Conditions are favorable for a strong U.S. stock market performance in the fourth  quarter of 2014 and into first half of 2015 once the current corrective selling has abated. Here’s why.

quarter of 2014 and into first half of 2015 once the current corrective selling has abated. Here’s why.

Yearly Cycle

Since 1950, November and December have been the third and first best months for stocks. The recent decline in stocks has the markets well positioned to deliver gains in the last two month of the year.

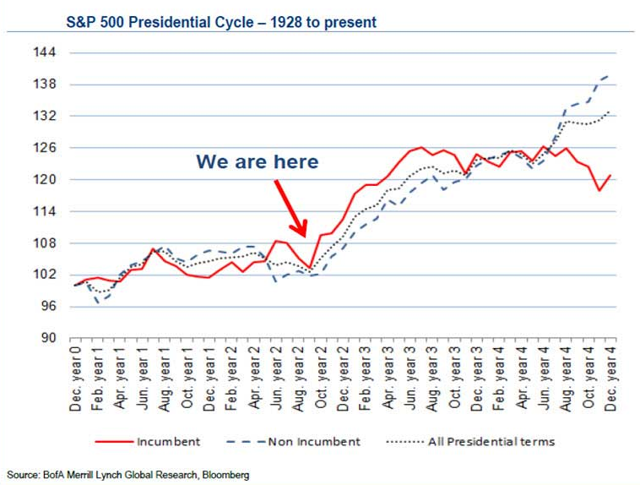

Presidential Cycle

The quarter leading up to a midterm election tends to be a poor one for stocks, but the next three quarters have delivered the best returns of a presidential term, with the second term of an incumbent president the strongest of all.

This period from November to April has historically:

- delivered 15% gains and the market

- moved higher 94% of the time and

- 100% of the time for an incumbent president.

Summary

Stocks are poised to rally in Q4 based on a corrective trend reversal. The dollar is overbought and the three-month rally ended this week.

Major stock indexes are either oversold or close to being oversold. The current selling has not yet ended though, so a bottom could still be days or weeks away.

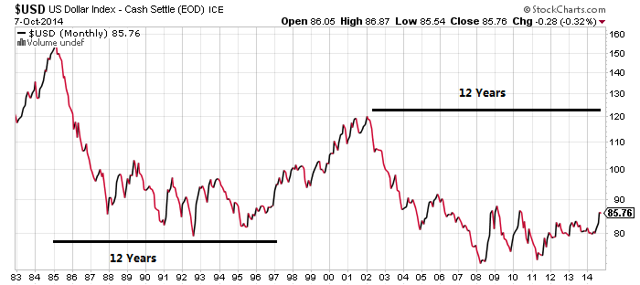

Commodities and foreign markets are likely to rally on a weaker U.S. dollar, but longer term the U.S. dollar appears ready to begin a move higher, based on economic fundamentals and a very strong repeating pattern in the chart, which would be unfavorable for most non-U.S. assets heading into 2015 and beyond.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

* http://seekingalpha.com/article/2554875-dollar-and-presidential-cycles-lining-up-for-a-rally (© 2014 Seeking Alpha)

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. Why the USD Is So Strong & the Implications For the Economy & Stock Market

Given the recent upside breakout in the U.S. dollar I’ve been getting a lot of questions about the reasons behind the strength as well as implications for the stock market. Here are my views on the situation. Read More »

This article suggests that the Australian and Canadian dollars, and the British pound Sterling, can expect to decline significantly relative to the U.S. dollar in the months ahead and gold to decline even further relative to industrial commodity prices. Here’s why. Read More »

3. Divergence of U.S. & Euro Area Economies Is Dramatic – and Tragic! Take a Look

4. Markets & Economy NOT Topping Out & Ready to Roll Over – Here’s Why

Sure, the market is getting more and more expensive, debt levels are still high around the globe, and the Drudge Report assures us daily that the world is going to hell in a handbasket, but does this signal the end is near for stocks and the economy? This article presents 4 “big picture” charts or indicators to help determine whether the markets and economy are topping out and ready to roll over. Let’s take a look. Read More »

5. How Will the Markets Perform For the Balance of 2014?

The S&P 500 just extended its winning streak to seven straight quarters, and it’s reasonable to wonder just how long it can continue…[That being said, however,] investors often enjoy a strong wind at their back in the fourth quarter, based on seasonal patterns and stock market history. Will 2014 be different [or will, as history suggests,] investors find a shiny new quarter during the next three months? [This article looks at these patterns to come to a better understanding of how the markets likely will perform for the balance of 2014.] Read More »

6. How Favorable Are Conditions For Stock Market? You’ll Be Surprised

Our “Barnyard” analysis from a year ago resulted in 6 out of 8 points indicating that the market would be favorable over the next 6-18 months. That has come true, with the S&P 500 up nearly 20% since then. We expect many will be surprised by the latest Barnyard Forecast which we present below. Read More »

7. What Are the Most Important Stock Market Drivers Forecasting?

In our view, the four primary drivers of market valuations are earnings, dividends, interest rates and inflation, of which two stand out above the others as being the most important. We look at each factor and then conclude with what it means for stocks. Read More »

8. Is the S&P 500 Overvalued? Here’s an Assessment

The S&P 500 has rallied for three years in a row, without a significant correction. This puzzles many observers who consider equities to be overvalued. Many experts predicted a correction (or worse) this year – after predicting one last year which has not happened – so how high is the S&P 500 valuation, after all? Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money