Currency debasement is going to be the major contagious disease that the world must live with in coming years. It will happen to most currencies in the world and spread like wildfire.

must live with in coming years. It will happen to most currencies in the world and spread like wildfire.

The original article has been edited here for length (…) and clarity ([ ]). For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE tri-weekly Market Intelligence Report newsletter (see sample here)

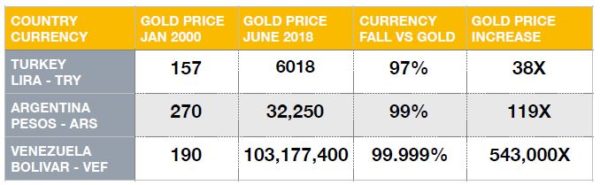

Like many diseases it normally starts in the periphery. Just take the examples of Turkey, Argentina and Venezuela. The currencies of these three countries have collapsed in this century and the fall is now accelerating.

- The Turkish lira has lost 97% against gold since January 2000 and the fall is now picking up speed. For anyone who has been protected in gold, the gold price has gone up 38x vs the lira in the last 18 years. (See chart below)

- …The Argentine Peso has lost 99% against gold since 2000. This means that gold is up 119x vs the peso in this century.

- …The Venezuelan Bolivar has lost 99.999% against gold since January 2000 so the Bolivar is up 550,000x against gold in this century.

This all might sound unreal…[but] it certainly isn’t unreal to the people in the three countries who have to suffer these precipitous losses in the value of their money and disastrous falls in their standard of living and don’t think for one second that their governments told them to protect themselves even when they knew they were going to print unlimited amounts. No, the people had no warning.

It is the same in all Western countries today. Governments in Europe, the U.S. and Japan, to mention a few, are already on the way to destroy their currencies in the 2000s. As the table below shows, the Euro is down 75%, the Dollar 78% and the Yen 75% against gold since 2000 so inflation, leading to hyperinflation, is already on the way in the West. It always starts slowly, although the fall so far in the last 18 years is already significant…

No government talks about how they are destroying their currency and no Western government tells their people to protect themselves by holding gold. They do the opposite. They manipulate the price of gold and see gold as a barbarous relic that has no place in a modern currency system. We know why they do this of course. Because gold can’t be printed or debased. Also, the gold price reveals their deceitful actions in ruining the currency and the economy….

Conclusion

My advice to investors is to learn from the recent economic problems/disasters in Turkey, Argentina and Venezuela. Any amount of personal gold, even very small, would have saved the holders in these countries from misery.

It is also now critical to heed the strong warning signs of deep trouble coming in Europe, Japan and the USA. A 75-79% fall in the currencies of these countries is telling us that they will all go to their intrinsic value of ZERO in the next few years. This will lead eventually to the same hyperinflation as in Argentina and Venezuela…

Support our work: like us on Facebook, follow us on Twitter, or share this article with a friend. munKNEE.com – Voted the internet’s “most unique” financial site! (Here’s why)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money