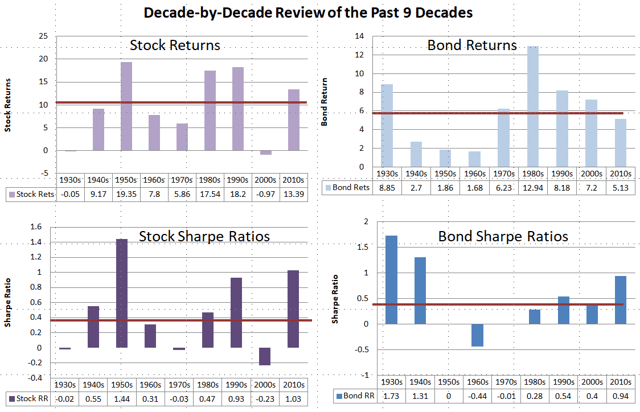

…In the following article, we present a decade-by-decade review of U.S. stock and bond returns over the past 9 decades…

Stock and bond returns over the past decade are near their respective norms, but the returns per unit of risk (Sharpe Ratios) are well above. It’s been a good decade with average returns far below average risk.

- Stocks earned 13.39% per year, exceeding their 10% average return.

- Bonds earned a little less than their 6% average return, delivering 5.13% per year.

- On a risk-reward basis, stocks tripled the .35 average, earning 1.03% per unit of risk (standard deviation).

- Similarly, the bond Sharpe ratio of .94 is more than double the historical average. Also of interest, the bond Sharpe ratio for the past decade is the highest in the post-war era.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money