Despite the recent inaction by the Fed, most pundits still believe a rate hike will occur in September. The problem with this assumption is that most media pundits are basing this action on a headline number such as unemployment and not the underlying details of the labor market which suggest that if the Fed raises rates, the U.S. will go back into recession. Let me explain.

The above edited excerpts and the copy below come from an article* by John Manfreda as posted on SeekingAlpha.com under the original title of Forget About Rising Interest Rates, Prepare For Q4 which can be read in its entirety HERE.

The current unemployment rate of 5.5% looks great but that is because only 62% of the population is participating in the work force. The mainstream press attributes this to the retirement of baby boomers, but the statistics don’t support their thesis.

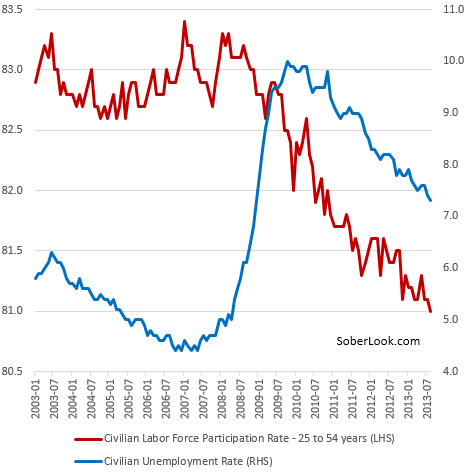

A look at the chart above clearly shows a correlation between the decline in the unemployment rate, and the decline in the labor participation rate.

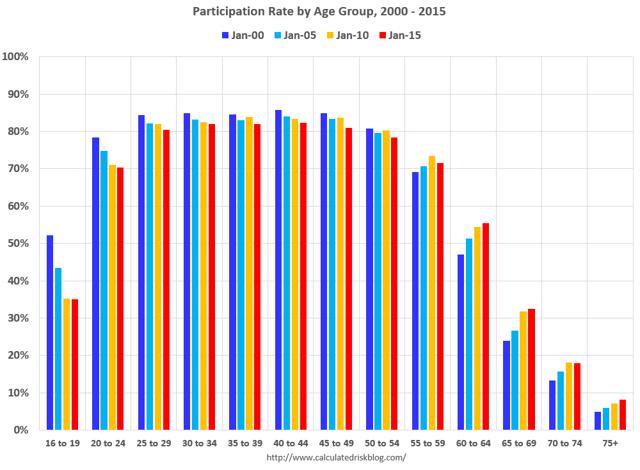

The mainstream press attributes this to the retirement of baby boomers, but the statistics don’t support their thesis as the chart below clearly shows that the declining labor participation rate has come from the age groups between 16-54 years old, people that are considered to be in their prime working years. The age group of 55-75, has actually increased its labor participation rate. This is the opposite of what normally would be occurring.

(click to enlarge) If you look at the other economic indicators, one can see that the unemployment rate is more of an outlier, then an indicator.

If you look at the other economic indicators, one can see that the unemployment rate is more of an outlier, then an indicator.

- two thirds of Americans are living paycheck to paycheck,

- 1st quarter GDP was reported at a negative growth rate,

- the Chicago PMI is reporting numbers that are reaching a 13 month low,

- the ISM numbers are contracting, and recently

- the Chicago economic activity index was reported to be negative for the second straight month.

What media pundits fail to understand is that any increase in interest rates would cause:

- the money supply to contract, and as the money supply contracted,

- the economy to recede back into recession,

- corporate debt to become much larger and much more burdensome because artificially low interest rates have allowed corporations to borrow money so they can repurchase their own stock,

- corporate earnings to decline due to the higher share count that would occur, and much lower earnings per share numbers (EPS) would start to be reported, as these share repurchase programs turned into share issuing programs as a means to raise cash, and this would ultimately result in

- the stock market to decline rapidly. This is because the recent bull market in stocks has been fueled by artificially low interest rates, not the economic “recovery” and cause

- the Fed to step back in with another round of QE, as a means to support its ongoing wealth effect theory.

The above is what the mainstream press has been ignoring, and why the Fed is reluctant to raise interest rates.

*http://seekingalpha.com/article/3281075-forget-about-rising-interest-rates-prepare-for-q4?ifp=0

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

The Reason Why?