Pushing the big problems into the future appears to have been the working strategy for both the Fed and recent Administrations, yet the U.S. dollar and the budget deficit do matter, and the future is at hand. The day of ultimate financial reckoning has arrived, and it is playing out. Words: 1096

Read More »A Country’s GDP Keeps Changing Relative to Others – Take a Look

A lot has happened to the global economy over the last 35 years. The forces of economic liberalization, globalization, and the rise of the multinational corporation have all left their mark...[Check out the dynamic Voronoi diagram below showing how] the GDP (total market value of all goods and services produced in a country for a given time period) of each of the world's largest countries have grown or contracted relative to others from 1980 to 2015.

Read More »The Bottom Is In for Gold and Silver – Here Are the Reasons Why (+2K Views)

No one has a crystal ball and I certainly don’t claim to have one. [Nevertheless,] I strongly believe that the prices we see today in gold and silver will be looked back upon in the next few years as a great buying opportunity. The data I read and understand tells me the case for gold and silver is now a strong one...If you are conservative dollar cost average into a position for a long time now [otherwise] I am OK with a full allocation into gold and silver at this point in time...

Read More »I’m “making the call” for a market correction of 50% – or more!! (+3K Views)

I don't relish the job of constantly pointing out the risks to the equity markets but since few on Wall Street seem willing (or able) to do this, I'm "making the call" for a market correction, as enough variables have aligned to indicate a high likelihood of stocks heading downwards from here. Words: 1203; Charts: 6

Read More »8 Key Dynamics Which Will Impact Us Over the Next 2-3 Years & Their Eventual Consequences (+2K Views)

Risk is inevitably mispriced when unprecedented intervention suppresses risk [and, as such, the] policies that appear to have been successful for the past four years may continue to appear successful for a year or two longer but that very success comes at a steep, and as yet unpaid, price in suppressed systemic risk, cost, and consequence. [This article identifies 8] key dynamics that will continue to play out over the next two to three years [and an] understanding of the eventual consequence of such influential trends - that risk is inevitably mispriced when unprecedented intervention suppresses risk. Words: 1299

Read More »BRICS Plan to Abandon U.S. Dollar Will Hurt U.S. and Help Gold (+4K Views)

Frustrated with what they viewed as being ignored by the West and not having a prominent role in institutions like the World Bank and the International Monetary Fund, Brazil, Russia, India, China and South Africa (also known as the BRICS countries) have held their second summit...[and declared war on the U.S. dollar. Let me explain.] Words: 572

Read More »WSJ Economist Survey Estimates Regarding Future GDP and Probability of Recession Inconsistent! Here's Why

50 economists forecast their estimates for real GDP over the next 6 quarters in a recent Wall Street Journal survey [and their projections, on average, show a modest increase through to the end of 2012 as the table below shows. In addition, they were asked] to forecast... the probability of a recession in the U.S. in the next 12 months] and the results were quite surprising - quite. Let me show you.] Words: 600

Read More »What is the Primary Reason for Lack of Economic Growth in America? Here is the Answer

The widespread stagnation in wages, rather than the level of unemployment, may offer a better explanation for the failure of economic growth to accelerate two years after the end of the recession. Workers’ ability to negotiate higher earnings won’t return until the job market strengthens, and flagging confidence has raised the risk that consumers may retrench. [Let us explain.] Words: 1018

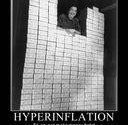

Read More »America's Future: Growing Deficit, Shrinking Economy, Imploding Dollar and Exploding Inflation

The new [debt ceiling deal] legislation will add $2.4 trillion to the $14.3 trillion national debt in a little over a year - and we don’t even start saving money until after the debt reaches $16.7 trillion! This bill doesn’t even cut the deficit. It just slows the growth of government spending to around 8% a year! So, even if Congress cuts $2.1 trillion out of the budget over the next 10 years, we will still be running annual deficits of more than $1 trillion...[That means that in addition to a deficit that will continue to grow we can look forward to a shrinking economy, an imploding U.S. dollar and exploding inflation. Some future! Let me explain.] Words: 827

Read More »Check Out THE Number to Watch for Market Direction

Many investors believe the market will rise if the economy is growing and sink if it's shrinking but that is the wrong way to think about it. Instead, the real focus should be on whether the economy is growing at a slow pace or a moderate pace. Indeed, with 2% growth, the stock market could steadily fall. Yet with 3% Gross Domestic Product (GDP) growth, the market could surge. The difference between 2% and 3% may not seem like much, but it is. [Let me explain.] Words: 730

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money