…This is a critical point for investors and, while it’s difficult to know what’s in store for any coming decade, it’s not impossible to know. This article explores the accuracy and reliability of 10-year forecasts and offers one of its own.

…When we look ahead 12 months or more, the value of a well thought out forecast begins to improve and it continues to improve as we lengthen the time frame even more but, at about the 10-year mark, the accuracy (and therefore the value) of a forecast starts to peak because anticipating the health of the economy 10 years out is pure guesswork at best…

A Look at the Record Over the Last 120 Years

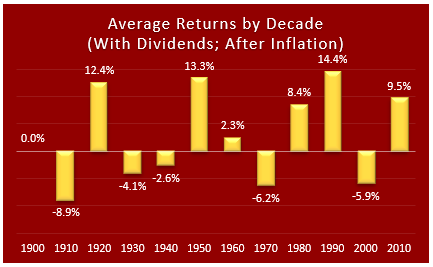

Equities have delivered the following annualized returns since 1900:

• 6.12% nominal (price only, excluding dividends).

• 9.48% nominal (price change plus dividends).

• 3.06% real (price only, adjusted for inflation).

• 5.67% real total return (price change, plus dividends, adjusted for inflation.)

…The only returns that matter are real total returns because the whole point of investing (putting your life savings at risk) is to accumulate real wealth, net of inflation. Real wealth is purchasing power, not a number on your brokerage statement.

Average annual real total returns since 1900

,,,The variability of the above returns by decade was quite high, however, as exemplified in the following table:

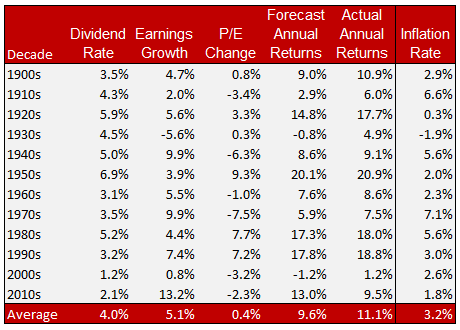

What drives stock prices?

According to the late Jack Bogle, the inventor of the index fund, and a majority of academics who have studied stock market returns over the years, there are 3 primary drivers of equity returns:

1. The dividend yield.

2. The rate of earnings growth.

3. The change in the Market Price/Earnings ratio.

…Mr. Bogle summarized the influence of these drivers in the table below:…

Of the three main drivers of returns, dividends are the most consistent. The other two, earnings growth and P/E change, are far more variable from decade to decade…

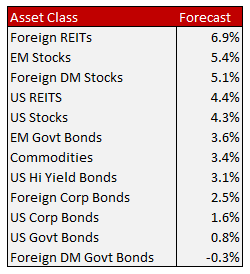

What about the next 10 years?

Bogle…says that the next 10 years, equities are likely to produce annual returns of 4-5%. I think he’s too optimistic. Other top minds in the business are calling for near-zero returns…

Mean Reversion

The basis of my assertion that equity market returns over the next 10 years will likely be in the low single digits, if not negative, is my belief in the irresistible force of mean reversion….

Ask yourself if you are willing to ignore an overvalued market with the belief that things will always work out eventually? It’s a quaint idea, and one that is heavily promoted by the investment industry as the only reasonable choice for most investors.

Buy & hold through thick & thin is the mantra of the adviser community. They say market timing doesn’t work but think about the benefits to the investment adviser that accrue from this point of view.

- Advisers, fund managers, wealth managers, and the like are compensated based on the size of their book. The more client assets they have under management, the higher their compensation.

What happens when a client leaves the stock market and shelters in cash or Treasury bonds?

- The adviser takes a direct hit to his or her bottom line so it’s in their best interest to keep clients fully invested at all times, so they can maximize their revenue per client. This doesn’t make them bad people. It’s a flawed business model that’s to blame.

The next time your adviser tells you to “stay the course” when things are falling apart, ask yourself if that’s really the best way to proceed.

…It’s quite possible that the market will shake off the current doldrums and go on to make new highs but I am less optimistic about the longer-term prospects for the economy and the stock market. I believe that we are once again headed into a lost decade, where average annual returns will be minuscule, if not outright negative…I am pessimistic…[because] the market is stretched. That alone is not enough to be pessimistic because there have been many periods in market history where high valuations were followed by even higher valuations. This time around, though, we have some major clouds forming above the economy and the stock market.

-

- The ballooning of the budget deficit. This is not an immediate threat, but at some point, our debt burden will begin to impact our economy…

- The enormous balance sheet at the Fed. They are working to reduce it, and the only way to do that is to raise interest rates…

- The geopolitical risks…[we face are also] higher today than it has been in many years…

What’s an investor to do about all of this?

…What’s called for is a well-thought-out contingency plan – one that is ready to go when the time is right. This plan should include several defensive steps to be taken thoughtfully and gradually as needed. I won’t go into the details of how to design a contingency plan because every investor has different objectives, time frames, and risk preferences. Suffice it to say that vigilance is called for and [you need to] start thinking about what steps you can take to protect what you have built over the last 10 years.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Thanks for this remarkable piece of cautionary analysis. Too bad that those who could benefit most–the permabulls–probably wont even read, much less heed, it.