While the monetary policies in the United States, Japan and Europe are accommodative to a large extent, these policies are not having the desired effect on inflation. I expect the long-term impact on inflation will be quite positive but the short-term deflation worries are more than enough to weigh on the prices of gold and silver. Deflationary pressure might prevail in the short-term and will probably give us a chance to buy precious metals at lower levels.

policies are not having the desired effect on inflation. I expect the long-term impact on inflation will be quite positive but the short-term deflation worries are more than enough to weigh on the prices of gold and silver. Deflationary pressure might prevail in the short-term and will probably give us a chance to buy precious metals at lower levels.

The above are edited excerpts from an article by ONeil Trader as posted on SeekingAlpha.com under the title Gold And Silver: More Short-Term Pain?

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say in further edited excerpts:

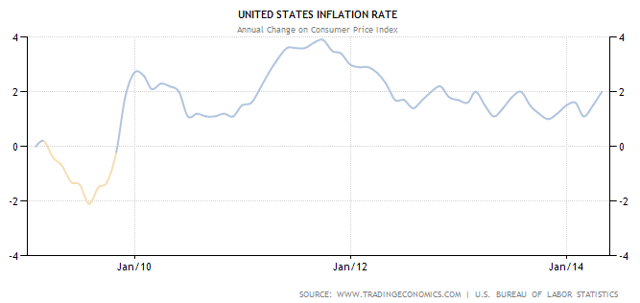

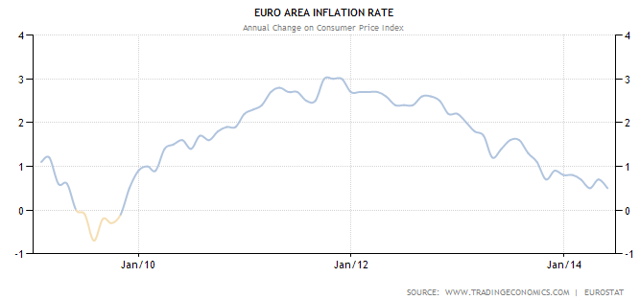

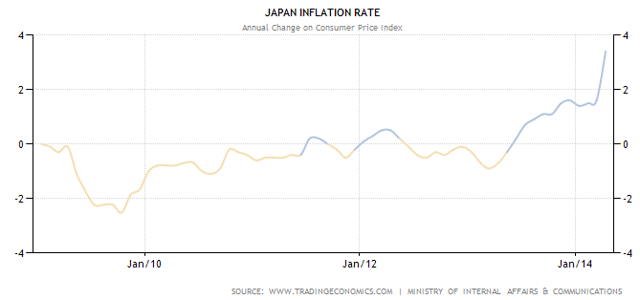

As the charts below show, inflation in the most of the developed world has been subdued in the last two years.

Source: www.tradingeconomics.com

- The U.S. inflation rate is in the 1% to 2% range since the end of 2012.

- The situation in the eurozone is even worse, as the inflation is the lowest since the 2009-2010 period.

- The situation in Japan is getting better, but this might be a short-term event because of the pickup in consumer demand before the sales tax hike in April. We should find out soon if this was a one-time event, and what the impact of the sales tax hike was on Japan’s inflation rate.

- China’s inflation rate has been declining in the past several months.

Safe-haven buying

- Although the Ukraine crisis seems far from over, it will likely remain a local conflict, and should not have an impact on the prices of precious metals…

- The China-Japan and China-Vietnam territorial disputes might spark safe-haven buying, but I do not think that there is potential for serious escalation.

- The instability of equity markets has also been a non-issue so far, but may be in the intermediate-term. This may be also linked to deflation worries which are not bullish for gold and silver, and they could both plummet together with the equity markets, as they did for the most part in the 2008-2009 period.

Stay connected!

- Register for our Newsletter (sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

- Subscribe via RSS

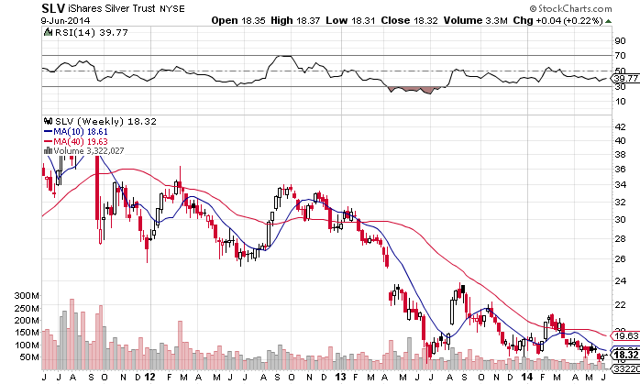

The Gold & Silver Charts

Gold and silver are on their way to test their 12-month lows in the next couple of weeks.

- Silver is already there and may break to the downside any day…

- Gold is still 5% above its July and December 2013 lows…

The rallies following the lows have taken gold and silver prices to a lower level than before, which is also bearish for the precious metals, as it shows the buyers are not able to take the price higher.

Source: Stockcharts.com

Conclusion

I believe that the inflation and price charts paint a clear picture, and that until inflation in the world picks up significantly, there will be no meaningful rallies in precious metals…[While] I am bullish on gold and silver long term, the short-term pressure is still evident and might take them lower in the next couple of months.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://seekingalpha.com/article/2260773-gold-and-silver-more-short-term-pain?ifp=0 (© 2014 Seeking Alpha )

Related Articles:

1. Probability of Deflation Is 60%, Inflation Is 25% and Muddling Through Is 15% – Here’s Why

At the end of last year virtually every every single economist expected interest rates to rise this year as the Fed tapered their purchases and the economy improved but, in fact, interest rates on the 10 year U.S. Treasury have been going down year to date (from 3% to 2.5% after rising from about 1.6% to 3% last year). The masses, going along with this crowd, got fooled but we have been calling for a decline in interest rates for some time now due to world-wide deflation and it couldn’t be clearer to us that this is the most likely scenario for the United States. Let us explain. Read More »

2. Inflation: What You Need to Know

The March year-over-year inflation rate was 1.51%, which is well below the 3.88% average since the end of the Second World War and 37% below its 10-year moving average. Read More »

3. These 5 Events Will Lead to Higher Gold & Silver Prices

It is my contention that the move in precious metals…[from] late 2008 through 2011 was largely a result of the expansion in central bank balance sheets and the perceived threat of runaway inflation. Since 2011, [however,] we’ve seen economic growth improve and inflation rates across the globe subside. As a result, investment banks and market strategists are arguing against owning gold, and making the case that, with a lack of inflation and an improved economy, the need for owning gold as an insurance hedge against inflation and currency debasement is no longer present. I strongly disagree. Read More »

4. Is There a Direct Link Between Rising Inflation and a Rising Demand For Gold?

History clearly shows there is a direct link between inflation and gold demand. When inflation jumps, or even when inflation expectations rise, investors turn to gold in greater numbers. When gold demand rises, so does its price and you can guess what happens to gold stocks. Below is a look at the extent of consumer purchases after inflation (and in some cases hyperinflation) took off in a number of countries. Read More »

5. Gold Going DOWN to $1200/$1220 in June Then UP to Retest $1520 – Here’s Why

With gold’s current setup, we’ve finally reached a significant cycle pivot…and I believe that we are likely to be treated to a very surprising turn of events. Directly ahead, I believe, is a major turn and rally for gold. Read More »

6. Present Gold Price Is No Surprise & It Likely Will Decline Even Further – Here’s Why

Much has been written over the years about gold going up dramatically in price to $5,000, $10,000 and even higher yet here we sit at $1,250 or so. Surprised? You shouldn’t be. Below are articles outlining why the decline is underway and what to expect as a bottom price. Read More »

7. The Future Price of Gold and the 2% Factor

It is my contention that the price of gold rallies whenever the U.S. dollar’s real short-term interest rate is below 2%, falls whenever the real short rate is above 2%, and holds steady at the equilibrium rate of 2%. Let me explain. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money