Given the global economic backdrop, and in particular the sharp correction in energy prices to which Canada is highly exposed, the risks of a Canadian housing correction are rising. Home prices, which corrected about 10% during the recession, have surged again, making household balance sheets look increasingly fragile. Economists are becoming concerned. [Should Canadians be worried too? Let’s review the situation.] Words: 280

correction in energy prices to which Canada is highly exposed, the risks of a Canadian housing correction are rising. Home prices, which corrected about 10% during the recession, have surged again, making household balance sheets look increasingly fragile. Economists are becoming concerned. [Should Canadians be worried too? Let’s review the situation.] Words: 280

So say paraphrased comments from an article posted in its original format* at http://soberlook.com.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say, in part:

Canada…did not experience the same level of housing bubble, nor the correction that followed, as did the US (see chart below)….[In fact] Canadian home prices [continue to] …grow quite rapidly…. Some may argue that this is justified because Canada’s unemployment rate is lower. 8.1% in the US vs. 7.4% in Canada. Is that enough to justify such a divergence in housing prices, particularly when the GDP growth rates in the two countries is fairly similar?

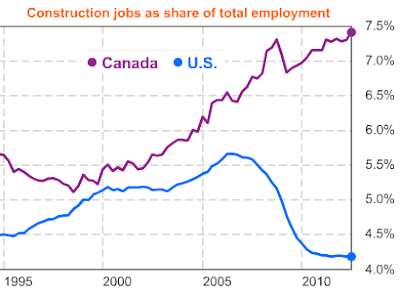

In addition, construction in Canada is booming. The chart below compares construction jobs as a percentage of total jobs for the US and for Canada. The divergence is quite striking.

Source: Bloomberg

Canadians have also been growing household debt levels. The chart below, though a bit dated, includes mortgage debt (total debt as percentage of net worth).

Watch the BBC video below to get a feel for the situation on the ground.

*http://soberlook.com/2012/05/soberlook.html?utm_source=BP_recent (To access the original article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Why Canadian real estate is not in a bubble

The ownership premium in Canada’s largest cities is unprecedented, dangerous to new buyers, and unlikely to persist – and if analogies to the U.S. situation at its peak back in 2005 are at all valid, this is bad news. [Let me explain.] Words: 430

3. American/Canadian Home Price Performance Comparisons by Major Cities

The following charts indicate relative performance of US home prices in Phoenix, Los Angeles, San Francisco, Chicago, Las Vegas, New York and Miami to Canadian home prices in Vancouver, Calgary, Toronto, and Montreal. US home prices are reflected in Canadian dollars for comparison purposes. Words: 240

4. Unlike the U.S and U.K, Canada’s Home Prices Are STILL Rising!

Canada, France and Switzerland stood alone among nine markets measured in recording annual price gains, based on second-quarter data, with inflation-adjusted price increases of 5%, 5% and 4%, respectively, compared to declines of 6% in the U.S., the U.K. and Australia, 10% in Spain and 14% in Ireland. In fact, Canada’s home prices have escalated 44% since 2005 – with a high of 68% in Vancouver – and they are up 7.7% in the past 12 months! Words: 1244

5. Believe it or Not: Australia’s Housing Bubble is Worse Than That in the U.S.

The explosion of Australia’s mortgage debt is viewed by many economists and commentators as the key factor behind Australia’s unaffordable housing [and the primary] reason why Australia’s housing bubble is larger than that experienced in the United States in the mid-2000s. [Another factor is] the strangulation of fringe urban land supply via increasingly restrictive planning processes. [Let me substantiate that contention by comparing the two countries housing situation via a number of descriptive graphs. Words: 817

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money