Higher interest rates will lead to higher deficits and still higher borrowings. As such, we will have the perfect vicious circle that leads to the whole caboodle collapsing.

the perfect vicious circle that leads to the whole caboodle collapsing.

The comments above and below are excerpts from an article by Egon von Greyerz (GoldBroker.com – All rights reserved) which has been edited ([ ]) and abridged (…) to provide a fast & easy read.

We are now approaching the final mania in markets:

- The Dow seems to be on its last swansong [despite the fact that the markets is just shy of]…the “magic” level of 20,000. Memories are very short in markets. A few weeks ago, everyone was forecasting that a Trump win would be a disaster for stocks and for the world but now he is clearly a godsend.

- the fact that the stock market has gone up 3X since March 2009 is clearly no concern and

- a risky Shiller p/e of 27, 56% above the average, is totally ignored by this exuberant market…

- Normally investors would worry about higher interest rates but currently the market is in a euphoric mode so any bad news is ignored in this final crescendo.

- Also, the market is taking in its stride that Trump will take debt levels up by a minimum of $10 trillion or 50% in the next few years. Higher spending and lower taxes seem to be the perfect recipe for a higher stock market.

Interest rates to reach 1970 levels of above 15%

In recent articles I have discussed the 35 year interest cycle turning and this is clearly happening with a vengeance. Higher interest rates will lead to higher deficits and still higher borrowings. As such, we have the perfect vicious circle that leads to the whole caboodle collapsing.

We will have interest rates as high as in the 1970s to 1980 when we saw rates in the high teens in many countries including the U.S.. This will of course mean that:

- no one will [be able to] afford the interest costs on their house, car or credit card and

- no government [will be able to] pay the interest on their surging debt. That won’t be a problem…[for them, though,] because all they [will] need to do is to print more money to cover the interest. This would be the perfect perpetual motion financing model but the consequences are clear – collapsing currencies and inflation leading to hyperinflation.

Global stock markets diverging – a major warning signal

The current stock market bonanza in the U.S. is likely to be short lived. It is not just the massive overvaluation which is pointing to that. Technical indicators indicate that we soon will see a major downturn.

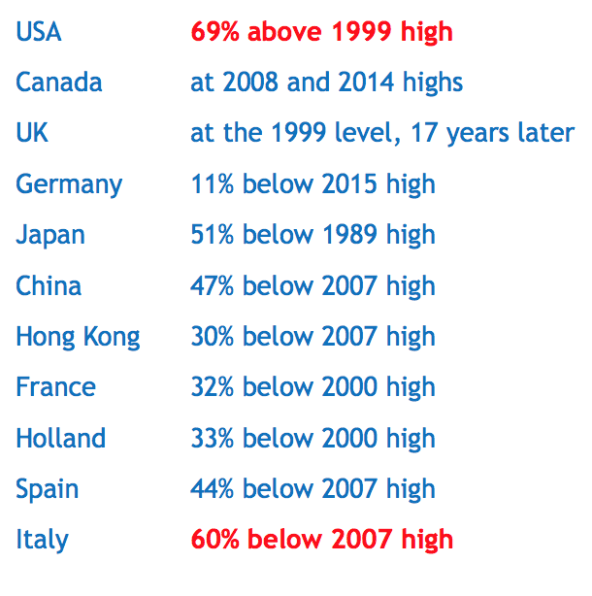

If we look at every other market in the world, none of them confirms what is happening in the U.S. We must remember that the U.S. is not an isolated economy and totally independent on what is happening in the rest of the world. The time when a major economy can diverge from the rest of the world is gone. There can be a slight time lag but in the end, there will be a global convergence. [Below is the] performance of some major stock markets in relation to their respective highs:

US stocks to fall 90% like in 1929-32

In a converging world market, the divergences between the U.S. and other major stock markets are a major warning signal that the overvalued U.S. market is living on borrowed time. In real terms, the U.S. market is likely to fall at least 75% in the next few years and probably 90% as it did in 1929-1932. The conditions and risks today in the U.S. and the rest of the world are substantially worse than in the 1930s.

We will reach a point when there will be “no offer” for gold

If the U.S. market indices fall 90% in real terms, they will fall at least 95% against gold and probably a lot more. This is something that virtually no investor can see today and that is why the shock will be of a magnitude that will shake the world and create a demand for physical gold that can never be met. We will reach a point when there will be “no offer” for gold. The trader or bank will have no physical gold to sell and therefore…[not be able to] sell it at any price regardless of what the buyer is prepared to pay…

If you want more articles like the one above: LIKE us on Facebook; “Follow the munKNEE” on Twitter or register to receive our FREE tri-weekly newsletter (see sample here , sign up in top right hand corner)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money