The past month has been marked with volatility and steep sell-off in stocks on a global scale. The unprecedented downgrade of US government debt from S&P, the high unemployment and the slowdown in the U.S. economy all caused investors to be bearish on equities. As stocks keep on falling however, companies keep on generating positive earnings surprises. Despite all the bearish news, I believe that now is the perfect time to start accumulating stocks, [particularly the following 5 “sleep-well-at-night” dividend growth stocks. Here’s why.] Words: 1362

So says Dividend Growth Investor (www.dividendgrowthinvestor.com) in an article* which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say in large part:

In an environment where everyone is inflating the gold bubble and the U.S. Treasury bubble, stocks are being overlooked by investors. The “lost decade” has burned many U.S. investors, who saw stagnating stock prices since the early 2000s. That being said, stock prices could go lower, thus making stocks an even better investment at lower valuations for smart long term investors.

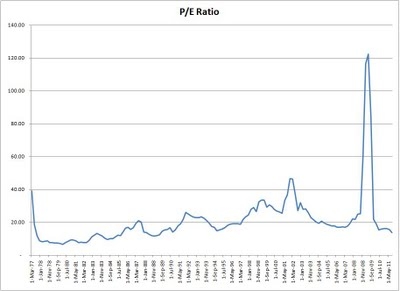

For the 4 quarters ending June 30, 2011, [the] S&P 500 index, which is my benchmark, has “earned” $83.87. The dividends paid to S&P 500 investors amounted to $24.34, while operating earnings amounted to $90.90. Based on the current S&P 500 price of $1154, the index is trading at a P/E ratio of 13.76 and yields 2.10%. (Source S&P.)

The average P/E ratio has been 20.80 times earnings since 1977. Based on that information, stocks are at their cheapest valuations in years. In addition, since 1871, P/E ratios on S&P 500 have averaged 15 times earnings.

click to enlarge

Analysts are estimating that S&P 500 companies will generate operating earnings of $98 in 2011, followed by an increase in operating earnings to $112 in 2012. It looks as if investors are discounting that these increases will be much lower. However, even if earnings stagnate for several years, companies will generate a sufficient amount of earnings in 14 years which is equal to today’s S&P 500 prices.

Investors should not overlook the fact that most of the stocks with the highest weightings in the S&P 500 are global multinationals, which generate a high amount of their revenues and earnings from international operations. In a previous study I found out that international operations account for almost half of revenues for the top 10 companies in the S&P 500.

The types of companies that I am looking to invest in are blue chip dividend growth stocks, which have long histories of increasing dividends [and] the types of dividend stocks I am looking to buy on any further weakness include:

PepsiCo, Inc. (PEP) engages in the manufacture, marketing, and sale of foods, snacks, and carbonated and non-carbonated beverages worldwide. This dividend aristocrat has managed to hike dividends for 39 years in a row. The company has increased dividends at an annual rate of 13% over the past decade. Analysts are expecting earnings growth of 13.80% in 2011 and 9% in 2012. Yield: 3.30%…

Colgate-Palmolive Company (CL), together with its subsidiaries, manufactures and markets consumer products worldwide. This dividend champion has raised dividends for 48 years in a row. The company has increased dividends at an annual rate of 12.40% over the past decade. Analysts expect the company to grow EPS by 17.60% in 2011 and 9.90% in 2012. Yield: 2.50%…

Abbott Laboratories (ABT) engages in the discovery, development, manufacture, and sale of health care products worldwide. This dividend aristocrat has raised dividends for 39 years in a row. The company has increased dividends at an annual rate of 8.80% over the past decade. Analysts expect the company to grow EPS by 56.70% in 2011 and 7.50% in 2012. Yield: 3.70%.

Unilever PLC (UL) provides fast-moving consumer goods in Asia, Africa, Europe, and the Americas. This international dividend achiever has raised dividends for over one decade. The company has increased dividends at an annual rate of 9.20% over the past decade. Analysts expect the company to grow EPS by 21.60% in 2011 and 8.50% in 2012. Yield: 3.90%.

Chevron Corporation (CVX), through its subsidiaries, engages in petroleum, chemicals, mining, power generation, and energy operations worldwide. This dividend achiever has raised dividends for 24 years in a row. The company has increased dividends at an annual rate of 8.10% over the past decade. Analysts expect the company to grow EPS by 43.40% in 2011 and a 2% decrease in 2012. Yield: 3.10%.

The [above] “sleep-well-at-night stocks” should provide a rising dividend income stream to investors as well as the potential for capital appreciation.

*http://www.dividendgrowthinvestor.com/2011/09/my-bullish-case-stocks-are-cheap.html

Related Articles:

1. Yes, the S&P 500 Stocks are on Sale – Here’s Why

With all the negative talk that we are consistently fed, the truth is, that corporate America is strong. The fundamentals underpinning most of our great companies warrant higher valuations than they are currently receiving. With interest rates at all-time lows, and therefore, the price of bonds at all-time highs, they are less competitive to stocks than normal. Consequently, I believe that equity valuations should be higher than normal, not lower. Therefore, I feel that now is a great time for investors to be building equity portfolios whether the market is at the total bottom or not. [Let me be more specific as to why I think that is the case.] Words: 1493

2. How the Dow 30 Stocks Compare According to Their Margins of Safety

Benjamin Graham, known as the father of value investment, is famous for his simple, yet powerful, valuation method as first explained in his 1973 book, Intelligent Investor, and later updated in his book entitled Renaissance of Value. His “Graham Number” approach has been adapted and applied to all 30 stocks listed on the Dow Jones Industrial Index to determine which of the stocks have above average safety factors – of which only 10 do. Below is an explaination of the approach, the formula and the results for all 30 stocks. Words: 1220

3. Which Stocks Trade at a Discount to the “Graham Number”?

Benjamin Graham, the “godfather of value investing” created an equation to calculate the maximum fair value for a stock, referred to as the Graham Number and any stock trading at a significant discount to this number would appear undervalued. [Here are the names of 18 such stocks.] Words: 1707

4. Buy:Sell Ratio Suggests Weakness in Equities is Due to Fear – NOT Fundamentals

While it would seem that moms and pops and the average punter out there are running out of the equity market and into the “safety” of US Treasuries, corporate insiders are doing the exact opposite. This is yet another bullish contrarian sign. From the start of 2004 at least, this is the biggest buying spree that corporate insiders have engaged in. [Allow me to show you the specifics.] Words: 345

5. Now’s the Time to Buy Quality Dividend Stocks – Consider These 11

The decrease in stock prices over the past weeks has many investors scared that the market is forecasting a dip in the economy. This panic has started to create an environment where enterprising dividend investors could start adding to their positions at cheaper prices. In fact, if stocks keep going lower this would create tremendous opportunities for enterprising dividend investors to scoop up some of the best dividend stocks in the world at fire sale prices. In this article I will explain why the market dip has created a perfect opportunity for dividend investors and specify 11 stocks worth considering. Words: 819

6. Don’t Fight the Fed: Buy Some of These 20 Blue Chip Stocks Instead!

The herd continues to stampede into U.S. Treasury debt of every possible maturity to, theoretically, avoid risk. Yields on AA+ 10-yr bonds can be locked in to yield 2.11% per year and you get your principal back in 10 years. [As we see it, though] the only justification for [such a meagre] return on invested capital must be tied to the belief that a return is better than nothing given the prospects of a future depression. We believe, however, that fighting the Fed and investing like a depression is coming is not the right way to position your portfolio. [Below are 20 suggestions on how to generate in excess of 2.11% returns plus strong appreciation potential with modest risk.] Words: 657

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money