…As investors, we can form expectations of the future based on a number of factors and adjust our risk and investment thesis as we learn more and as the analyses below show, IF mean reversion occurs in price and valuations, then our expectations should be for losses over the coming 10 years. The analyses below offer substantial clues.

…The earnings trend growth rate for U.S. equities has been remarkably consistent over time and well correlated to GDP growth. Because the basis for pricing stocks, earnings, is a relatively fixed constant, we can use trend analysis to understand when market returns have been over and under the long-term expected return rate.

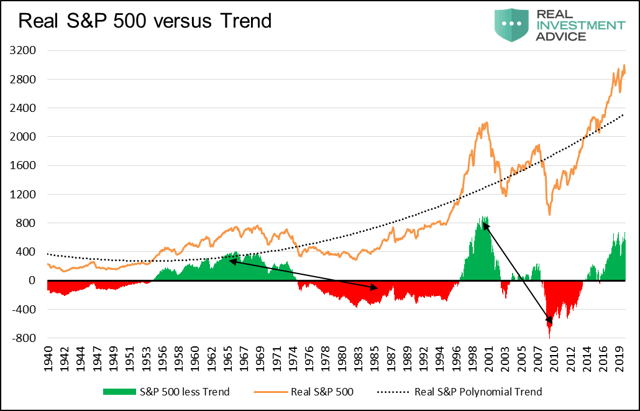

The graph below does this for the S&P 500. The orange line is the real price (inflation adjusted) of the S&P 500, the dotted line is the polynomial trend line for the index, and the green and red bars show the difference between the index and the trend.

Data Courtesy Shiller/Bloomberg

- The green and red bars point to a definitive pattern of over-performance and under-performance.

- Periods of out-performance in green are met with periods of under-performance in red in a highly cyclical pattern.

- Further, the red and green periods tend to mirror each other in terms of duration and performance.

- We use black arrows to compare how the duration of such periods and the amount of over/under performance are similar.

If the current period of out-performance is once again offset with a period of under-performance, as we have seen over the last 80 years, then we should expect a 10-year period of under-performance.

If this mean reversion were to begin shortly, then expect the inflation adjusted S&P 500 to fall 600-700 points below the trend over the next 10 years, meaning the real price of the S&P index could be anywhere from 1500-2300 depending on when the reversion occurs.

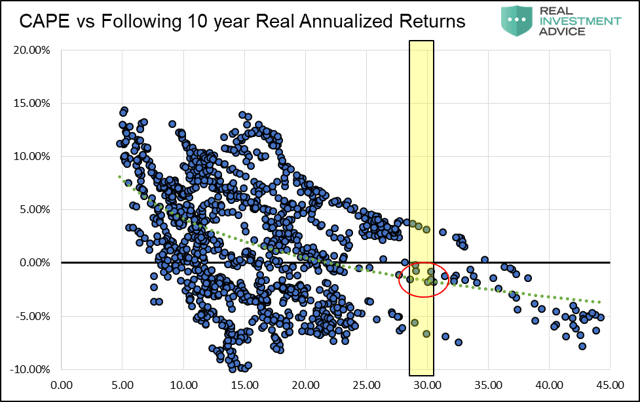

We now do similar mean reversion analysis based on valuations. The graph below compares monthly periods of Cyclically Adjusted Price to Earnings (CAPE) versus the following 10-year real returns. The yellow bar represents where valuations have been over the last year.

Data Courtesy Shiller/Bloomberg

Currently CAPE is near 30, or close to double the average of the last 100 years. If returns over the next 10 years revert back to historic norms then, based on the green dotted regression trend line, we should expect annual returns of -2% for each of the next 10 years. In other words, the analysis suggests the S&P 500 could be around 2300 in 2029. We caution, however, valuations can slip well below historical means, thus producing further losses.

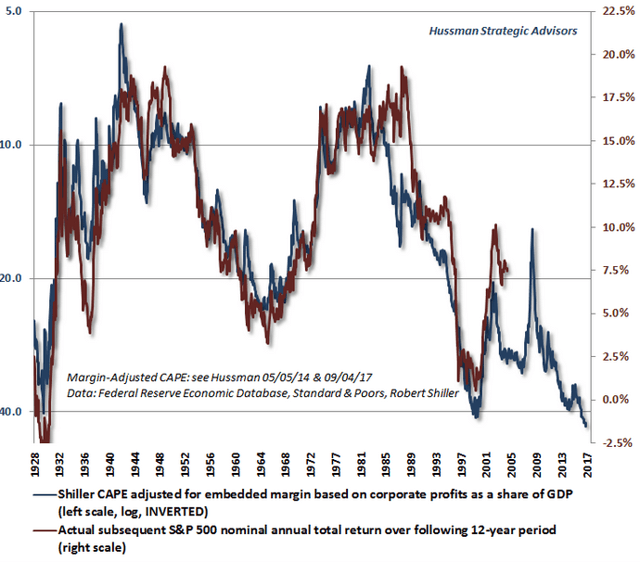

John Hussman, of Hussman Funds, takes a similar but more analytically rigorous approach. Instead of using a scatter plot as we did above, he plots his profit margin adjusted CAPE alongside the following 12-year returns.

In the chart below, note how closely forward 12-year returns track his adjusted CAPE. The red circle highlights Hussman’s expected 12-year annualized return.

If we expect this strong correlation to continue, his analysis suggests that annual returns of about negative 2% should be expected for the next 12 years. Again, if you discount the index by 2% a year for 12 years, you produce an estimate similar to the prior two estimates formed by our own analysis.

Summary

None of these methods are perfect, but the story they tell is eerily similar. If mean reversion occurs in price and valuations, then our expectations should be for losses over the coming ten years.

- …Whether such an adjustment happens over a few months as occurred in 1987 or takes years, is debatable.

- It is also uncertain when that adjustment process will occur.

- What is not debatable is that those aware of this inevitability can be on the lookout for signs mean reversion is upon us and take appropriate action.

The analysis above offers some substantial clues, as does the recent equity market return profile. In the 20 months from May 2016 to January 2018, the S&P 500 delivered annualized total returns of 21.9%. In the 20 months since January 2018, it has delivered annualized total returns of 5.5% with significantly higher volatility. That certainly does not inspire confidence in the outlook for equity market returns.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money