…Market participants often expect the next crisis to look like the last one, but it never does…. [IMO,]…the current monetary system’s ultimate financial crisis, meaning the crisis that leads to a new monetary system, will have to be inflationary. Here’s why.

[IMO,]…the current monetary system’s ultimate financial crisis, meaning the crisis that leads to a new monetary system, will have to be inflationary. Here’s why.

This version of the original article , by Steven Saville has been edited* here by munKNEE.com for length (…) and clarity ([ ]) to provide a fast & easy read. Visit our Facebook page for all the latest – and best – financial articles!

This version of the original article , by Steven Saville has been edited* here by munKNEE.com for length (…) and clarity ([ ]) to provide a fast & easy read. Visit our Facebook page for all the latest – and best – financial articles!

The ultimate financial crisis will have to be inflationary, because deflation scares provide ‘justification’ for central bank money-pumping and thus enable the long-term credit expansion to continue with only minor interruptions.

To put it another way, a crisis won’t be system-threatening as long as it:

- can be ameliorated by central banks doing what they do best, which is promote inflation and

- involves an increase in demand for the official money.

The 2007-2008 crisis was such an animal. Like every other crisis in the U.S. since 1940:

- it did not involve genuine deflation, almost regardless of how the word deflation is defined.

- The money supply continued to grow,

- the total supply of credit did no worse than flatten out, and…

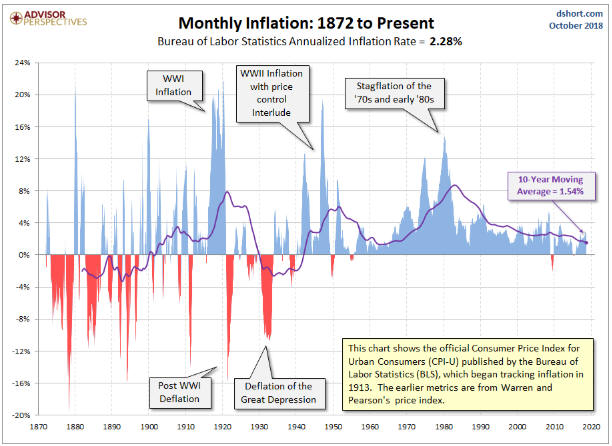

- there was nothing more than a downward blip in the Consumer Price Index (see chart below).

- However, with the stock market losing more than half its value and commodity prices collapsing, for 6-12 months it sure felt like deflation was happening.

What actually happened during 2008 was a deflation scare, as opposed to genuine deflation. I define a deflation scare as a period when the total supply of money and credit continues to grow, but a surge in the demand for money makes it seem as if the economy is experiencing severe deflation.

Since there is no limit to the amount of new money and credit that can be created out of nothing by the central bank, it will always be possible for the central bank to keep the current system going in the face of a crisis that involves a surge in the demand to hold the official money. The problem (for the monetary authorities) will occur when:

- the crisis involves a plunge in the demand for the official money. In such a situation the central bank’s most powerful weapon becomes not just ineffective, but counter-productive*.

The bottom line is that, regardless of its other details, IF the next crisis involves deflation or a deflation scare then it will be just another bump in the road.

- It will prompt another bout of aggressive money-pumping that will alleviate the perceived shortage of money and eventually inflate new investment bubbles.

Only a crisis that entails a decline in the desire to hold the official money can be an existential threat to the monetary system.

*Creating money out of nothing is always counter-productive if the goal is to hasten long-term economic progress, but it can be productive if the goal is to prolong the existence of a debt-based monetary system.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money