recent report by the Silver Institute (see their table below) and research by the GFMS team at Reuters show that silver scrap dropped by 60 million ounces in 2013.

The large drop in scrap silver led to total silver supply dropping in 2013 despite an increase in mine supply. In fact, this was the largest drop in scrap silver since the 1980’s as the large price drop discouraged people and industry to sell scrap silver. Looking forward, we believe…scrap supplies may drop further because silver prices have dropped significantly since 2013…[and] we may see scrap supply drop below 150 million ounces. This would leave a deficit of 40-50 million ounces of silver that would have to be made up from elsewhere to keep the market in equilibrium. Since mine supply growth will not be able to supply that amount of silver, we can see quite a bit of loss in investment demand before there will be a true surplus in the market – quite a bit of leeway for investors.

2. Primary Silver Producers Struggling to Produce Silver Profitably at Under $20 per Ounce

…In 2013 costs were higher than the average silver price (even after considering write-downs) according to SRSrocco…[with] a loss of $0.97 per ounce sold, while our calculations give us a loss of around $1.50 an ounce (Silver Sold / Adjusted Income). Regardless of the method used, the top 12 primary silver miners reported a loss of anywhere from $0.97 to $1.50 per ounce sold – and this was at silver prices 25% higher than the current spot price!

Finally, and perhaps more importantly, most of these cuts have medium to long-term side effects of cutting future production. Silver miners have been cutting back significantly on exploration and development expenses, which benefits the bottom line in the short term, but in the long term it ends up cutting future production. Throw in the fact that many of these miners are high-grading existing mines which ends up lowering mine life, and you have a formula that will result in future drops in silver production.

As we discussed in our first point, silver scrap has been plummeting and should fall further in 2014 as prices are much lower than in 2013.[W]hat happens if mine supply does not grow as many current analysts predict? What if we actually see a drop in mine production as primary silver miners cut back on production or process less, more profitable ore? In that case we’d be pairing a decline in scrap with a drop in mine supply and we’d have the formula for a surprise supply deficit – even as most metal advisory firms and analysts predict a surplus. That is how contrarian trades are made and won by thoughtful investors.

What About Silver Being Mined as a Byproduct?

Many of you will point out that even if there are cuts in production from primary silver miners, most silver production (around 70%) comes as a result of the mining of other metals, so primary silver production drops may not have a large effect on total mine supply. That is true, but that also means that silver mine production can be affected by the production of these other primary metals – that is silver production can actually fall despite a rising silver price.

According to NRC research from 2008 (we haven’t had any luck finding more recent numbers but readers who know of more recent data please let us know), the majority of silver mine reserves were held mostly in:

- copper-zinc ore (55 percent);

- gold and silver ore (23 percent),

- lead-zinc ore (18 percent) and

- nickel-copper ore (4 percent)

so what happens to copper, gold, lead, and zinc will have a major effect on future silver production.

- We already know that gold production is expected to drop starting in 2015 (we think it will drop in 2014), so that should take quite a bit of silver byproduct production with it.

- Additionally, according to Joseph Gallucci of Dundee Capital…a number of “…big zinc ore bodies are near an end and there is no replacement on the horizon,” which will again have a domino effect on the silver production associated with those deposits.

- Finally, copper production isn’t doing particularly well as Codelco, the world’s largest copper producer, reports that prices are rising due to declining output.

3. Meanwhile on the Demand Side

We believe that economic growth will be nil to weak in the next few years, which will constrain base metal production growth and thus byproduct silver supply. However, if we do have strong economic growth, then we can also see a situation where silver demand grows as most silver is used for industrial purposes (about 60%). That means we can have a situation where investors are busy selling silver because of its correlation to gold, meanwhile industry is taking advantage of low silver prices to purchase forward as much physical silver as possible as their usage grows…

Conclusion for Investors

There are a number of other reasons we like silver, but even the three strong reasons listed above are enough for us to consider trading some of our gold for silver. Not because we think that gold has a dull future, but because silver simply has a brighter future at current prices.

The kicker for us is that the silver market is much smaller than the gold market and any sizable movement of money into the market has the potential to move it quickly. Investors should remember that annual silver market supply at current prices (1 billion ounces multiplied by the spot price) is under $20 billion. That is five times LESS than the amount of annual gold mine production (a little over $100 billion) – a few hedge funds could quickly move the price up with very little leverage.

We would expect a move in silver to be sharp and fast, so this is not a market that investors should be looking for a nice bottom – the silver market is too small for that. This is the type of market that we expect to see a V-bottom type event – maybe that’s what we are seeing now as silver approaches its 2013 lows.

We have already started re-allocating from cash and gold to silver and silver equities because we don’t expect a smooth bottom and we don’t want to miss out on the largest gains that are found during the early moves.

Investors who believe in the fundamentals that we’ve outlined above should gain exposure to silver with positions in:

- physical silver and the silver ETFs (iShares Silver Trust, PSLV, CEF).

- We like the miners even more because of the amount of leverage that they carry to the silver price and the fact that they have been beaten down pretty badly. Investors interested in the miners should consider companies like First Majestic Silver (AG), Pan American Silver (PAAS), Hecla Mining (HL), or Endeavour Silver (EXK).

- Investors looking for even more risk and reward may want to consider some smaller or more developmental stage companies such as MAG Silver (MVG), Revett Minerals (RVM) (though they are a different situation), or Great Panther Silver (GPL).

Analysts and investors seem to be very bearish towards silver, but we think that the fundamentals of silver are now becoming extremely attractive in terms of contrarian opportunities. Volatility and risk are not always commensurate, and we believe that silver offers investors fundamentals that can be much stronger than expected and returns that would be magnified by the small size of the silver market (and the bearish positioning by participants). Contrarian investors would be wise to take note.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://seekingalpha.com/article/2247053-why-we-are-now-selling-our-gold-positions-for-silver-positions (© 2014 Seeking Alpha )

Related Articles:

1. Silver Likely to Rally Even Farther & Faster Than Gold In Coming Months – Here’s Why

It is a reasonable bet that gold, about 40% below its 2011 high and facing large demand and dwindling supply, will rally in price over the next few years. Silver prices will follow gold prices but rally farther and faster from their currently low and oversold condition. Read More »

2. Buy Silver Instead of Gold! Here’s Why

People who have trusted the paper market first go to gold when they have their awakening because it is the largest precious metals market in the world but the more I learned about silver, however, the more I realized that silver was the smart decision. Here a a few reasons why that is the case. Read More »

3. Gold:Silver Ratio Suggests Much Higher Future Price for Silver – MUCH Higher!

The majority of analysts maintain that gold will reach a parabolic peak price somewhere in excess of $5,000 per troy ounce in the next few years. Given the fact that the historical movement of silver is 90 – 95% correlated with that of gold suggests that a much higher price for silver can also be anticipated. Couple that with the fact that silver is currently greatly undervalued relative to its average long-term historical relationship with gold and it is realistic to expect that silver will eventually escalate dramatically in price. How much? This article applies the historical gold:silver ratios to come up with a range of prices based on specific price levels for gold being reached. Words: 691 Read More »

4. Silver Is Signaling Potential For Large Upside Move This Year – Here’s Why

While not widely reported or analyzed, over the past several months there has been an enormous amount of buying in the various markets for physical silver – both one-ounce sovereign-minted coins and refined bars. Along with some standard trading signals I’ll discuss below, I believe the activity in the market for physical silver is signaling the potential for a large upside move sometime this year. Let me explain. Read More »

5. There’s a New “Silver Sheriff” in Town & He’s NOT American!

There’s a new Silver Sheriff in town, and it happens to be located north of the U.S. border. While [American] Silver Eagle sales and growth were impressive in 2013, [Canadian] Silver Maple Leaf sales outgunned the competition by a wide margin. [By how much? Take a look.] Read More »

6. A Rise In Silver Prices and a Fall In S&P 500 Index Seems Both Inevitable and Imminent – Here’s Why

Silver has had three bad years while the S&P has had 5 good years. It is time for both markets to reverse. Here’s why. Read More »

7. Spectacular Rally in Silver Depends on Whether This Dow 30 Rally is Real or Fake – Here’s Why

Which will it be – a long wait for a spike in silver or will it be soon? It all depends on whether this current Dow rally is real or fake. I think it’s fake. Read More »

8. Stock Market Will Collapse In May Followed By Major Spike in Gold & Silver Prices! Here’s Why

The unintended consequences of five years of QE are coming home to roost! In May or early June the stock market parabola will collapse…followed by a massive inflationary spike in commodity prices – particularly gold & silver – that will collapse the global economy. Read More »

9. These 5 Events Will Lead to Higher Gold & Silver Prices

It is my contention that the move in precious metals…[from] late 2008 through 2011 was largely a result of the expansion in central bank balance sheets and the perceived threat of runaway inflation. Since 2011, [however,] we’ve seen economic growth improve and inflation rates across the globe subside. As a result, investment banks and market strategists are arguing against owning gold, and making the case that, with a lack of inflation and an improved economy, the need for owning gold as an insurance hedge against inflation and currency debasement is no longer present. I strongly disagree. Read More »

10. Silver Has the Potential to Increase 4-Fold From Today’s Price – Here’s Why

The price ratio of gold to silver has fallen precipitously in raging bull markets for the metals, so the silver price could have an upwards move at four times the rate of any gold price increase. I think that the fundamentals look better than ever, and…[that] there is an explosive move coming in 2014. [Indeed,] I think that within a reasonable timeframe silver will probably trade over $100. Read More »

11. Massive Debt Levels Will Push Silver To $150 And Beyond

The process of the devaluation of gold and silver, started by the demonetization of gold and silver, is about to reverse at a greater speed than ever before. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I like Silver because:

1. It has much less BLING connected with it and therefore it offers investors much less public notoriety when buying and/or sell Silver than Silver.

2. It cost less to buy per oz and that alone allows Silver to look very attractive to potential new PM investors!

3. If the Gov’t. declares that private Gold ownership is no longer allowed, it is quite possible that they will not also include Silver in that order, which will give investors some additional time to reposition their portfolios.

4. Silver jewelry attracts much less attention than Gold and therefore is safer to wear in public and/or own.