On Monday, major U.S. stock indexes experienced their most significant decline since 2022. The S&P 500 fell by approximately 3%, while the NASDAQ dropped over 6%. The Dow Jones Industrial Average (DJIA) also declined, losing roughly 1,000 points, equivalent to nearly 3%. This downturn was part of a broader global sell-off, exacerbated by heightened recession fears following a disappointing jobs report.

Key Factors

The U.S. Bureau of Labor Statistics reported that employers added 114,000 jobs in July, significantly below the expected 185,000. The unemployment rate increased to 4.3%, up from 3.7% earlier in the year. This rise triggered the “Sahm Rule,” a recession indicator suggesting that an increase of 0.5% in the unemployment rate within a year often precedes a recession.

Market Reactions and Economic Indicators

The weak employment data and growing recession concerns have led to calls for the Federal Reserve to implement a significant interest rate cut. Some investors are even advocating for an emergency rate cut before the Fed’s scheduled meeting in September. Additionally, Japan’s Nikkei 225 index saw a sharp decline, falling over 12%, marking its worst trading day since 1987.

In the technology sector, chipmaker Nvidia experienced a substantial drop of over 14%, while Apple shares fell by more than 8%. The broad market declines reflect a general sentiment of caution among investors, with equity markets trading heavily in the red.

Tuesday’s Stock Market Rebound

However, this downturn reversed itself as the U.S. equity market rebounded on Tuesday. The DJIA rose by 293.66 points, or 0.76%, closing at 39,253.66. The S&P 500 increased by 1.04%, finishing at 5,290.07, while the NASDAQ gained 1.03%, ending the day at 16,537.40.

This recovery was driven by easing recession fears and investors capitalizing on lower stock prices following the sharp declines on August 5, 2024. Additionally, global markets showed signs of recovery, with Japan’s Nikkei 225 rebounding significantly, which also contributed to the positive momentum in U.S. markets

Economic Outlook

Goldman Sachs economists have raised the probability of a U.S. recession in the next year from 15% to 25%, underscoring the growing economic uncertainty. The market’s performance in the coming weeks will likely depend on further economic data and the Federal Reserve’s response to these developments and a potential cut to the Federal Funds Rate (FFR).

Silver vs the Feds Funds Rate

Some investors are betting on a potential rate cut in the near term, especially if economic data continues to show signs of slowing growth. Fed funds futures indicate a roughly 48% chance of a rate cut by September 2024, driven by expectations of a further economic slowdown and rising recession fears

The correlation between the silver price and the FFR can vary over time and depends on various economic conditions. Historically, there has been an inverse relationship between the two, meaning that as the FFR rises, silver prices tend to decline, and vice versa.

This inverse relationship often stems from the fact that higher interest rates make interest-bearing assets more attractive, reducing the appeal of non-interest-bearing assets like silver.

However, the correlation is not always consistent, as it can be influenced by other factors such as inflation expectations, geopolitical events, industrial demand, and supply and demand dynamics in the silver market.

Silver as a Safe Haven in Volatile Markets

As investors navigate through the current financial turbulence, attention is increasingly turning towards assets that can provide stability amidst uncertainty.

Silver, historically known as a safe haven during economic downturns, is garnering interest due to its potential to hedge against market volatility. With global markets reacting to fluctuating economic indicators and the possibility of an impending recession, silver’s role in investment portfolios is being reconsidered.

The recent correlation between silver prices and the FFR highlights the complex dynamics at play. While traditionally there has been an inverse relationship between the two, external factors such as inflation, geopolitical risks, and industrial demand are now influencing this connection.

Understanding these variables is crucial for investors looking to silver as a potential safeguard against the unpredictability of the current market environment.

Recent Silver Correlation with the Feds Funds Rate

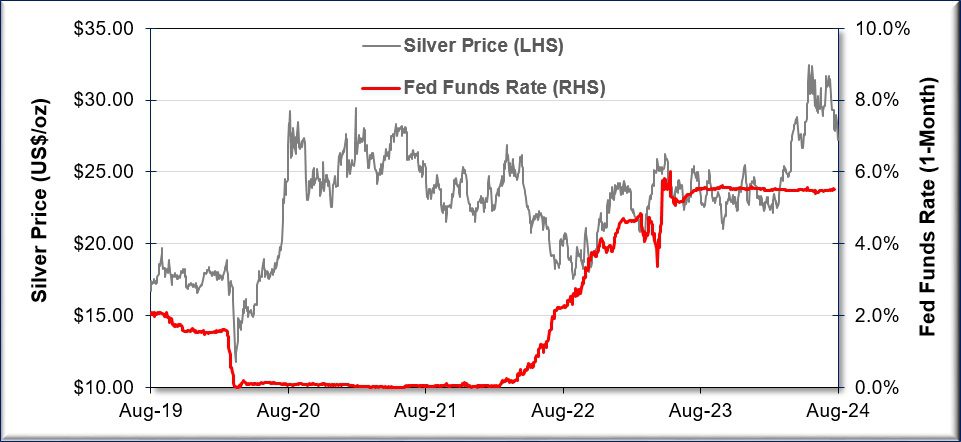

Over this 5-year period, there has mostly been an inverse correlation between the silver price and the Fed Funds Rate (see Figure 1).

However, in early 2020, both the price of silver and the Fed Funds Rate dropped in lockstep during the early part of the pandemic, highlighting the impact of global events on silver prices.

Aggressive rate hikes in 2022 caused a significant drop in silver prices, with silver falling from around $26 per ounce to $18 per ounce.

This trend reversed in late 2022 as expectations grew that the rate hikes might end, causing silver to regain some ground. The forecast suggests that a potential end to the rate hikes or even rate cuts could create a more favorable environment for silver.

However, since the start of the year, the price of silver has seen an increase as the Fed Funds Rate remained relatively unchanged.

Recent Silver Trends

Over the past five years, the price of silver has traded as low as $11.77/oz and as high as $32.43/oz, with an average price of $22.84/oz.

Even with the sharp drop in March 2020 that corresponds with the onset of the COVID-19 pandemic, the price of silver is up 56% over the five-year period.

Over the past year, the average silver price was approximately $25.41/oz, hitting a low of $21.02/oz in October 2023 and a high of $32.43/oz in May.

Since July 31, 2024, the price of silver has experienced significant volatility in response to oscillations in global stock markets. These movements were influenced by heightened recession fears, a weaker U.S. dollar, and fluctuating interest rate expectations.

Although the silver price is up 17% in the last year and almost 30% from its recent low, it is only up 13% from the start of the year and down 16% from its recent high.

The recent decrease in silver prices might present a good entry point for investors.

Figure 1: Silver Price vs Fed Funds Rate

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money