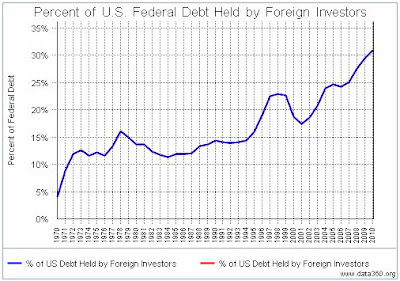

Over the years foreigners have been buying more and more U.S. debt and now amounts to 33% of the total which is up from “just” 27% at this time 4 years ago and less than 15% only 20 years ago. However, given the dire state of U.S. finances it makes one wonder how much longer this trend will continue and what the consequences will be when the U.S. nolonger has a ready buyers to subsidize their excessive ways. Let’s take a look at which countries and entities hold the U.S. debt and the extent to which it has changed over the years. Words: 480 33% of the total which is up from “just” 27% at this time 4 years ago and less than 15% only 20 years ago. However, given the dire state of U.S. finances it makes one wonder how much longer this trend will continue and what the consequences will be when the U.S. nolonger has a ready buyers to subsidize their excessive ways. Let’s take a look at which countries and entities hold the U.S. debt and the extent to which it has changed over the years. Words: 480

Below is a list (fromCNBC) of the major holders of U.S. debt at the end of 2011:

= Total of $US 11.6 trillion of the entire $US 15.7 trillion public debt. Foreign holders of U.S. debt are given in this table 1 (also below):

We can see that over the months that foreigners are buying more and more debt, rising from $US 4477.6 billion in March 2011 to $US 5117.6 billion today. In March 2011, total U.S. public debt was $US 14.2 trillion, today it’s $US 15.7 trillion. When we look at a longer term (November 2007). We have $US 9.1 trillion of total debt, of which $US 2.3 trillion is held by foreigners. Which leaves 9.1 – 2.3 = 6.8 trillion, held by the U.S. So 6.8/9.1 = 75% is held by the U.S.

So we can conclude that over the course of the years, foreigners have accumulated larger percentages of U.S. debt. You could say that foreigners are subsidizing the United States. I have done the calculation on other time stamps using these sites (Foreign Treasury Holdings and Total Public Debt):

I came up with this chart. Mathematicians call this a hyperbole. However, it doesn’t look like foreign interest will go away. If we look at 1970 untill 2010 we get this picture.

|

| I’m wondering how much higher this chart can go until foreigners start to dump U.S. treasury debt.*http://katchum.blogspot.ca/2012/06/who-is-holding-us-bonds.html

Related Articles: 1. The Zombification of the Financial System: Debt is NOT a Free Lunch, Debt is NOT Wealth! Why are both debtors and creditors willing to build a status quo of massive unprecedented debt? [After all, the delusions of] creditors that debt is wealth and should never be liquidated, and of debtors that debt is an easy or free lunch have been smashed by the juggernaut of history many times before…[and] I think they will soon be smashed again. [Let me explain.] Words: 1150 2. U.S Likely to Hit the Financial Wall by 2017! Here’s Why The deficits aren’t going to stop anytime soon. The debt mountain will keep growing…Obviously, the debt can’t keep growing faster than the economy forever, but the people in charge do seem determined to find out just how far they can push things….The only way for the politicians to buy time will be through price inflation, to reduce the real burden of the debt, and whether they admit it or not, inflation is what they will be praying for….[and] the Federal Reserve will hear their prayer. When will the economy reach the wall toward which it is headed? Not soon, I believe, but in the meantime there will be plenty of excitement. [Let me explain what I expect to unfold.] Words: 1833 3. True Money Supply Is Already Hyperinflationary! What’s Next? |

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money