Natural gas is increasingly becoming an important fuel in meeting the global energy needs. Let’s take a quick look at the largest natural gas fields in the world. Words: 300

So says David (www.topforeignstocks.com) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) has further edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

David goes on to say, in part:

Eastern Europe and Eurasia have the largest known natural gas resources, which are concentrated in the countries of the former Soviet Union. The Middle East also holds large volumes of natural gas due to the presence of oil. [In fact,] more than half of the world’s proven reserves are concentrated in Russia, Iran and Qatar in large conventional fields.

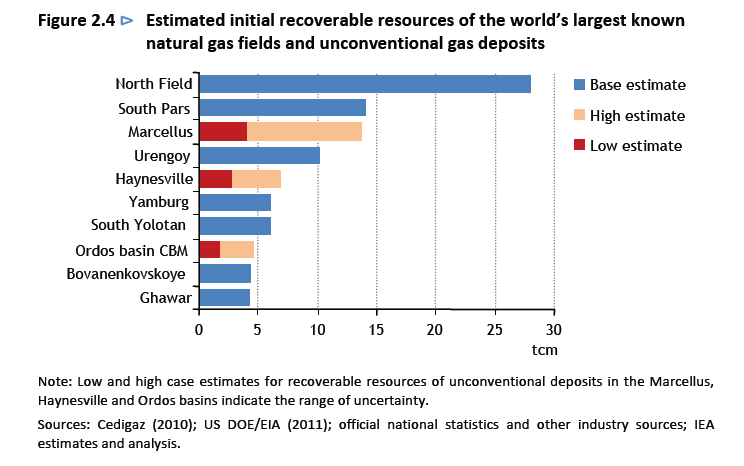

The following chart shows the World’s Ten Largest Known Natural Gas fields:

Click to enlarge

Based on assumptions of recovery and extent of deposits, Marcellus and Haynesville, two of the largest identified fields in the United States, rank respectively as the the third and fifth-largest fields gas fields in the world.

Why spend time surfing the internet looking for informative and well-written articles on the health of the economies of the U.S., Canada and Europe; the development and implications of the world’s financial crisis and the various investment opportunities that present themselves related to commodities (gold and silver in particular) and the stock market when we do it for you. We assess hundreds of articles every day, identify the best and then post edited excerpts of them to provide you with a fast and easy read.

Sign up here to begin receiving munKNEE.com’s FREE Financial Intelligence Report

The world’s other largest fields are located in:

1. Qatar (North Field),

2. Iran (South Pars),

3. U.S. (Marcellus),

4. Russia (Urengoy),

5. U.S. (Haynesville),

6. Russia (Yamburg),

7. Turkmenistan (South Yolotan),

8. China (Ordos basin),

9. Russia (Bovanenkovskoye), and

10. Saudi Arabia (Ghawar, which is also the world’s largest oil field).

*http://topforeignstocks.com/2011/11/17/the-worlds-10-largest-known-natural-gas-fields/

Related Articles:

1. How to Play the Lowest Natural Gas/Crude Oil Ratio on Record

One of the things we look for in the markets is anomalies or disconnects from historical tendencies that signal some element of a traditional relationship between two things is changing or has changed. Often, the relationship is eventually returned to “normal”, meaning money can be made if an investor is on the right side of the trade. Other times, the relationship has been fundamentally altered in some way, so understanding the reasons behind the shift can become a source of opportunity, since it can either provide understanding about relevant long-term trends or signal a shift in an existing one. [Such being the case let’s take a look at] the ratio between natural gas and crude oil [and determine how best to play this investment opportunity.] Words: 1069

2. Where Do Gold & Silver Rank in Vulnerability to a Recession Among Other Commodities?

A Barclays Capital research [report] notes that gold prices are vulnerable to a recession – more so than some of the other commodities. In the last recession of 2008, gold prices appreciated the least among precious metals. Below is a table that ranks 30 different commodities. Words: 571

3. Commodities, Including Gold & Silver, Historically Perform Well (on Average) in November

Have you been wondering how commodities will fare in November? [Below is a chart of] how select commodities performed in the past 25 Novembers (since 1986). Words: 489

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money