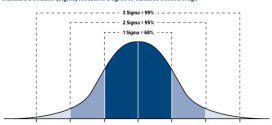

In the investment management process...[it is important to] actively monitor both short- and long-term cycles...in order to manage expectations based on historical patterns...[as well as] oscillators - diagnostic tools that help us measure a security’s upward and downward price volatility - but to understand how oscillators work, though, you first need to become familiar with standard deviation and mean reversion. In this article, we do just that.

Read More »Any Way You Look At It the S&P 500 is Overvalued In Excess of 40%!

The S&P 500 is considerably overvalued - somewhere in the range of 34% to 61% - depending on which of 4 market valuation indicators are used and whether the valuation is based on the arithmetric or geometric mean of each. While these findings are not useful as short-term signals of market direction...they play a role in framing longer-term expectations of investment returns and suggest a cautious outlook and guarded expectations. [Here are the details.] Words: 676

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money