There exists in the Congress, in the Obama administration, in the media and on Wall Street, a national belief that America can print paper money and grow its economy as its route map out of debt. With annual GDP growth expectations of 2% to 3% over the next several years, this is a completely false hope!

Street, a national belief that America can print paper money and grow its economy as its route map out of debt. With annual GDP growth expectations of 2% to 3% over the next several years, this is a completely false hope!

So write Christopher Funston & Ian A. Gordon (LongwaveGroup.com) in an article* originally entitled Desperate Acts to Retain the Paper Monetary System going on to say:

Within the current global economic environment, central bankers – of the world’s developed economies and those of emerging markets alike – remain obsessed with the struggle to incorporate monetary policies which will engender renewed gross domestic product (GDP) growth in their respective economies. These central bankers have been led by the example of the U.S. Federal Reserve, whose implementation of a multi-year quantitative easing program, i.e. the $4.5 trillion (U.S.) purchase of U.S Treasurys and mortgage-backed securities, has been coupled with the maintenance of historically low administered interest rates; such as the present 0% – 0.25% range for the Federal Funds Rate.

Complicating the global GDP growth challenge has been the persistent increase in the debt levels of many sovereign credits, once again led by the United States, whose national debt level now exceeds $18 trillion (U.S.) – that’s $18,000,000,000,000 (U.S.).

The Folly of Elastic Money

In his book Paper Money Collapse, author Detlev Schlichter recounts how the recent financial crisis has exposed the instability of the global financial system. While there is always plenty of talk of reform, only a few economists are yet willing to consider that the root cause is the limitless supply of paper money.

Subscribe to munKNEE.com’s free Market Intelligence Report (sample here)

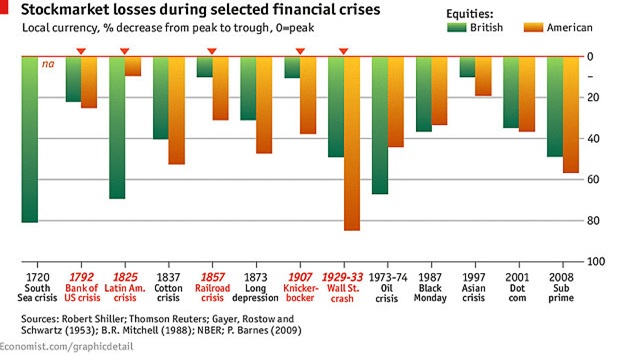

All paper money systems have either collapsed in chaos, or society has returned to commodity money – usually based on gold – before a total currency disaster occurred. Such controversial conclusions clash with today’s general consensus that elastic state money is superior to inflexible commodity money. Moreover, the majority of economists believe that expanding the money supply is harmless or even beneficial as long as the inflation rate remains low. A great many people working in the financial markets, in the media and in monetary policy positions are unwilling to appreciate the underlying problems with elastic money and the danger it presents.

The U.S. Dollar’s 70-Year Dominance Is Coming to an End

In a recent Daily Telegraph article, journalist Liam Halligan wrote: Seventy years ago the Bretton Woods agreement marked the moment the dollar’s unquestionable supremacy was secured. Since then, global commerce has been conducted largely in dollars and leading economies have held the greenback as their primary reserve currency. The same system remains intact today, with the lion’s share of commercial settlements worldwide still clearing the U.S. banking system; even if the parties involved have nothing to do with the United States. Meanwhile, the dollar’s hegemony continues to be cemented by the operations of the International Monetary Fund (IMF) and the World Bank. Founded at Bretton Woods, they are both Washington-based and controlled by America. The advantages this system bestows upon the United States are enormous. Reserve currency status generates huge demand for dollars from governments and companies around the world, as they are needed for reserves and trade. This has permitted successive American administrations to spend far more than is raised in taxes and export revenues, year-in and year-out. [As such,] America doesn’t worry about balance of payments crises, since it can pay for imports in dollars the Federal Reserve can just print. Indeed, Washington keeps spending willy-nilly as the world buys ever more Treasurys on the strength of regulatory imperative and the vast size of the U.S. debt market.

A Nation in the Red

In his book of the above title published earlier this year and which focuses on the U.S. government debt crisis, author Murray Holland concludes: Our government debt is rising every day. Our population is shifting as more people retire and fewer are able to find work. Our social programs, including the Affordable Care Act (Obamacare), are not only adding to our financial burden, but are also hindering our domestic economic growth.

“Follow the munKNEE” daily on Twitter

The United States is in very deep financial trouble.

- Firstly, the concept of repaying $18 trillion (U.S.) in debt is not even a remote possibility over the next 100 years even if the government produced small surpluses.

- Then, because the country is recording such large deficits, the national debt is increasing and getting worse, indeed much worse.

- In addition, the government has approximately $70 trillion (U.S.) in unfunded liabilities which must be resolved. This means it needs to either decrease the benefits – primarily under Medicare and Social Security – or to increase taxes, or both.

- Pray that the market for the national debt remains open so the United States can keep borrowing to repay the money it previously borrowed and then, the government will have to re-borrow to repay the money it just borrowed.

- There is no chance the bond market will not change its demeanor over the next 100 years. It will certainly experience periods of higher interest rates and bond yield levels. It will also witness times of lack of demand for Treasurys, due to economic pressures and geopolitical events around the world.

- Even under the Obama administration budget deficit trend, interest expense for outstanding Treasury issues will exceed $1 trillion (U.S.) a year by 2022.

- The scenario of worse-than-projected tax receipts for the government, along with considerably higher than disclosed liabilities, is a recipe for disaster for the United States.

Conclusion

If you are not terrified at the thought of the collapse of the United States, you should be. Almost everyone in the world will be negatively affected, particularly the poor…

The above post is presented compliments of www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

*http://www.longwavegroup.com/publications/economic_winter/2014/_pdf/Economic_Winter_V63_I1_Paper_Monetary_System.pdf (Copyright © Longwave Group 2014. All Rights Reserved.)

Post a Comment on this article (Scroll down to bottom of page)

Related Articles:

1. There’s debt, Then There’s Debt, Then There’s U.S. DEBT

The next time someone says, “The US is the richest country on Earth” correct them and state that “The U.S. is the most bankrupt and indebted country in the history of the world” because that’s reality. Let me explain. Read More »

2. We’re Doomed! Rising Interest Rates Will Cause Our Financial System To Implode

We’re doomed! Even if the economy were growing at a faster pace, it wouldn’t come close to offsetting the interest payments on our ever-expanding debt. As such, any sort of credit shock – either rising rates or a decline in the rate of debt expansion – will cause the system to implode. Let me explain why that is the case. Read More »

3. What Could – What Will – Pop This “Money Bubble”?

There is too much debt. Debt works the same way for a country as it works for an individual or a family, which is to say if you borrow too much, then your life basically craters. Everything gets harder to do, and you end up doing things in order to deal with your past mistakes that you would never do normally. You start trying absolutely crazy things, and that’s where the world’s governments are right now. We are doing all these things that are essentially con games and getting away with it so far, because a printing press is a great tool for fooling people. I don’t see how we can get away with it too much longer. Read More »

4. $17+ Trillion U.S. National Debt Adversely Affects Every American – Here’s Why & How

For the first time in U.S. history, the national debt has risen past $17 trillion. That number is a bit hard to comprehend and means little to Americans when not applied to their everyday lives. So just how does the national debt affect consumers, and why should the average American care about how much this country owes? Here’s why and how. Read More »

5. Monetary System Collapse Guaranteed – Here’s Why & How to Invest & Insure Your Wealth Accordingly

Our monetary system is guaranteed to collapse. The central banks prints money like there is no tomorrow. The governments spends like a drunken sailor and yet inflation is benign and interest rates sit at generational lows. Banks are gaining in profitability while their bad debts are being erased by rising asset prices. What’s not to like? Plenty! This article goes into the details of the money creation process to understand how and why this is happening, what the future implications will be and how to best invest to protect oneself from these eventualities. Read More »

6. U.S. Dollar Collapse Will Be Cataclysmic Endgame of Current Fiscal Policy

Government fiscal policy – profligate spending, leading to debt crisis, leading to currency crisis, leading to…the fall of the U.S. dollar – is the major cataclysmic endgame that is going to befall the U.S. Read More »

7. Borrowing Binge & Asset Bubble to Continue Until…Until

History strongly suggests that, rather than a return to a nice, placid world of “normal” interest rates, we are likely to see a continuation of the borrowing binge/asset bubble until real rates spike as a result of either soaring nominal rates soar or plummeting inflation. Here’s why that is the case. Read More »

8. Inflation Will Become a Huge & Growing Problem Beginning In 2015 – Here’s Why

A temporary period of deflation will result from the end of the Fed’s massive asset purchases followed by a period of inflation that will make the ’70s seem like an era of hard money. Here’s why. Read More »

9. High Inflation IS Coming – It’s Just A Question Of When – Here’s Why

There have been many econoblog posts of the form, “ha, ha, the people predicting inflation have been wrong so far, when will they give up?”. Let me try to explain why we know high inflation is coming eventually. Read More »

10. It’s Imperative That You Know ALL About Interest Rates! Here’s Why & How To Do So

I read hundreds of financial articles every week and most are nothing more than “financial entertainment” – unfounded forecasts, fear mongering or cheer-leading. That being said, there are a number of articles that are absolutely MUST READS if you are to become an informed investor and be in position to understand what is evolving in the financial environment and act accordingly. Introductory paragraphs and links to a number of them are provided in this post. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money