Currently, Russian gold reserves rank 7th in the world. It’s clear that there is a concerted effort by Russian authorities to build up the country’s gold reserves as part of a national strategy to negate the effects of economic warfare waged by the United States.

The comments above and below are excerpts from an article written by Jay Syrmopoulos (thefreethoughtproject.com) which may have been enhanced – edited ([ ]) and abridged (…) – by munKNEE.com (Your Key to Making Money!)

to provide you with a faster & easier read. Register to receive our bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner.)

…While many analysts have noted the increased build-up in Russia’s military arsenal, seemingly few have highlighted the massive build-up of Russian gold reserves over the past decade.

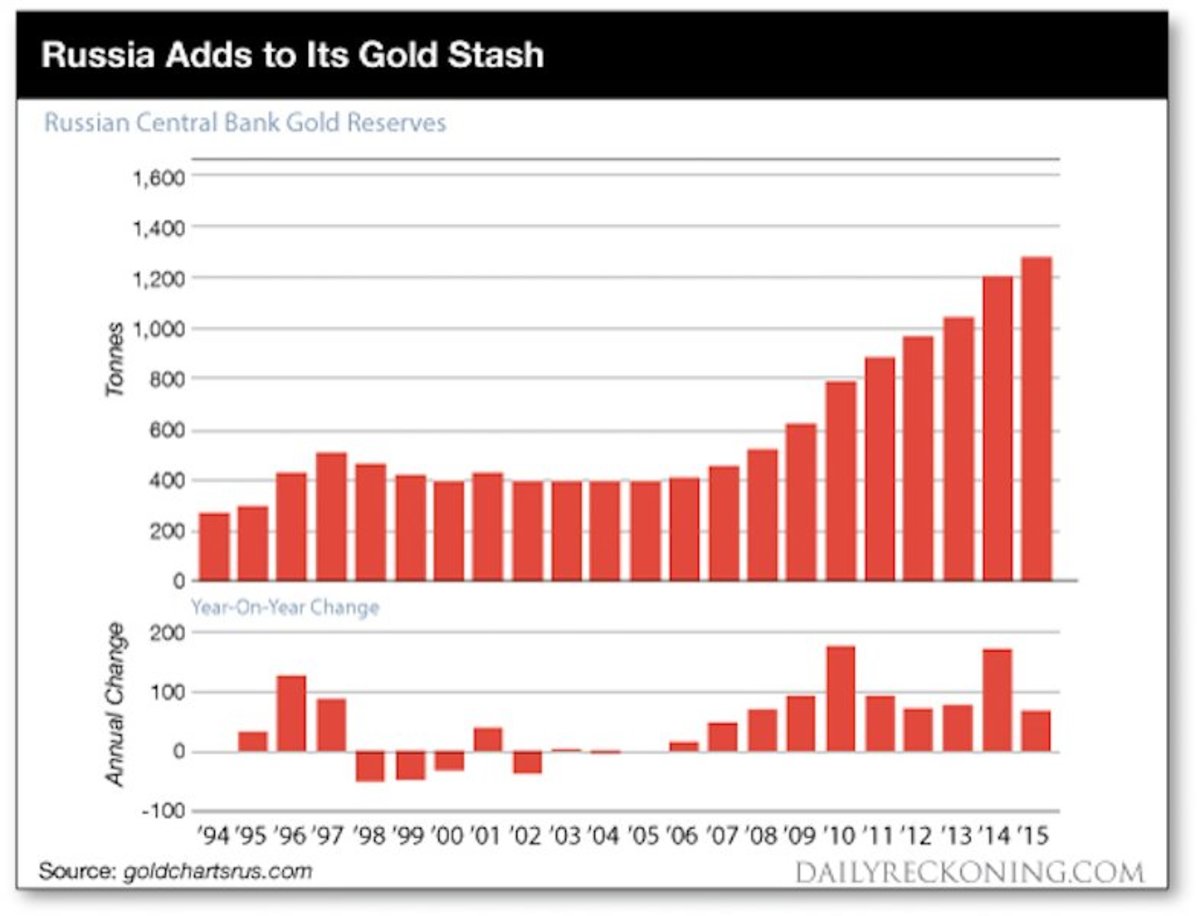

Below is a chart showing Russian gold reserves between 1994 and last year, 2015:

Since 2006, there has been a year-on-year increase that reveals a significant upward trend. The chart clearly reveals that Russia’s state policy of increasing state monetary assets, in the form of gold. Additionally, the Russian government has been converting state rubles into gold assets. From 2006 to 2015, Russia’s state holdings of gold tripled and within just the past year Russia has substantially increased its gold holdings adding 200,000 ounces in July…

Rickards, in his 2011 book “Currency Wars,” theorized that Russia and China could combine their gold reserves to form a global gold-backed currency to compete against the U.S. dollar. Currently, Russian reserves stand at roughly 1,500 tonnes, with Chinese reserves totaling over 1,800 tonnes…

With the U.S. about to lose overarching control of policymaking within the International Monetary Fund (IMF), [according to Epoch Times]…imagine for a moment the distinctly real possibility that Russian-Chinese alliance could exercise indirect (or even direct) control over the IMF’s gold reserve of over 2,800 tonnes. Russian, Chinese and IMF gold combined would equal roughly 6,100 tonnes, and would allow for direct competition with the U.S. gold reserves, estimated at 8,100 tonnes.

Russia and China have realized that the petrodollar is wielded by Washington as it’s weapon of choice when opposing a well-armed state, and clearly see the writing on the wall – thus they are working together to create a new global financial paradigm.

The reality is that the United States is $20 trillion dollars in debt, and eventually the time will come when the U.S. economy begins to implode — and all the fiat currency people are stuck holding will essentially be worth nothing more than the paper it’s printed on. Hard assets, such as gold and silver, should be bought and taken custody of while there is still an opportunity to do so, as a means of hedging against the potentially disastrous results of the U.S. using the petrodollar as a “weapon.”

…[Russia has been] gradually weaning itself off of the hegemony of the U.S. petrodollar by working with China to create an alternative to the SWIFT payment system that isn’t solely controlled by Western interests, [creating the Asian Infrastructure Investment Bank, and the New Development Bank and using its increased influence with the IMF and World Bank].

It’s not Russian nuclear weapons that people should fear, as the policy of mutually assured destruction essentially voids any benefit of a state launching a first-strike nuclear attack. The true threat to America is our economic house of cards, built upon the back of a neoliberal trade policy that puts the “rights” of corporations over that of people.

Editor’s Note: There is no longer the need to “surf the net” looking for the most informative financial articles available. My Facebook page has the BEST financial articles on the internet – bar none! Check it out. I guarantee you will not be disappointed – and don’t forget to “like” or “love” those articles of particular interest to you. I need the feedback.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

The Fed “talks” forward guidance, but utters gobbledegook and produces obfuscation, but this piece gives readers real clarity on what to expect as we go forward. Thanks!