…Negative interest rates were embraced following the 2008 financial crisis in an effort to boost global economies. The purpose was to make borrowing easier. When interest rates are low, businesses and individuals are more likely to borrow. Unfortunately, the resulting sub-zero interest rates were the exact opposite than those intended.

Normally, a bank or lender pays the depositor to place his or her funds with the bank. When those interest rates drop below zero percent, the depositor ends up paying the bank to hold its money. In other words, the depositor loses money by keeping funds in a bank.

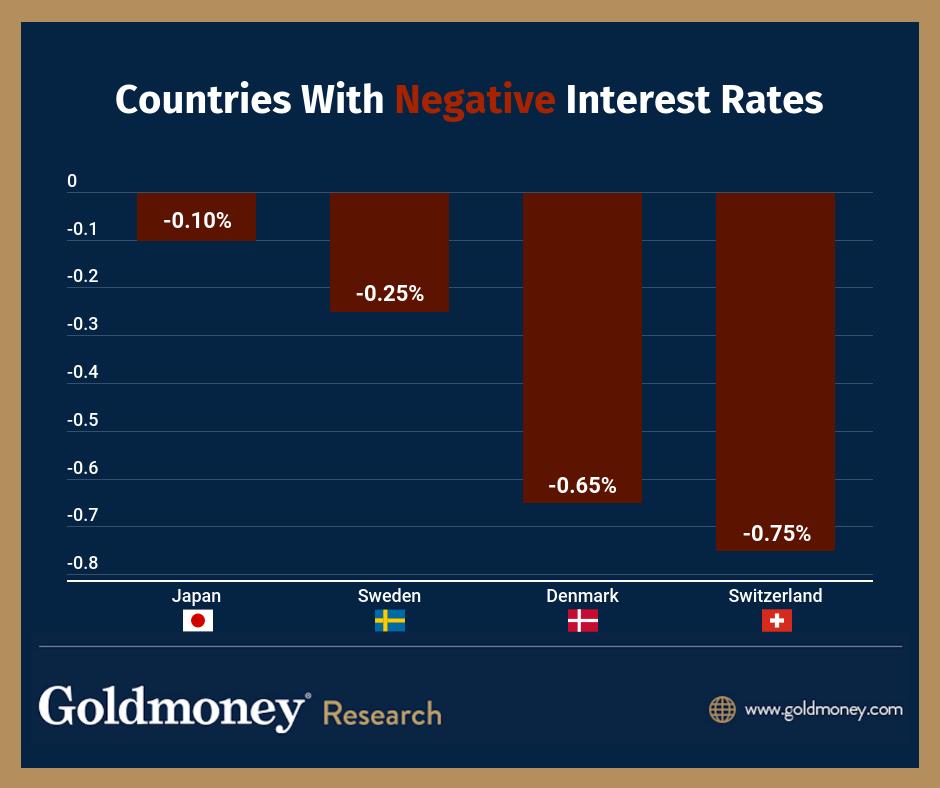

Globally, central banks have been buying up bonds…This is especially relevant in Europe and Japan. The U.S. is nearing negative interest rates, with the current Federal Reserve interest rate standing at 2.5 percent. In 2014, several European central banks, such as Sweden, Switzerland, and Denmark, slashed interest rates below zero, and the Bank of Japan soon followed. This has become a normal economic policy…

When central banks drop their interest rates, the economy suffers instead of improving. Lending ceases to be profitable as banks have less of an incentive to act as lenders. Ultimately, instead of boosting the economy, central banks’ policy of negative interests effectively serves to decrease any economic growth. Investors lose money instead of making money.

The theory that subzero interest rates lower the cost of borrowing has shown to be false. It has not proven to bring about the anticipated economic stimulus that central banks initially anticipated. Instead of paying banks to hold their money, businesses and individuals will find other sources in which to put their money…

Nearly half of corporate CFO’s anticipate a recession by the end of the year. While the U.S. Federal Reserve Bank continues to manipulate the economy with artificially low-interest rates, this policy is likely to backfire in the event of a recession. The Federal Reserve’s policies mask the true state of the economy and could bring about the recession it claims it wants to avoid…

With the Federal Reserve keeping interest rates low no one really knows how will it act during a recession and that is the real problem. Continuing a policy of negative interest rates will prove detrimental in the long run.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

So much for experimental fiddling, trying to prolong the life of an old economic cycle with heroic artificial life support.