No stock market crash (a decline greater than 15%) has occurred over the past 30 years without the presence of a Hindenburg Omen except on one occasion (the mini-crash of July/August 2011). As such, without an official confirmed Hindenburg Omen, we are pretty safe from experiencing a major stock market correction. On the other hand, if we have an official Hindenburg Omen, then a critical set of market conditions necessary for a stock market crash exists. As of September 19, 2014, we have such a condition in the market…

without the presence of a Hindenburg Omen except on one occasion (the mini-crash of July/August 2011). As such, without an official confirmed Hindenburg Omen, we are pretty safe from experiencing a major stock market correction. On the other hand, if we have an official Hindenburg Omen, then a critical set of market conditions necessary for a stock market crash exists. As of September 19, 2014, we have such a condition in the market…

The above introductory comments are edited excerpts from an article* by Robert McHugh Ph.D. (technicalindicatorindex.com) as posted on Gold-Eagle.com under the title We Got An Official Confirmed Hindenburg Omen On September 19th, 2014.

McHugh goes on to say in further edited excerpts:

What is a Hindenburg Omen?

A Hindenburg Omen is the alignment of several technical factors that measure the underlying condition of the stock market — specifically the NYSE — such that the probability that a stock market crash occurs is higher than normal, and the probability of a severe decline is quite high.

Because it signals the possibility of a stock market crash, my good friend, the late Kennedy Gammage, a terrific technical analyst in his own right, dubbed it the Hindenburg Omen after the famous ill-fated aircraft associated with the word “crash.”

Specifically,the criteria for an official confirmed Hindenburg Omen observation are as follows:

- the daily number of NYSE New 52 Week Highs and the Daily number of New 52 Week Lows must both be so high as to have the lesser of the two be greater than 2.2 percent of total NYSE issues traded that day.

- the NYSE 10 Week Moving Average is higher than the level at any time during the previous 10 weeks and

- that the McClellan Oscillator is negative on that same day

- the New 52 Week NYSE Highs cannot be more than twice New 52 Week Lows but the New 52 Week Lows can be more than double New 52 Week Highs and

- there must be more than one signal, i.e. a cluster (defined as two or more such observations) within a 36 day period.

…Critics have taken this Hindenburg Omen definition and pointed rightly to several failed Omens. In other words, with just the first three filters defining a Hindenburg Omen, there were too many false positives to render the indicator useful. I conducted research, convinced that this indicator had strong potential to predict periods of extreme stock market declines, and came up with two more filters that vastly improved the predictive value of this indicator. I added condition # 4 and I also added condition # 5 to substantially increase the probability of a coming stock market plunge…

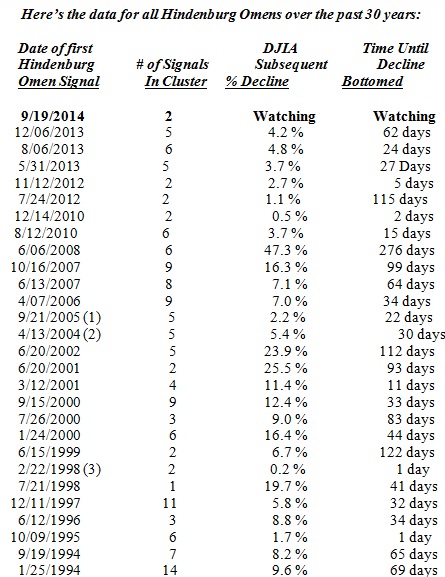

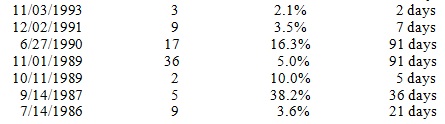

Based upon the 5 parameters noted above, here’s what I found:

- Confirmed Hindenburg Omens are very rare. There have been only 35 confirmed Hindenburg Omen signals over the past 30 years. September 2014’s is the 35th. This is amazing when you consider that during that time span, there were roughly 7,500 trading days. Of those 7,500 trading days where it was possible to generate a confirmed official Hindenburg Omen, only 228 (3.04 percent) generated one, clustering into 35 confirmed potential stock market crash signals. This is a very rare alignment, a rare but potentially dangerous condition in the stock market.

- Plunges can occur as soon as the next day, or as far into the future as four months. In either case, the warning is useful. It just means, if you want to play the short side after a confirmed signal, or move out of harms way, you must be prepared to see it happen as soon as the next day, or four months from now, possibly after you forgot about it. About half occurred within 41 days.

“The rationale behind the indicator (according to Peter Eliades as he put it in his Daily Update, September 21, 2005, on stockcycles.com), is that, under normal conditions,

- either a substantial number of stocks establish new annual highs or a large number set new lows — but not both.”

When both new highs and new lows are large, “it indicates that:

- the market is undergoing a period of extreme divergence — many stocks establishing new highs and many setting new lows as well – and such divergence is not usually conducive to future rising prices. A healthy market requires some semblance of internal uniformity, and it doesn’t matter what direction that uniformity takes. Many new highs and very few lows is obviously bullish, but so is a great many new lows accompanied by few or no new highs. This is the condition that leads to important market bottoms.”

We got a first Hindenburg Omen observation on Thursday, September 18th, 2014, and a second official confirming Hindenburg Omen observation Friday, September 19th, 2014, meaning we are now on the clock watching for a stock market crash, and at the very least a significant decline. There is a much higher-than-random probability of a stock market crash starting sometime over the next four months.

This is the 1st [time we have had a] Hindenburg Omen since December 6th, 2013, and only the 8th since 2008, the 2008 signal which of course led to the massive stock market crash in the autumn 2008, and the 9th since the Bear Market started in October 2007. We got crashes after both the October 2007 and June 2008 Hindenburg Omens.

How has this signal performed over the past 30 years, since 1985?

If we define a crash as a 15% decline, of the previous 34 confirmed Hindenburg Omen signals,

- 8 (23.5%) were followed by financial system threatening, life-as-we-know-it threatening stock market crashes.

- 3 (8.8%) more were followed by stock market selling panics (10% to 14.9% declines).

- 4 more (11.8%) resulted in sharp declines (8% to 9.9% drops).

- 6 (17.6%) were followed by meaningful declines (5% to 7.9%),

- 9 (26.5%) saw mild declines (2.0% to 4.9%), and

- 4 (11.8%) were failures, with subsequent declines of 2.0% or less.

Put another way, there is:

- a 23.5% probability that a stock market crash — the big one — will occur after we get a confirmed (more than one in a cluster) Hindenburg Omen,

- a 33.3% probability that at least a panic sell-off will occur (a decline greater than 10%),

- a 44.1% probability that a sharp decline greater than 8.0 % will occur, and

- a 61.7% probability that a stock market decline of at least 5% will occur.

Only one out of roughly 8.5 times will this signal fail.

(1) In September 2005, the Fed pumped $148 billion in liquidity from the first week in September, just before the Hindenburg Omens were generated — to the third week of October, an 11 percent annual rate of growth in M-3 (2.5 times the rate of GDP growth and 5 times the reported inflation rate), to stave off a crash. The liquidity held the market to a 2.2 percent decline from the initiation of the signal.

(2) In April 2004, the Fed pumped $155 billion in liquidity from the last week in April — right after the Hindenburg Omens were generated — to the third week of May, a 22 percent annual rate of growth in M-3, to stave off a crash. Even with the liquidity, the market still fell 5.0 percent.

(3) The 12/23/1998 signal barely qualified, as the McClellan Oscillator was barely negative at –9, and New Highs were nearly double New Lows. Had this weak signal not occurred, condition # 5 would not have been met. This skin-of-the-teeth confirmation may be why it failed. It says something for having multiple, strong confirming signals.

Other points to make here are that:

- the actual stock market declines are often greater than the measures in the prior data chart because oftentimes the decline from a top has already started before the Hindenburg Omens have been generated. These percent declines are only measuring the declines from the first Omen in a cluster so, f we measured declines from the tops, it would be worse in many cases. (For example, the September 2005 signals came after the September 12 high of 10,701. The autumn decline of 2005 into October 13, 2005 bottom ended up being 545 points (5%) even with all the liquidity pumping by the Fed.

- Oftentimes equities will rally after a Hindenburg Omen occurs, faking folks out, then the plunge comes on the other side of the hilltop. 1987 is a perfect example of that.

- Once you get two solid Hindenburg Omens in a cluster, the probability of a severe decline does not seem to increase as more Omens occur within the cluster. Sometimes a two signal cluster produced a worse decline than a 5, 11, or 17 signal cluster but what can be said about multiple signal clusters is that the warnings are being given further out in time, keeping us on the alert. More signals also assure us a greater likelihood of better quality signals, which seems to matter. Multiple signals are telling us things are not getting better, that something continues to remain wrong with the market.

What does it mean for traders and investors when we get a confirmed Hindenburg Omen?

This is really important to understand. A confirmed Hindenburg Omen, such as we now have, is not a guarantee of a stock market crash. The odds of a crash based upon the history since 1985 is 23.5%. That means the odds we will not have a crash are quite high, at 76.5%…[but] a 23.5% probability of a stock market crash is extremely high, however, when you consider that there have been only 8 over the past 30 years, and the normal odds of a crash happening randomly are only about one-tenth of one percent...Even with the heavy liquidity the Fed has been pumping around the time of the past two signals, the odds of a 5% decline – or more – remain pretty high at 61.7%.

You may want to think about taking prudent precautionary action…given the much higher than normal odds of a crash…[That] may mean:

- increasing cash positions or

- hitting the sidelines for a while or

- developing a carefully constructed shorting strategy that limits losses, and invests only the amount which you can afford to lose.

We do not think it is wise to listen to folks who minimize the risk in markets pointed out by the Hindenburg Omen.

We disagree with the argument that since so many of the listings on the NYSE, especially those of the New High “stock” group recorded for the Omen, are some type of Fixed Income product (ETFs, preferred stocks, etc) that the Omen isn’t really capturing “stocks” when it says “we got x % New Stock Highs,” therefore the Omen is irrelevant. Our position is that the argument that the “stock market Omen” isn’t measuring the internals of the “stock” market is false. Here is why:

- A huge percent of NYSE stocks are financials, banking firms, and include firms such as General Electric which is essentially a financial firm, although many people would not think of them that way. Financial firms hold substantial positions in bonds. Almost every bank listed on the NYSE carries a fixed income bond portfolio somewhere between 15 and 30 percent of their entire balance sheet, and have for years, going back far beyond the past 30 years of our research, a period of time when the Hindenburg Omen worked just fine, thank you very much.

- Bond and other fixed income products are prevalent throughout the distribution of companies listed on the NYSE, and have been for years.

The Hindenburg Omen has worked for at least the past 30 years. It accurately called the stock market crashes of 2007 and 2008 when the NYSE included many stocks holding significant positions in fixed income instruments. It does not matter. Our entire economy has essentially moved from a manufacturing base to a financial base. This makes the Hindenburg Omen relevant.

We believe it would be unwise to ignore this potential stock market crash warning.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.gold-eagle.com/article/we-got-official-confirmed-hindenburg-omen-september-19th-2014 (From McHugh: Consider trying our free 30 day trial subscription or subscribe now!)

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. What Are the “Titanic Syndrome” & “Hindenburg Omen”? What Are They Now Saying?

There are two market warning signs which have just recently been triggered and which have gotten a lot of press attention due to their catchy names – the Titanic Syndrome and the Hindenburg Omen – both of which are giving a “preliminary sell signal” based on analyses of 52-week New Lows (NL) in relation to New Highs (NH) on the NYSE within a specific period of time. Read More »

2. Dreaded “Hindenburg Omen” Indicator Suggests 77% Likelihood of Imminent Major Market Decline

The probability of a move greater than 5% to the downside after a confirmed Hindenburg Omen was 77% [conversely, 23% of the time no significant market downturn occurred] and usually took place within the next forty-days. The probability of a panic sellout was 41% and the probability of a major stock market crash was 24%. The Omen was activated on the New York Stock Exchange on August 11 so the probability is that we will see a steep market decline sometime in September. Words: 871 Read More »

3. Take Note Because Those Investors Who Ignore These Observations Do So At Their Great Peril

Is a major top at hand? It is often said that bells do not ring to signal the end of a bull market but if the broad averages were in fact to plummet in the weeks ahead, never forget that bells did indeed ring. This article contains the opinions of three heavyweights in the guru world which are so insightful that any investors who ignore their observations do so at their great peril. Read More »

4. What Does the 10-year Yield’s Death Cross Mean For Stocks?

The 10-year yield’s Death Cross has proven to be a pretty significant risk-off shot across the bow over the last decade and this matters today because the 10-year yield put in a Death Cross back in early April of this year. So what does the 10-Year’s Death Cross mean for stocks this time? Read More »

5. Financial Asset Values Hang In Mid-air Like Wile E. Coyote – Here’s Why

The financial markets are drastically over-capitalizing earnings and over-valuing all asset classes so, as the Fed and its central bank confederates around the world increasingly run out of excuses for extending the radical monetary experiments of the present era, even the gamblers will come to recognize who is really the Wile E Coyote in the piece. Then they will panic. Read More »

6. Look Out Below? Buffett Market Indicator Has Now Surpassed 2007 Level

Market Cap to GDP is a long-term valuation indicator that has become popular in recent years, thanks to Warren Buffett and it is now at the second highest level in the past 60 years – even surpassing the levels reached in 2007. Read More »

7. World’s Stock Markets Are Saying “Let’s Get Ready to Tumble!”

To ignore all the compelling charts and data below would be irresponsible and, as such, will NOT go unnoticed by institutional investors. Such bearish barometers for stocks worldwide will, unfortunately, be ignored by the ignorant and gullible hoi pollo causing them severe financial loss as investor complacency in the past has nearly always led to a stock market crash. Read More »

8. Stock Market Bubble to “POP” and Cause Global Depression

In their infinite wisdom the Fed thinks they have rescued the economy by inflating asset prices and creating a so called “wealth affect”. In reality they have created the conditions for the next Great Depression and now it’s just a matter of time…[until] the forces of regression collapse this parabolic structure. When they do it will drag the global economy into the next depression. Let me explain further. Read More »

9. It’s Just A Matter Of Time Before the Stock Market Bubble Is Pricked! Here’s Why

Once again the stock market is in full bubble mode. The market was already overvalued earlier this year and the froth continues to build. Valuations are off the chart and euphoria is setting in while, at the same time, you have inflation eroding the purchasing power of regular Americans not participating in this casino. All the signs of a bubble top are there – massive speculation, unexplainable valuations, and blind optimism – even though the fundamentals don’t make any sense. This article substantiates that contention. Read More »

10. Coming Stock Market Enema Will Be A VERY Messy Occasion!

Who knows how long before the Dow Jones Index finally receives a well overdue market enema, but I can assure you of this, when it arrives it will be a VERY messy occasion! Read More »

11. History Says “Expect An Economic Crash AGAIN In 2015″ – Here’s Why

Large numbers of people believe that an economic crash is coming next year based on a 7-year cycle of economic crashes that goes all the way back to the Great Depression. Such a premise is very controversial – some of you will love it, and some of you will think that it is utter rubbish – so I just present the bare bone facts below for you decide for yourself if it is something to seriously consider protecting yourself from in 2015. Read More »

12. This Weekend’s Financial Entertainment: “A Stock Market Crash IS Coming!”

Our financial system is in far worse shape than it was just prior to the financial crash of 2008. The truth is that we are right on schedule for the next great financial crash. You can choose to ignore the warnings if you would like but, ultimately, time will reveal who was right and who was wrong and, unfortunately, I think I will be proven to have been right. Read More »

13. Present Bull Rally In Stocks Dangerously “Beyond the Pale” – Here’s Why

It is frighteningly clear to any objective analyst and/or intelligent investor that the present bull market rally in stocks (2006-2014) is “beyond the pale” (outside the bounds of acceptable behavior) i.e. the excess valuation is dangerously above the market excesses of the 1920s. Read More »

14. We’re All Cued Up For A Bear! Here’s Why

When taking a step back and viewing longer-term gauges, we see warning signs flashing. Many of these readings are in extreme territories, and historically bear markets have occurred from such overbought positioning. We are all cued up for a bear! Read More »

15. SELL! U.S. Stock Market Is An Investor’s Nightmare – Here’s Why

The stock market is presently a roulette wheel with dimes on black and dynamite on red. We continue to have extreme concerns about the extent of potential market losses over the completion of the present market cycle. Read More »

16. Harry Dent: Get Into Cash – Stock Market Will Crash to 5,500-6,000 By 2017!

You have to get out of stocks. Stocks have bubbled again and when they go down they’re going to go down hard. Read More »

17. Coming Bear Market Could Turn Into A Historic Crash – Here’s Why

Amazingly, we are on the verge of a global deflationary downturn and what could be a historic bear market, yet Wall Street prognosticators remain focused on the inflationary risks of excessive monetary stimulus. Their focus could not be more wrong. Let me explain further. Read More »

18. Take Note: A Bubble Isn’t Necessary To Have A Sharp Decline In Stocks

With valuations stretched, investors seem to be justifying their stock purchases here with the argument that we have yet to reach the mania of 1999-2000 but history has shown us that there doesn’t have to be a bubble for there to be a sharp decline in stocks. As we saw in 2007, it doesn’t mean there is no risk of a significant market decline or that valuations are compelling and that investors should be expecting above average long-term returns from here. They should not. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money