Sadly, things have now gone too far to stop the inevitable currency collapse and implosion of the  financial system but that doesn’t mean that it is too late for individuals to protect themselves.

financial system but that doesn’t mean that it is too late for individuals to protect themselves.

The comments above and below are excerpts from an article by Egon von Greyerz (GoldSwitzerland.com) which has been edited ([ ]) and abridged (…) to provide a faster and easier read.

As we enter this final phase, there will be panic in financial markets with governments and central banks taking draconian measures. Below are some of the potential risks that all investors must protect themselves against today:

- Currency collapse – leading to destruction of capital

- Capital controls – making it impossible to take money out of bank or country

- Bail-ins – the bank will steal your money in order to try to save itself

- Forced investments – compulsory purchase of treasuries with your bank or pension assets

- Custodial risk – stocks and bonds will be hypothecated by the bank, leaving you nothing

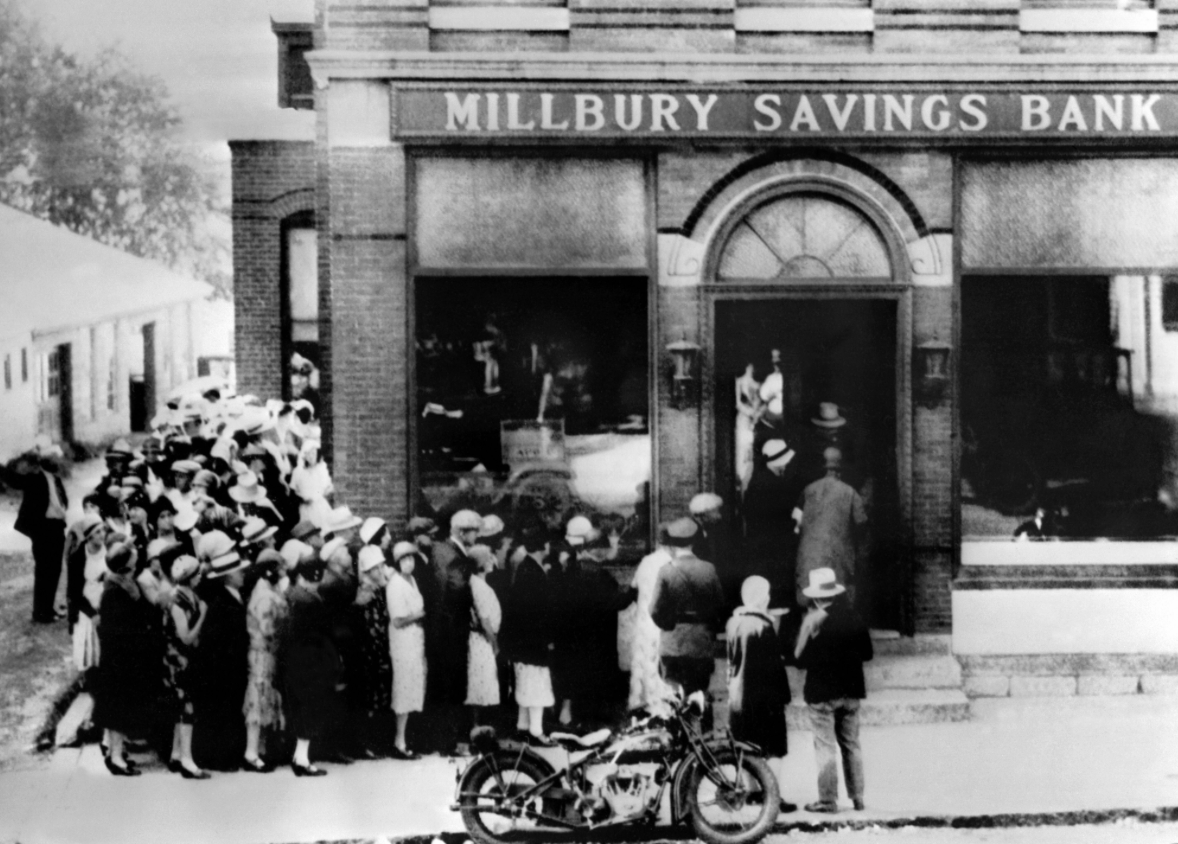

- Bank failures – all your investments will disappear as the bank becomes insolvent

The above list in not exhaustive but it contains the most likely events that will take place in the next few years.

Most private investors don’t see the above risks and have zero protection against them. [In addition,] professional money managers haven’t got a clue about real risk, nor do they see any need for protection or insurance [because,] when you manage other people’s money), you take maximum risk in order to benefit from the upside – the downside is not your risk and thus it can be ignored. This strategy works extremely well until the music stops but, as long as money printing and credit creation inflates markets, these professionals will never spend a second worrying about the total destruction of clients’ money.

How likely are the above risks and how do you protect against them? Anyone who has followed some of my work will know that I consider all the above risks as guaranteed to materialise.

Currency collapse is already happening with all currencies down 97-99% in the last 100 years. The final 1-3% will happen in the next few years as governments print unlimited amounts of money, but remember that the last 1-3% fall is 100% from here and thus a total destruction of money, so whatever cash you have will be totally worthless in the coming hyperinflationary phase.

Capital controls are likely to start within 12-18 months in many countries including the US. As deficits increase and currencies fall, governments will stop anyone from taking money out of the bank as well as out of the country. This is just the next step in the total control money. We have lately seen FATCA (Foreign Account Tax Compliance), cash bans and the OECD Automatic Exchange of Bank Information. Capital controls will be the next logical step in an attempt to virtually confiscate money. Governments on the road to bankruptcy will take any desperate measure to control the people and their money.

Bail-ins are guaranteed and in the legislation of most western countries. The average person has no idea what bail-in is nor its consequences. Simply, it means that for insolvent banks, which will be the case with most banks, governments will not bail them out but instead depositors’ money and assets will be used to cover the banks’ losses. Since banks are leveraged 10-50 times, all the money belonging to the bank customers will be gone. At that point, after the bail-in, governments will need to step in with bail-outs, but any government intervention will be futile since they will just create more debt to solve a debt problem.

Forced investment in treasuries will happen as governments issue an ever increasing amount of debt. At that point, the government will be the only buyer as we are seeing in Japan currently. Therefore, governments will force people to put their bank assets into treasuries to shore up the country’s finances. By then, though, it will be too late and all the money going into government bonds will be totally worthless as these bonds go to zero.

Custodial risk means that it is not just clients’ cash which is at risk. Any asset deposited in a bank carries the same risk as cash. In theory stocks, bonds or physical gold should not be in the balance sheet of the bank and therefore not be part of a bankruptcy. Firstly, it could take years for the receiver to sort that out but, more importantly, as banks come under pressure they will use client assets in order to shore up the assets of the bank. This was the case for MF Global for example. We often see banks not actually having the allocated physical gold that they have told the customer he possesses. When banks come under pressure, they will take any desperate measure to save themselves and this will definitely include client assets – and don’t believe that the government will help you since they are bankrupt too.

Bank failures will be commonplace in coming years as banks’ irresponsible lending will be exposed. Collapsing asset prices will exacerbate this problem dramatically. Most people believe that money or assets in the bank will be totally safe. Personally I wouldn’t deposit any major amounts of money or assets in a bank – and if I did I would ask for collateral. Banks today are totally untrustworthy borrowers of depositors’ money and anyone hoping to get their money back will soon learn that they won’t.

If you can’t trust the banks, what do you do with your money? In uncertain times it is essential to avoid counterparty risk. Therefore, no assets should be held with a counterparty who is heavily exposed financially. Directly controlled assets is the best way to control investments. This can be property, land, direct ownership of companies including direct registration of stocks.

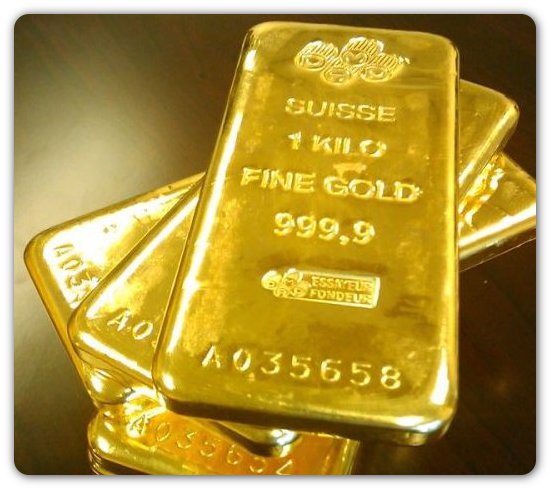

The best insurance money can buy

The best and cheapest insurance against the risks outlined above is to hold physical gold and silver…in physical form, outside the financial system and outside your country of residence. It is also critical to have direct access to your wealth preservation asset which should not be held through a counterparty.

Conclusion

Gold and silver will not protect investors against all the problems that the world will experience in coming years but, if they are held in the right way and place, precious metals will be the best insurance against the massive wealth destruction that will take place in the next few years.

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money