…Thesis: Sovereign interest rates have reached their bottom, setting the stage for an inflationary investment environment.

for an inflationary investment environment.

So says William Koldus in edited ([ ]) and abridged (…) excerpts from the original article.

Koldus goes on to say:

The deflationary panic has reached a crescendo. Interestingly, inflationary assets, including precious metals, crude oil, natural gas, real-estate, and even the government’s inflationary gauges do not confirm this latest panic. This positive divergence is a sign that the pendulum towards deflation has swung too far, and investors should at least consider, and be prepared for the opposite outcome, which is the rise of inflation.

…Global bond yields have reached new lows:

- In Germany, ten-year Treasury Bond Yields breached negative territory this week. Yesterday, Thursday, June 16th, 2016, they closed at -0.02%…

- In Japan, 10-Year Japan Treasury Yield’s reached new lows, closing at a mind boggling -0.19% yield level.

- Switzerland has seen the yields on their 30-Year Treasury Bonds go negative…[as well].

- The United States has not been immune with U.S. 10-Year Treasury Yield’s making new multi-year lows, closing at a yield level of 1.57%. 10-Year Treasury Yields are now very close to challenging their 2012 lows of 1.43%…

In summary, long-term sovereign bond yields have clearly undercut their February 2016 lows, as deflationary fears have gained a wide following among investors in the global bond markets…

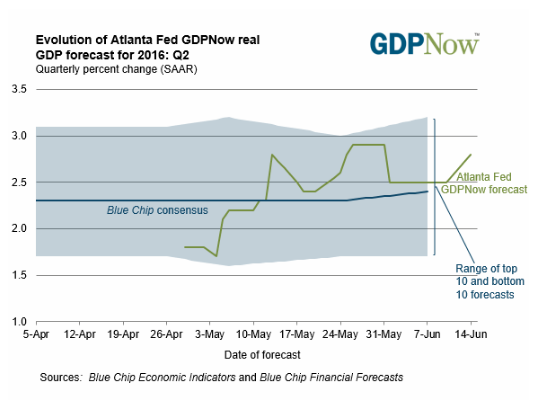

One would think that we are on the precipice of a global economic contraction [but] this does not appear to be true. In fact, the opposite is the case, as the Atlanta Fed’s GDPNow barometer is now forecasting 2.8% GDP growth for the U.S. economy in the second quarter of 2016.

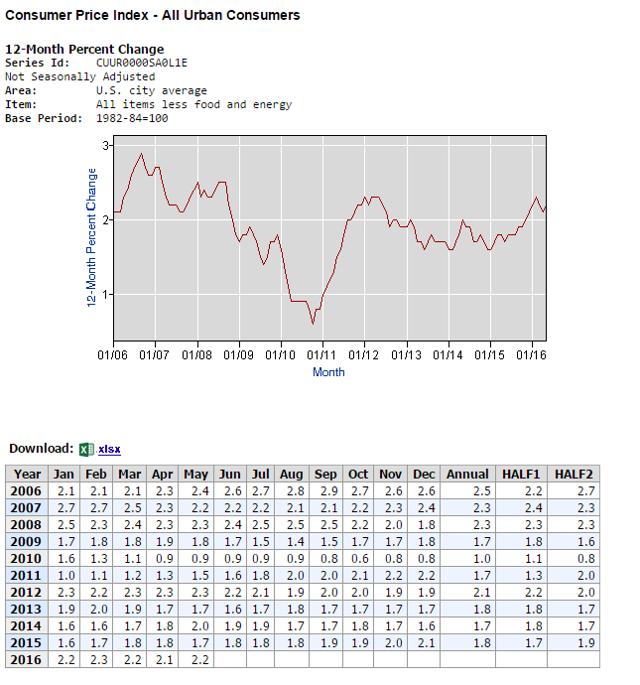

Adding to the inflationary pressures is the fact that the Bureau of Labor Statistic’s Core CPI calculation, which excludes food and energy prices, has printed a reading consistently above 2% in 2016.

Looking at the above data, it…[is] clear that there has been no deflation or even disinflation in the United States over the last seven years.

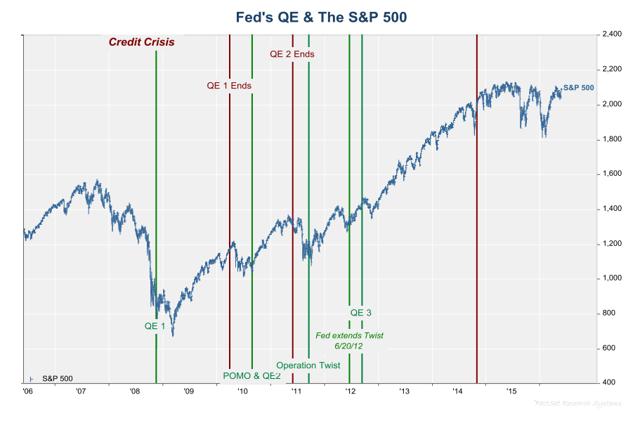

Adding further to this case, anytime the S&P 500 Index has weakened materially over the last seven years, the Fed has always come to the rescue.

Conclusion – An Irrational Fear Of Deflation

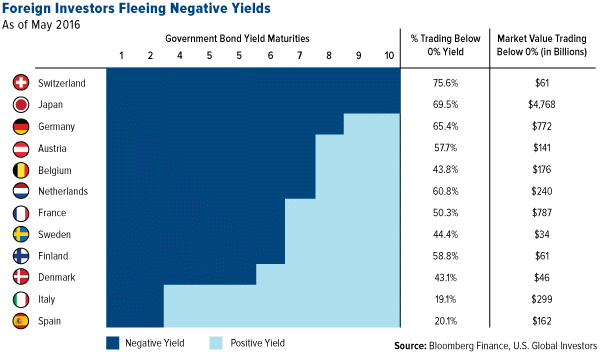

Global sovereign bond yields are under a renewed wave of selling pressure. According to U.S. Global Investors, who has a terrific suite of research, $7.5 trillion of global sovereign bonds now trade at negative interest rates, meaning investors are willing to pay money, on an annual basis, for the security of holding sovereign debt in $7.5 trillion worth of securities.

The willingness of investors to give up principal for price security has, understandably, ratcheted up the fears of deflation. These deflationary fears are completely unfounded, as inflationary assets are experiencing their largest price increases in over five years.

Adding to the case against deflation are the facts that U.S. GDP growth is on pace to accelerate in the second quarter of 2016, and inflationary pressures, as measured by the “Core CPI”, have actually picked up in the United States over the last six months, printing their highest readings since the bull market began in March of 2009…

To close, if you think the Fed, and other central bankers are going to stand aside, and let the creative destructive forces of capitalism run their natural course, feel free to buy sovereign bonds and bet on a deflationary bust. However, if you believe that central banks will continue to intervene, and combat the downturn in the real economy with liquidity, then inflation is the only outcome.

Disclosure: The above article was edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money