Many investors live by the saying – “Cash is King.” The gold sector should be no exception as those gold miners that are able to bring in positive cash flow from their operations, while at the same time using some of it towards capital expansion, are the ones that are likely to appreciate most in value and price. This could apply to the five gold stocks on our list today.

The comments above and below are excerpts from an article from SmallCapPower.com which has been edited ([ ]) and abridged (…) to provide a faster and easier read.

1. Centerra Gold Inc. (TSE:CG) – $7.29

Gold

Centerra Gold Inc. is a Canada-based gold mining company focused on operating, developing, exploring and acquiring gold properties in Asia, North America and other markets across the world. The Company’s exploration segment includes the operations of Lagares Project in which the activities are related to its subsidiary, Centerra Gold (KB) Inc. Its Kyrgyz segment includes Kumtor Gold Co. (KGC) (Kyrgyz Republic), which operates Kumtor Mine. Its Mongolian segment includes Centerra Gold Mongolia LLC (CGM) (Mongolia), which operates ATO Project and Gatsuurt Project, and Boroo Gold LLC (BGC) (Mongolia), which operates Boroo Mine. Its Turkish segment includes Centerra Luxembourg Holdings S.ar.L (Luxembourg), Centerra Exploration B.V. (CEBV) (The Netherlands), and Oksut Madencilik Sanayi Ve Tkaret A.S. (Turkey), which operates Oksut Project. Its Canadian segment includes Hearts Peak Project and Greenstone Gold Mines (Canada).

-

Market Cap: 1,764,248,730

-

Revenues: 638,523,716

-

Free Cash Flow: 41,348,417

-

Total Debt: 96,487,079

2. Alacer Gold Corp. (TSE:ASR) – $3.37

Gold

Alacer Gold Corp. (Alacer) is an intermediate gold mining company that operates in the segment of mining, development and exploration of mineral deposits in Turkey. The Company’s principal products are gold, copper and silver. Alacer has an interest in the Copler Gold Mine in Turkey.

-

Market Cap: 983,836,792

-

Revenues: 279,991,758

-

Free Cash Flow: 23,095,427

-

Total Debt: 0

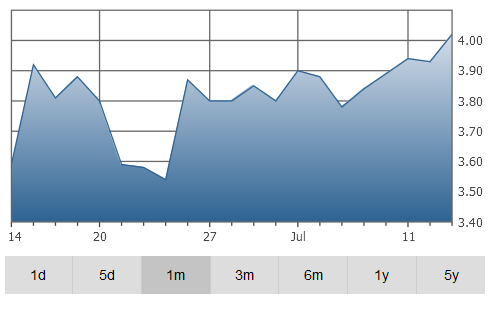

3. Newmarket Gold Inc. (TSE:NMI) – $3.93

Gold

Newmarket Gold Inc. is a gold mining, development and exploration company that owns over three operating mines, which include the Fosterville Gold Mine (Fosterville) and the Stawell Gold Mine in the State of Victoria and the Cosmo Gold Mine. It has a production capacity to produce over 200,000 ounces of gold annually from its approximately three Australian mines.

-

Market Cap: 215,285,203.21

-

Revenues: 329,946,108

-

Free Cash Flow: 19,404,773

-

Total Debt: 2,022,122

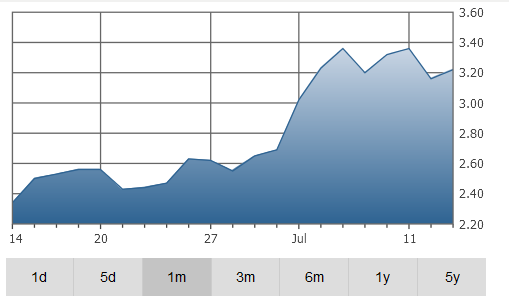

4. Primero Mining Corp. (TSE:P) – $3.16

Gold

Primero Mining Corp is a Canada-based precious metals producer that is active in Canada and Mexico. The Company focuses on gold, silver and copper development projects, and its portfolio of operating mines, as well as development-stage and exploration projects comprises San Anton, Ventanas, San Dimas Mine and Cerro del Gallo in Mexico, and Black Fox Mine and Grey Fox Project in Canada.

-

Market Cap: 114,570,744.63

-

Revenues: 354,152,862

-

Free Cash Flow: 15,256,722

-

Total Debt: 150,331,441

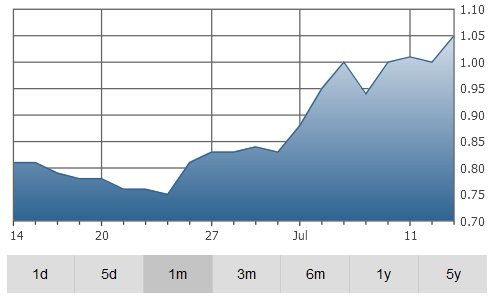

5. Golden Star Resources Ltd. (TSE:GSC) – $1.00

Gold

Golden Star Resources Ltd. is a gold mining and exploration company. The Company holds interest in the Wassa and Bogoso/Prestea gold mines in Ghana. In South America, the Company holds and manages exploration properties in Brazil.

-

Market Cap: 428,734,732

-

Revenues: 314,825,851

-

Free Cash Flow: 8,917,864

-

Total Debt: 166,075,384

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Related Articles from the munKNEE Vault:

1. Silver Penny Stocks That Should Continue To Shine

Silver’s performance since April 1, 2016, has more than doubled that of gold. That being said, the silver names on our list today should continue to shine as all have undertaken significant debt, using that as leverage to enhance production initiatives and sell more silver at these elevated prices.

2. These 5 Gold Stocks Have the Highest Return on Equity

The gold price has surged over 25% year-to-date, providing big gains in the gold sector as a whole. Companies that have generated strong earnings growth relative to total shareholders’ equity should continue to outperform the sector and entire market. To measure this, we took a look at return on equity (ROE) values and found the top 5 gold stocks with the highest ROE.

3. These 5 Energy-Related Stocks Yield Hefty Dividends

The U.S. Dollar has appreciated somewhat due to the recent Brexit fears, also bringing down the price of oil, but, moving forward, we believe oil prices have a clear path towards US$55-60/barrel. As such, we suggest investors take a look at the five energy-related stocks described below that also generate hefty dividend yields.

4. 5 Gold Penny Stocks That Aren’t Getting the Love They Likely Deserve

Gold has surged 20% year to date, powering many gold penny stocks up more than three fold, but the 5 names on our list could be considered undervalued due to the fact that they are trading at low sales multiples.

5. 10 Go-To Dividend Paying Stocks For 2016

I believe each of these 10 companies represent a high level of safety and the opportunity to produce above-average current dividend income and long-term dividend growth.

6. Even In This Market These 5 Energy Stocks Have Increased Their Dividends By 21% to 53%!

Recent headlines are enough to give any oil and gas investor the jitters BUT, if you’re still a believer in the oil price turnaround story, then the companies on our list today may be a good place to start your research, as they have been increasing their dividend payout even in this challenging market.

7. Check Out These SMALL Cap Stocks with BIG Insider Buying

Insider buying can be a strong indication of a mismatch between the current trading share price of a firm and its intrinsic value (what the shares should be trading at). Management, by far, has the best understanding of their business, and hence most often have the best opinions about valuation. Thus, purchasing their own stock is often a good sign for investors, which could be the case for shareholders of the companies on our list today.

8. Advantages/Disadvantages of Small Caps & 10 Worth Taking A Long, Hard Look At

I have come up with 10 rather intriguing-looking small companies that are also attractive from a valuation perspective. The portfolio review lists them by ticker, name, sector, debt to capital, P/E ratio, price to cash flow, dividend yield, market cap, near-term estimated earnings per share growth and longer-term trend line estimated EPS growth.

9. The 10 Best Resource Stocks To Invest In At This Time

Resource stock returns during the past few years have been downright lousy but that’s not to say investors should neglect the sector. It offers tremendous value currently and has historically produced some eye-popping gains. Here is a portfolio of 10 stocks we think will outperform long-term during both good and not-so-good times.

10. Any 1 Of These 20 Stocks Could Be A 10-Bagger At Higher Gold & Silver Prices

The list of stocks provided in this post are what I consider “must own”stocks if you want big returns. Why? Because most of them are potential 10-baggers at higher gold & silver prices. These are the cream of crop when it comes to risk/reward for large returns. They all have solid projects and growth potential. They all have the “goods” and are extremely undervalued. Take a look.

11. 7 Keys to Greater Profits in Canadian Penny Stocks

Buying penny stocks can pay off extremely well when it succeeds but, in addition to the business odds against success, it’s much easier to launch and promote a stock than it is to find a mine, for example, or invent a new battery. That’s why penny stocks are so common, even though profit-making companies are rare. It’s also why we think penny stocks should make up only a very small part of your portfolio. Words: 475

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money