…I think the pros outweigh the cons overall regarding indexing but it’s always a good idea to consider the risks involved when any idea becomes so popular so allow me to play Devil’s Advocate on index funds.

always a good idea to consider the risks involved when any idea becomes so popular so allow me to play Devil’s Advocate on index funds.

The comments above & below are edited ([ ]) and abridged (…) excerpts from the original article by Ben Carlson (awealthofcommonsense.com)

There are plenty of people out there worried about index funds but most of their claims are likely unfounded or misunderstandings about the way things work in the markets. The ones I don’t buy are that:

- indexing gives you “mediocre” or “average” results

- (it doesn’t – it almost guarantees you’ll be top quartile after fees),

- there are fewer investors allocating capital correctly

- (most of the money coming out of active funds was being closet indexed anyways)

- or index funds are a fad

- (I believe the shift to low-cost investments is secular, not cyclical).

Check out this Facebook wall. There’s a lot there to “Like”!

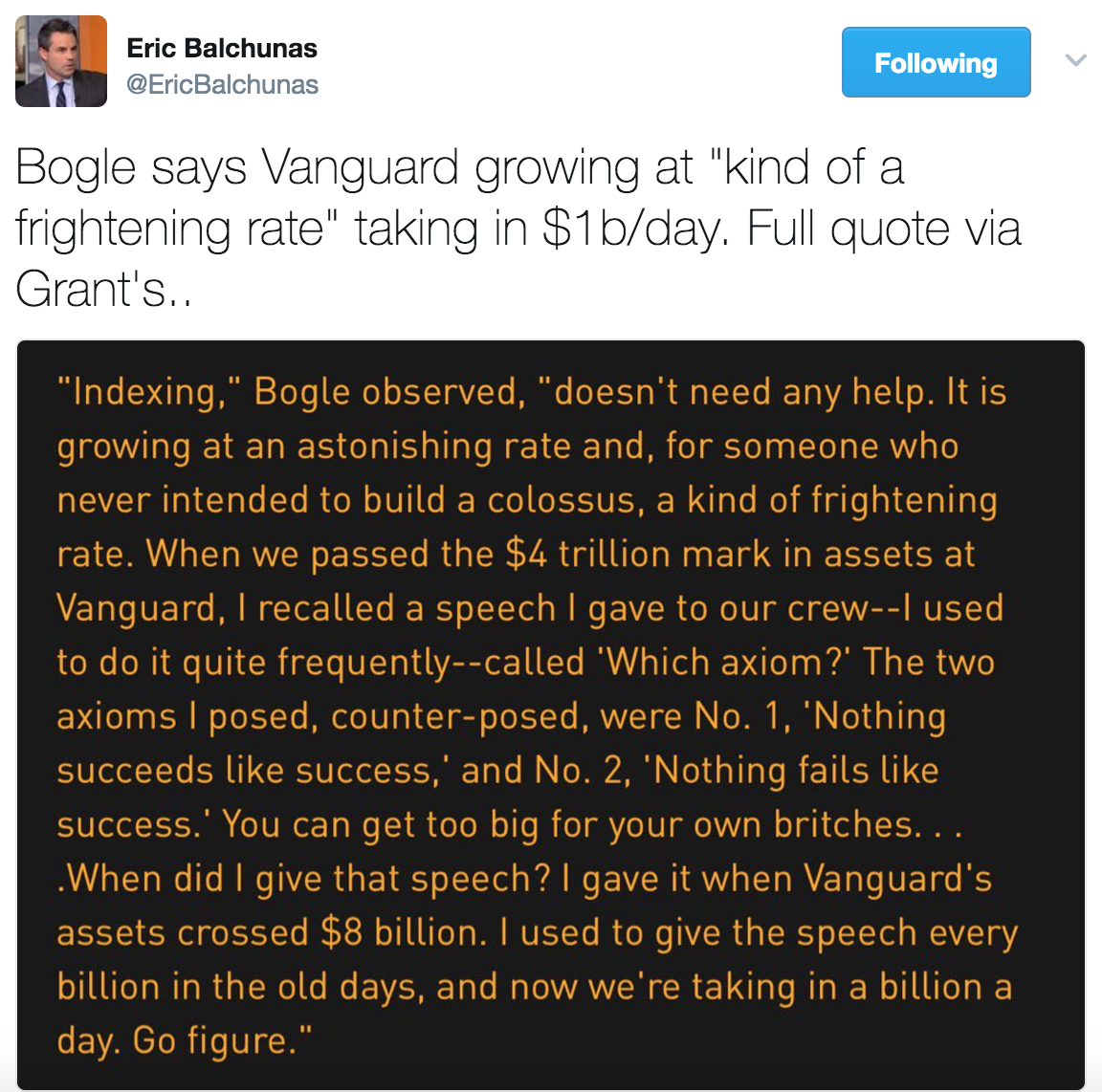

On the other hand, it would be silly to claim that the tsunami of fund flows into index funds will have no impact. Just this week John Bogle, the king of index funds, had the following to say on the subject:

Vanguard had around $2 trillion in assets in 2014. They now have double that amount less than three years later. This is an unbelievable achievement and has likely saved investors billions of dollars in fees but it’s right of Bogle to question whether there could be some drawbacks to this massive growth.

It’s intellectually honest to look at the other side of any argument but especially one in which you have strong views. Mr. Bogle’s comments got me thinking about some of the potential downsides of the popularity in indexing so allow me to play Devil’s Advocate on index funds:

1. Weak hands could lead to more volatility

…No matter what fund type is used there will always be a certain segment of the investor population who will panic and sell or buy at the wrong times. These weak hands could certainly cause an uptick in short-term volatility as they pile into and out of index funds at inopportune times.

Performance chasing is as old as the hills and it tends to amplify things at the extremes. Risks could rise as more and more investors buy into index funds who have no intention of sticking with them over the long-term.

2. “Index” can be a subjective term

Most of the money is going into traditional index funds that track something like the S&P 500 or a total market fund but there is plenty of money going into products that are index in name only…

3. ETF turnover is bonkers

The underlying funds may have low turnover in their holdings but investors are increasingly trading ETFs at ridiculous rates…because ETFs are easier to jump in and out of [but] low costs can easily be lost…with one poor timing decision.

4. Indexing is no panacea

…Even if you’re keeping your turnover, taxes, and costs lower than they would be in an active fund, you’ll still have to deal with bear markets and market crashes in index funds. This can be a very emotionally challenging strategy. It’s not for everyone.

5. No one knows the equilibrium between active and index funds

…No one really knows what the sweet spot is for the total amount of funds in passive products. 50%? 75%? I don’t know if we’ll ever get that high but…there would certainly be ramifications in the investment business and markets if something like this were to occur.

6. The concentration of power could lead to ‘normal accidents’

…Having a majority of investor capital going to a handful of fund firms increases the likelihood of a “normal” accident in the markets, which could be amplified by either human or organizational error.

So there you have it — my other side of the argument on the popularity of indexing. I still think the pros outweigh the cons overall but it’s always a good idea to consider the risks involved when any idea becomes so popular.

If you want more articles like the one above: LIKE us on Facebook; “Follow the munKNEE” on Twitter or register to receive our FREE tri-weekly newsletter (see sample here , sign up in top right hand corner).

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money