TIPS (Treasury Inflation Protected Securities) are telling us that inflation is expected to be low for as far as the eye can see, and the economy is expected to be weak for some time to come. This article provides an understanding of what TIPS are, how they work and what they are currently saying.

can see, and the economy is expected to be weak for some time to come. This article provides an understanding of what TIPS are, how they work and what they are currently saying.

So says Scott Grannis, the Calafia Beach Pundit (scottgrannis.blogspot.ca) in edited excerpts from his original article* entitled TIPS Are Priced To Low Inflation And Weak Growth.

[The following is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here). The excerpts may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Grannis goes on to say in further edited excerpts:

What Are TIPS?

TIPS…are a serious and liquid market, and quite valuable from an investor’s perspective, since it gives us:

- a reliable source for ex ante real interest rates across the maturity spectrum,

- a window into the market’s inflation expectations,

- a gauge for how strong the market thinks the economy is likely to be and

- the only U.S. instrument…[Canada has its RRB Real Return Bonds] that can guarantee a real return to an investor.

TIPS are unique among bonds, in that while they pay a fixed rate of interest (which is the real yield), their principal is adjusted monthly for inflation, and everything is guaranteed by the U.S. government….Real returns are the Holy Grail for all investors, of course, because if you don’t earn a return that is greater than inflation, then your investment will not increase your future purchasing power. Prior to TIPS, we could only know what real rates were ex post, by subtracting inflation from nominal yields. Now we know what risk-free real yields are expected to be out to 30 years, and that sets the floor for all other expected real yields.

What Are TIPS Saying Today?

1. The relatively low real yield on TIPS today means that real returns on other assets are expected to be relatively low also. For example, the low level of real yields on TIPS tells us that investors are not very optimistic about the future returns on equities. This dovetails with the current P/E ratio of the stock market, which is merely average at a time when corporate profits are at record highs.

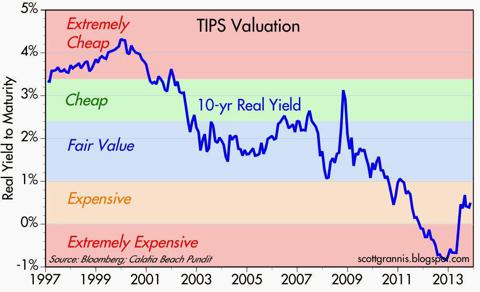

The above chart shows the real yield on 10-yr TIPS from their inception through today. I’ve added my judgment on what the level of real yields means in regards to valuation. The higher the real yield, the more attractive TIPS are as a standalone investment. The lower they are, the less attractive. The real yield on TIPS moves inversely with their price, so high real yields mean that TIPS prices are low, and low real yields mean TIPS prices are high.

In the early years, TIPS offered investors a guaranteed real yield of around 4%, which was extremely attractive from an historical perspective. Few investments have ever delivered 4% real returns over a 10 year period, but 10-yr TIPS back then guaranteed that result. I doubt that TIPS will ever carry a real yield of more than 5%, because it’s hard to imagine that other investments could ever be expected to generate real returns in excess of 5% for so many years. Since TIPS are risk-free, their real yield is effectively the minimum real return that the market demands. Recall that back in the late 1990s and early 2000s, investors expected the bull market to continue forever.

One year ago, real yields on 10-yr TIPS fell to almost -1%. That meant that investors were willing to give up 1% of their purchasing power every year just to have the security of TIPS. TIPS were extremely expensive, because the market was extremely risk-averse and very concerned that the future of the U.S. economy was bleak, and that the returns to be had from other investments were very unappealing. Currently, 10-yr real yields are only 0.6%. That’s a lot better than -1%, but it’s not very attractive from an historical perspective. Buying TIPS today means paying a stiff price for the risk-free nature of TIPS and their unique ability to compensate holders for whatever future inflation there may be.

The combination of the fixed coupon and the inflation adjustment to the principal of TIPS gives you a nominal yield that rises and falls as inflation rises and falls.

For example:

-

if inflation over your holding period is 5% per year and the real coupon on the TIPS you own is 1%, then you will receive a nominal annual yield on your TIPS investment of 6.05%

-

if inflation rises to 10%, then you’ll get a nominal annual yield of 11.1%,

-

if inflation falls, then you get less, but: TIPS have an asymmetrical response to inflation and deflation

-

if inflation should turn negative (i.e., deflation), then you won’t be penalized if you hold the TIPS to maturity, since the principal amount will mature at the original par value-meaning you will end up with whatever the original real yield was.

In short, TIPS not only offer inflation protection, but also deflation protection.

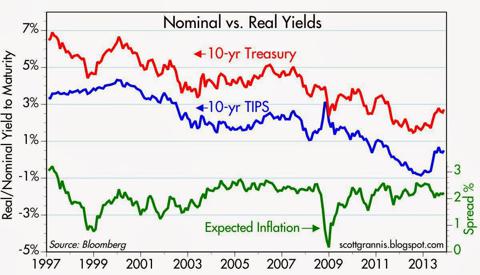

The chart above shows the nominal yields on 10-yr Treasuries, the real yield on 10-yr TIPS, and the difference between the two yields, which is the market’s expected average annual inflation rate (based on the CPI) over the next 10 years.

I note that although nominal and real yields have been trending down for the past 16 years, and have fluctuated between -1% and 7%, the trend in expected inflation has been relatively flat. The bond market today expects the CPI to average 2.2% over the next 10 years, and that is very close to what the CPI has averaged over the past 10 years: 2.4%. In other words, the bond market is expecting that the next 10 years are going to be pretty similar, inflation-wise, to the past 10 years.

Ten years ago, the bond market was expecting CPI inflation to average 2.3% over the subsequent 10 years, because nominal yields on 10-yr Treasuries were 4.3%, and real yields on 10-yr TIPS were 2%. With the benefit of hindsight, the bond market back then was pretty smart-it only underestimated future inflation by 0.1% per year.

Is the bond market just as likely to be guessing correctly today? Unfortunately we have no way of knowing, [but] I’m reluctant to place a lot of trust in the bond market’s current forecast of relatively low inflation for as far as the eye can see. [Why?] Mainly because the Fed’s QE monetary policy has yet to be reversed, and we have no way of knowing if the Fed will navigate the uncharted waters of reverse-QE successfully.

At the very least, QE has created a lot of uncertainty about the future of monetary policy and inflation. With TIPS expensive and priced to an optimal monetary policy result, I’d rather take my chances on inflation coming in higher than expected – better to sell TIPS and Treasuries than to buy them. With Janet Yellen at the helm (a career dove), the Fed is likely to err on the side of higher inflation. How high is anybody’s guess.

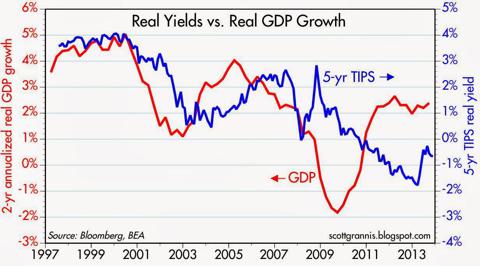

2. TIPS can also tell us about the expected health of the U.S. economy. The above chart compares the yield on 5-yr TIPS to the 2-yr annualized rate of growth of the U.S. economy. The idea behind this chart is that the risk-free, guaranteed real yield on TIPS tends to track the market’s perception of the real growth potential of the U.S. economy.

In the late 1990s, the economy was booming, with growth rates in excess of 4% so it’s not surprisingly that TIPS yields were 3-4%. If the economy is expected to grow 4% a year forever, then the risk-free real yields on TIPS ought to be a little less in order to remain competitive with expected real returns on other assets. Today, the market looks back and sees that the U.S. economy has been growing some 2-3% per year for the past four years. This would seem to call for 5-yr TIPS yields of 1-2%, but 5-yr TIPS today have a real yield of about -0.5%. This suggests that the market worries that economic growth could slip below 2% in the next few years. If growth comes in better than 3%, the real yields on TIPS ought to move substantially higher.

Conclusion

Personally, I like taking the odds that economic growth will be better than dismal, and I like the odds that inflation will be higher in coming years than it has in the past. Accordingly, I like equities, real estate, and high-yield debt. By the same logic, cash, Treasuries, TIPS, and MBS are relatively unattractive because real and nominal yields are likely to rise by more than the market expects.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://scottgrannis.blogspot.ca/2013/11/tips-are-priced-to-low-inflation-and.html

Related Articles:

1. Get Informed: 4 QE Myths Debunked

The Fed continues to assert that its Quantitative Easing bond purchases will boost economic growth by lowering borrowing costs for businesses and consumers but the evidence shows that QE bond purchases have actually coincided with increases in long-term interest rates. Read More »

2. Here’s How to Crash-Proof Your Portfolio

With the stock market seemingly reaching new highs every day, should we worry about a crash that puts an end to the party? If so, how should investors prepare? Let us explain. Read More »

3. Noonan: The Fed Will Never Ever Taper & What That Means For Gold

The Ponzi bubble is bigger than most can imagine. Western central planners… [continue to try to] suppress gold and silver in order to keep their sorry lives alive. In the process, the destruction of people’s financial well- being is unabated… Read More »

4. What Will Happen If (and probably when) the U.S. Debt Bubble Bursts?

The madmen who are responsible for the coming economic disaster continue to behave as if they can manage to avoid it. Violating Einstein’s definition of insanity, they continue to apply the same poison that caused the problem. These fools believe they can manage complexities they do not understand. The end is certain, only its timing is unknown, and, once interest rates begin to rise, and they will, it’s game over so it begs the questions “How much longer this can possibly go on?” and “What will happen to the U.S. and the world when it does?” Read More »

5. What is the Best Way to Inflation-Proof Your Portfolio? Here are the Options and Recommendations

With investors concerned about inflation it begs the following questions: “What is the best way to attempt to inflation-proof ones’ portfolios? Buy TIPS? Short Treasury bonds? Stocks? Real Estate? Commodities? Gold? Currencies?…[In this article we review each option and come to a conclusion as to how best to hedge the risk of inflation.] Words: 1672 Read More »

6.

While Treasuries are said to have no default risk as the Federal Reserve can always print money to pay off the debt, hidden risks might be lurking. As oxymoronic as it may sound, the biggest risk to the economy and the U.S. dollar might be, well, economic growth! Let us explain. Words: 2065; Charts: 1 Read More »

7.

The public’s estimates and predictions of inflation are significantly, and systematically, related to the demographic characteristics of the respondents…[and] even after we hold constant income, age, education, race, and marital status…women in our survey tended to think inflation was 1.9 percentage points higher than men. [There are more interesting findings, so read on.] Words: 987 Read More »

8. What is the Best Way to Inflation-Proof Your Portfolio? Here are the Options and Recommendations

With investors concerned about inflation it begs the following questions: “What is the best way to attempt to inflation-proof ones’ portfolios? Buy TIPS? Short Treasury bonds? Stocks? Real Estate? Commodities? Gold? Currencies?…[In this article we review each option and come to a conclusion as to how best to hedge the risk of inflation.] Words: 1672 Read More »

9. Relax! Inflation or Deflation Will Be Mild for Next Few Years – and Then…

There is no reason for investors to be worried about either inflation or deflation in the United States for at least the next few years. Words: 933 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money