Over the past 6 years, when the yield on high yield bonds (junk bonds) broke above resistance of bullish falling wedges, the S&P 500 ended up declining between 17% & 50%. Will it be different this time?

resistance of bullish falling wedges, the S&P 500 ended up declining between 17% & 50%. Will it be different this time?

So asks Chris Krimble (http://blog.kimblechartingsolutions.com) in edited excerpts from his original post* entitled S&P 500 fell between 17% to 50% last times junk bonds did this!.

[The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Kimble goes on to say in further edited excerpts:

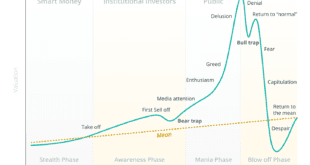

The effective yield on high yield bonds (junk bonds) are at historical lows at this time breaking above resistance of a bullish falling wedge for the third time since 2007.

CLICK ON CHART TO ENLARGE

Conclusion

Should we listen to the message coming from the yield breakout? Will it be different this time?

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://blog.kimblechartingsolutions.com/2013/06/sp-500-fell-between-17-to-50-last-times-junk-bonds-did-this/ (Check out our various services here)

Other Kimble Warnings:

1. “Eiffel Tower” Patterns Suggest Major Corrections in These 3 Asset Classes

Eiffel tower patterns can be very important to your portfolio construction & management because, when you experience the left side of the tower, you often experience the right side as well which often results in declines of as much as 50% from the peak. Currently it would appear that three specific assets could well be forming such patterns. Read More »

2. Nasdaq 100 Dropped 80% Last Time Penny Stock Volume Was So High – Will it be different this time?

Penny stock volume as a percentage of Nasdaq volume became a very large percentage (3.2%) back in the dotcom bubble peak in February of 2000, reflecting that a high level of speculative trading was taking place. In the next few years the Nasdaq 100 lost over 80% of its value! Recently such penny stock volume has risen to a record high of 4.5%! Will it be different this time? Read More »

3. History Suggests Dow Has Only 4% More To Go Before Correcting

The Dow is just a “pinch away” from a series of resistance lines, ranging from 13 years to 31 years, that have marked important emotional highs & lows in the past suggesting that once the Dow reaches 16,000 or so it will correct. Read More »

4. Invested in the S&P 500? Then Watch Price of WTI Crude Oil Closely – Here’s Why

For the past few years West Texas Intermediate Crude (WTIC) oil and the S&P 500 have trended together and have hit key highs and lows around the same time window. WTIC is now within 1% of the top of its multi-year pennant pattern which has brought on short-term S&P 500 corrections. What does that mean for the future direction of the S&P 500 this time round? Read More »

5. Level of Investor Margin Suggest Its Time to Lower Stock Exposure

Some times in history, investors feel so confident about the future of stocks, they actually use up all their available cash and then borrow money to invest in the stock market. Now is one of those times – and it suggests that now is the time to lower one’s stock exposure. Here’s why. Read More »

6. What Could Dropping Consumer Debt Mean for the S&P 500?

In the third quarter 2007 the American consumer was way out of shape when it came to the percentage of debt payments to disposable income, hitting a 30-year high at 14%… Today the ratio is nearing 30-year lows! Could this be good news for the markets??? Read More »

7. Gold & HUI Pushing Down Hard on 10-yr Support Lines – Will They Hold?

8. Will It Be Different This Time? Will the Dow and S&P 500 Go Up, UP and Awaaay?

Since the late 1800’s, the Dow has experienced three periods where it traded sideways, ranging from 13 to 17 years, [which always] resulted in upside breakouts . The S&P 500 finds itself within a few percentage points of where it was 13 years ago [so the question is “Has the time now come for the Dow and S&P 500 to once again go Up, UP and Awaaay?” Let’s take a look at some charts.] Words: 299; Charts: 2 Read More »

9. It Soon Will Be Decision Time for the U.S. Dollar Index – Which Way Will It Go?

10. Gold Miners Watch: Much Further GDX/HUI Weakness Could Result in a MUCH Further Decline – Here’s Why

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money