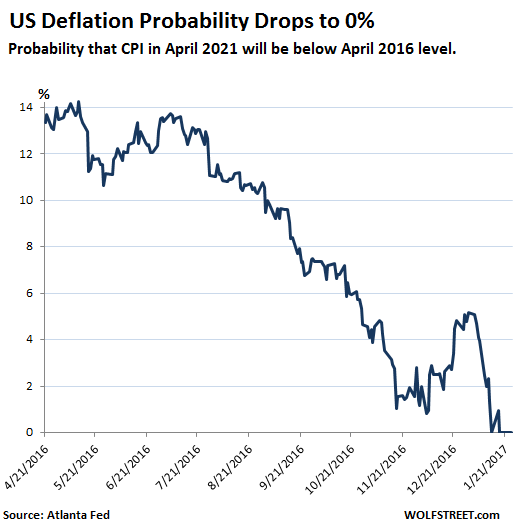

According to the Atlanta Fed’s closely watched “Deflation Probabilities” indicator, overall prices in the U.S., as determined by the Consumer Price Index, now have exactly 0% chance of dropping over the next 5 years, down from a probability of 14.1% in May last year.

indicator, overall prices in the U.S., as determined by the Consumer Price Index, now have exactly 0% chance of dropping over the next 5 years, down from a probability of 14.1% in May last year.

The comments above and below are excerpts from an article by Wolf Richter (WolfStreet.com) which has been edited ([ ]) and abridged (…) to provide a fast & easy read.

The scourge of consumer price deflation has been brandished furiously by central banks around the world in order to justify radical, scorched-earth monetary policies such as:

- zero-interest-rate policy (ZIRP),

- the entire absurdity of negative-interest-rate policy (NIRP),

- and asset purchases not only of government bonds but also of everything else, depending on the central bank, including corporate bonds, stocks [and] asset-backed securities…

Central banks have also brandished the threat of other mayhem that could befall the earth if it weren’t for those policies, but the threat of consumer price deflation has played a critical role.

Well, according to the Atlanta Fed’s closely watched “Deflation Probabilities” indicator, those of you in the U.S…[need not] worry: your overall prices, as determined by the Consumer Price Index, now have exactly 0% chance of dropping over the next five years, down from a probability of 14.1% in May last year.

…In my entire life, I’ve [only] suffered through 3 quarters of mild year-over-year deflation (when prices were slightly lower than a year earlier) [which occurred] during the financial crisis [of 2008], but many decades of inflation, including some in the double digits…so I’m glad that the probability of this evil condition returning to the U.S. over the next five years has fallen to 0%…

…[The chart below] is based on data from the Atlanta Fed. It shows the probabilities, as registered over time, that CPI in April 2021 will be below its April 2016 level (which is when this data series begins). This series started out high due to the collapse in oil prices:

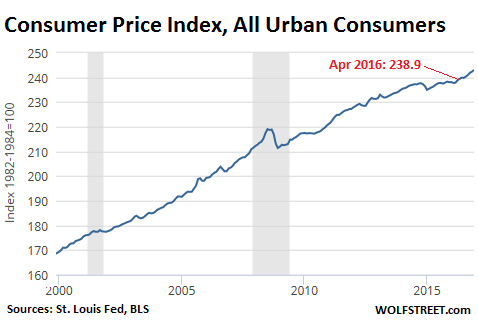

…[The chart above concludes that] there is 0% probability that in April 2021, CPI will be below where it had been in April 2016. At that time, CPI was at 238.9. At the last release, CPI for December was already at 243:

The Atlanta Fed’s Deflation Probabilities indicator is based on estimates derived from the markets for Treasury Inflation-Protected Securities…so these data points are the consolidated predictions made on a daily basis over time by the many participants in a very nervous US government bond market and they’re not worried one bit about deflation through 2021. They’re worried about inflation.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money