For a couple of years the world’s central banks fooled the public into believing that perpetual debt  was a good way to rejuvenate the markets but, alas, there will be no free lunch. Having a system addicted to perpetual debt is NOT a solution as the following 9 indicators clearly suggest. Again, nothing comes for free in this world.

was a good way to rejuvenate the markets but, alas, there will be no free lunch. Having a system addicted to perpetual debt is NOT a solution as the following 9 indicators clearly suggest. Again, nothing comes for free in this world.

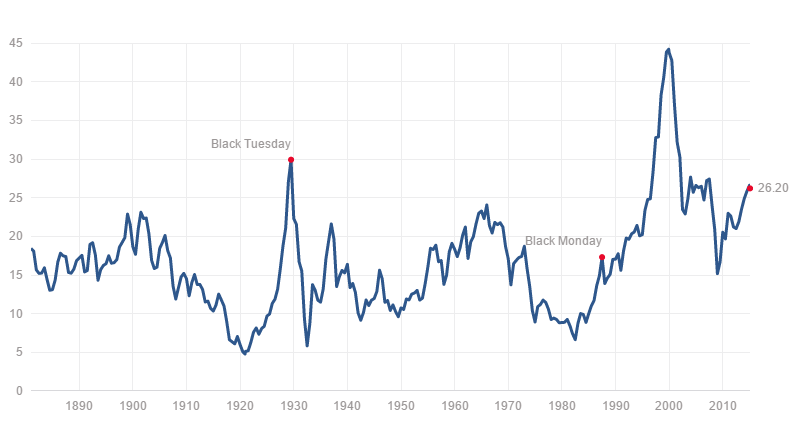

By MyBudget360.com. The original article* was posted under the title Market indicators suggesting a correction is coming: On Black Tuesday Shiller PE Ratio was at 30. Today it is at 26.2 and volatility is back in a big way.

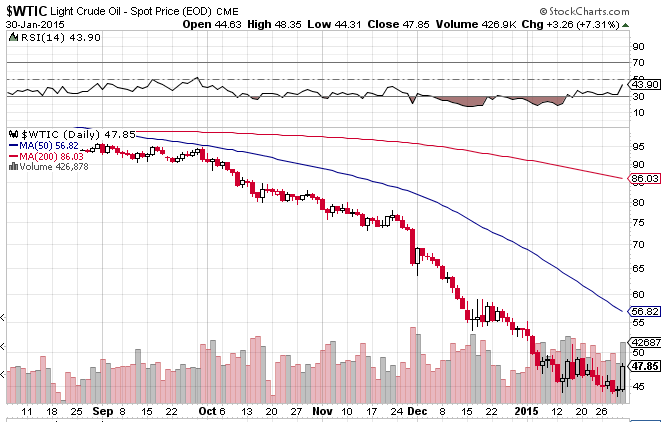

1. oil has crashed rather dramatically…[resulting in] plenty of supply with moderating demand. Then you have OPEC maintaining output to flush out high cost producers and gain market share. Of course this hit is going to reflect in oil producing countries like Russia, Canada, and Venezuela.

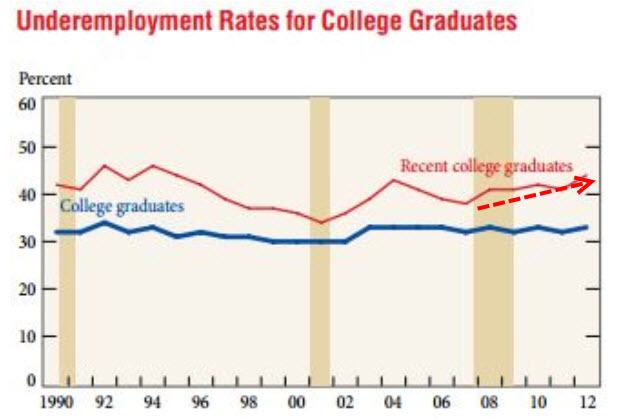

2. over half of recent college graduates are underemployed;

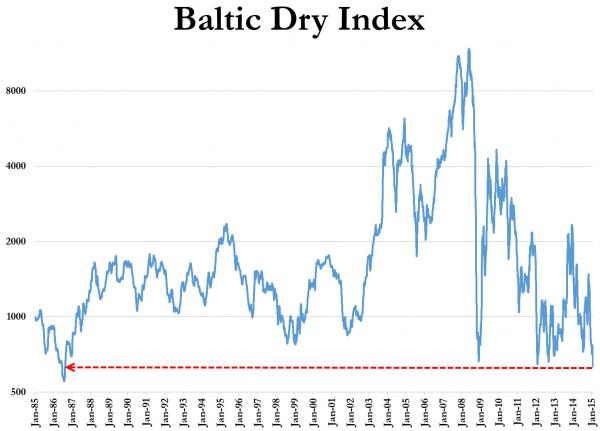

3. the Baltic Dry Index, a good measure of shipping goods, has collapsed…and what this is signifying to us is that the demand to ship goods is low thus pushing prices lower. The last time we saw a crash like this we ended up with the Great Recession.

4. stock markets are soaring based on inflated values. The S&P 500 is overvalued by 60% looking at historical price-to-earnings ratios [and] looking at price-to-earnings…[conveys] how much someone is willing to pay to get a dollar back. The Shiller PE Ratio [see below] was at 30 on Black Tuesday; today it is at 26.2 with the historical average being closer to 16. More importantly, we need to realize that many companies are using debt to leverage their balance sheets. Other companies have cut wages and benefits to increase the bottom line for a few at the expense of the many. In essence that is what we are looking at with the PE ratio and right now it is looking frothy:

5. Greece is reigniting further issues with the Euro;

5. Greece is reigniting further issues with the Euro;

6. Russia is on the brink of recession;

7. half of Americans live paycheck to paycheck;

8. inflation is alive and well only, if you bother to look;

9. volatility is back in a big way in the global markets. The S&P 500 has gone up 200 percent since 2009. A correction is bound to happen and the amount of volatility hitting the system currently is bound to expose some cracks.

Does any of the above sound like a stable market? Having a system addicted to perpetual debt is not a solution. It is merely a temporary measure to allow the financial wizards to siphon off real production into their hands. Again, nothing comes for free in this world.

[The above article is presented by Lorimer Wilson, editor of www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. This paragraph must be included in any article re-posting to avoid copyright infringement.]

*Original Source: http://www.mybudget360.com/market-indicators-suggesting-a-correction-is-coming-on-black-tuesday-shiller-pe-ratio-was-at-30-today-it-is-at-26-2-and-volatility-is-back-in-a-big-way/ (If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!)

Stay connected!

Register for our Newsletter (sample here)

Find us on Facebook

Follow us on Twitter (#munknee)

Subscribe via RSS

Related Articles:

1. When the Bubble Bursts It Will Cause Deflation & Drive Widespread Social Unrest – Here’s Why

Should we be concerned when tepid economic growth and low inflation are accompanied by increasing public and private debt? Are we borrowing just to stay alive? [As I see it,] national governments will increase national debt loads in order to stay in power until one or more of them default. Then their will be financial panic which will most certainly be deflationary. Here’s why. Read More »

2. You Should Be Terrified! U.S. Is In A Debt Trap & Oblivious to the Consequences

There exists in the Congress, in the Obama administration, in the media and on Wall Street, a national belief that America can print paper money and grow its economy as its route map out of debt. With annual GDP growth expectations of 2% to 3% over the next several years, this is a completely false hope! Read More »

3. Inflation Coming In 2015 – Here’s Why

This article takes a look at the expected trends in the price of oil, cost of living and currency wars and how they most likely will impact inflation. Read More »

4. 5 Lies About America’s $18 Trillion Debt Refuted

There has been a great deal of misinformation and propaganda – outright lies – about the $18 trillion U.S. government debt and this article examines 5 of the biggest such lies. Read More »

5. MoneyFactory.gov Records How Much Monopoly Money Fed Prints – Check It Out

I would bet my bottom Silver Dollar that when faith in holding U.S. Federal Reserve Notes heads into the toilet, it would be much wiser to own REAL MONEY than the monopoly paper printed by the MoneyFactory.gov. Read More »

6. Crushing Debt Cannot – & Will Not – Be Repaid! Here’s Why

The central bankers of the world have painted themselves into corner. Growing mountain of debt makes it harder for economies to grow at higher interest rates, hence forcing central banks into a downward spiral of record low rates and monetary stimulus that simply encourages more borrowing and worsening the underlying problem – what the BIS calls “a debt trap” Read More »

7. We’re Doomed! Rising Interest Rates Will Cause Our Financial System To Implode

We’re doomed! Even if the economy were growing at a faster pace, it wouldn’t come close to offsetting the interest payments on our ever-expanding debt. As such, any sort of credit shock – either rising rates or a decline in the rate of debt expansion – will cause the system to implode. Let me explain why that is the case. Read More »

8. There’s debt, Then There’s Debt, Then There’s U.S. DEBT

The next time someone says, “The US is the richest country on Earth” correct them and state that “The U.S. is the most bankrupt and indebted country in the history of the world” because that’s reality. Let me explain. Read More »

9. Monetary System Collapse Guaranteed – Here’s Why & How to Invest & Insure Your Wealth Accordingly

Our monetary system is guaranteed to collapse. The central banks prints money like there is no tomorrow. The governments spends like a drunken sailor and yet inflation is benign and interest rates sit at generational lows. Banks are gaining in profitability while their bad debts are being erased by rising asset prices. What’s not to like? Plenty! This article goes into the details of the money creation process to understand how and why this is happening, what the future implications will be and how to best invest to protect oneself from these eventualities. Read More »

10. What Could – What Will – Pop This “Money Bubble”?

There is too much debt. Debt works the same way for a country as it works for an individual or a family, which is to say if you borrow too much, then your life basically craters. Everything gets harder to do, and you end up doing things in order to deal with your past mistakes that you would never do normally. You start trying absolutely crazy things, and that’s where the world’s governments are right now. We are doing all these things that are essentially con games and getting away with it so far, because a printing press is a great tool for fooling people. I don’t see how we can get away with it too much longer. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money