I see gold going lower and lower eventually breaking below the psychological figure of $1,000 and perhaps even testing the $850 level to break the back of gold bugs and get the CNBC cheerleaders to claim the gold bull dead.

$1,000 and perhaps even testing the $850 level to break the back of gold bugs and get the CNBC cheerleaders to claim the gold bull dead.

The above introductory comments are edited excerpts from an article* by Doug Eberhardt (buygoldandsilversafely.com) entitled Is Deflation Still A Threat To Gold?.

Eberhardt goes on to say in further edited excerpts:

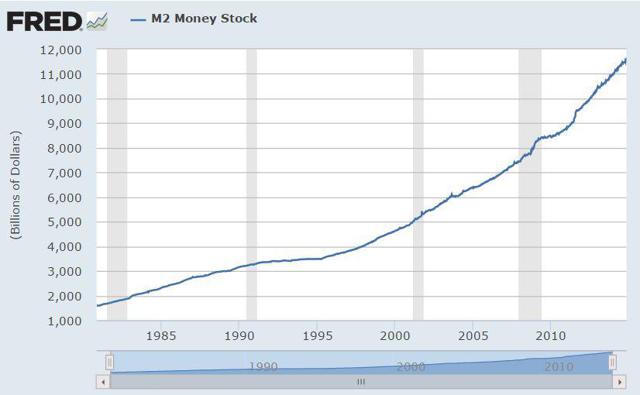

Money Supply

When you talk to investors as to why they buy gold many:

- look to the precious metal as being a hedge against inflation but, since 2011, we have been experiencing deflation and the yellow metal has felt the effect of an overall declining commodity market…and also

- many others point to inflation in the money supply, which…can be clearly seen in the chart below, but the problem is that it is not circulating…

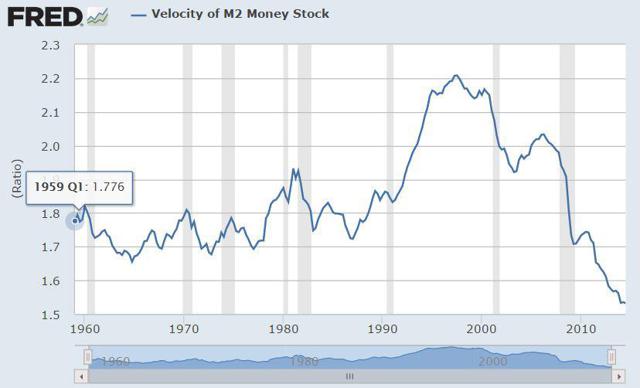

Money Velocity

The Fed doesn’t like this [lack of circulation] but even putting interest rates to zero won’t force consumers and businesses to spend. We have not seen this much of a decline in velocity in the 54 years that the Federal Reserve Bank of St. Louis has provided the chart presented below…This is a modern day unprecedented issue the Fed is fighting and is a possible precursor to more QE down the road if necessary to get money moving (inflation target of 2%).

When Bernanke was Fed Chairman he was very clear in his 2002 speech Deflation: Making Sure “It” Doesn’t Happen Here what the Fed would do during deflation…and there is no doubt in my mind that the Yellen-led Fed would implement more QE if interest rates started to shoot up past 3.06%.

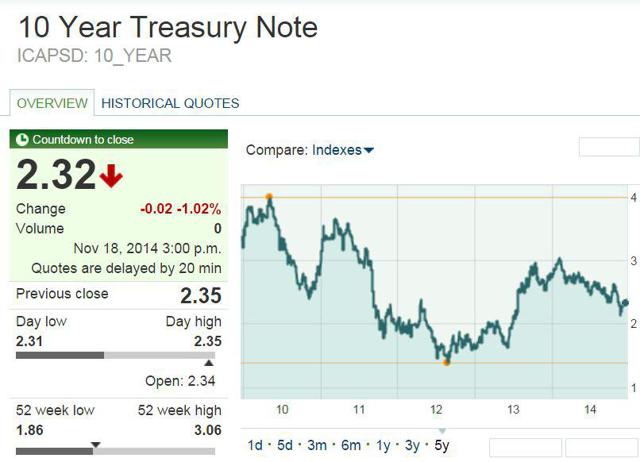

Interest Rates Coming?

The financial media keeps telling us the economy is moving along just fine and higher rates are coming based on the fact the Fed says higher rates are coming but what does the price action of rates show us? Interest rates are still low. The 3.06% rate mentioned above comes from the high of the last 12 months reached last year.

A decline of .02 on the 10 Year Treasury Note was the reaction for interest rates today despite the better than expected PPI report.

Commodities Declining

While we will get bounces in various commodities from time to time, like natural gas of late with the onslaught of winter snow hitting 50% of America earlier than expected, they are still mired in deflation and the Fed just can’t see it.

Have you seen commodity charts since 2011? Below is a chart of the Continuous Commodity Index (CCI)…[which] is the CRB index in its original equal weight form from 1957.

As you can see from the above chart, the 17 commodities that make up the index, including grains, oil and metals, [have] all…[been] falling in price since 2011. Sure, when you go to the grocery store you’ll see many products that have higher prices but some of that is related to the California drought driving up food prices…

One cannot consider higher college tuition costs or government health care-related prices being higher inflation related, because anything the government guarantees in price gives the companies doing the selling carte blanche to raise prices.

Dollar Still Bullish

As you can see from the chart below the dollar has been bullish since 2011. This just so happens to be the year for the top in gold and silver. Deflation has a tendency to be dollar bullish, the opposite of inflation…

Dollar Strength Hurts U.S. Producers

…In order to become more competitive and see your economy grow, you have to make your currency weaker. Currencies that are too strong or too weak not only affect individual economies, but tend to distort international trade and economic and political decisions world-wide…This is compounded by the fact that individual consumers can benefit from changes in the value of a currency, while producers in the same country are hurt…

Europe and Japan Experiencing Recession and Deflation

Japan and Europe had worse than expected data come out this week.

- Economic data showed the Japanese economy in the last quarter contracted fueling hopes of more stimulus or a postponement of a sales tax hike due next year.

- The IMF came out last week and said that the euro zone growth could be worse than expected.

Does the Fed not see that this could have an effect on the U.S.? Are some of the M&A deals offsetting the fact that American industrial production declined? Is the stock market possibly overvalued or does price action trump everything and follow the trend higher with stops? The trend is your friend and it sure hasn’t hurt those with 401k’s.

Consumer Confidence

…Perhaps the Fed believes the consumer knows all, but clearly they don’t despite October’s good consumer confidence numbers. Maybe the Fed should listen to the Measure of CEO Confidence where “slightly more than 44% of business leaders anticipate economic conditions will improve over the next six months, down from 53% last quarter”…

The Fed is Reactive

The Fed reacts AFTER the fact…[They] lowered interest rates pre-2008 to…stimulate the economy… [and we had] the financial crisis of 2008 and, when this current lower interest rate experiment fails, we will see more intervention. Anyone see a pattern here?…Eventually the U.S. will be swallowed up even more into this deflationary spiral and the Fed will fight it all the way…

How All this Deflation Relates to Gold Today

Gold prices are still feeling the effects of many of the issues I brought up above. This includes:

- a stronger dollar,

- no real inflation,

- commodities in a downward trend,

- countries experiencing deflation,

- strong treasuries,

- no money velocity

- and you can add a stock market that keeps money moving towards it rather than a beaten down asset like gold.

One can not ignore the above.

My Advice

My advice is to still dollar cost average into a position in the metals. While many utilize ETFs… to play the metals I think an investor should hold the real thing. Some may say that is because I sell the physical for living, but when you analyze the prospectus and see that these ETFs are not insured and the other problems associated with them, I view them only as trading vehicles.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://buygoldandsilversafely.com/gold/is-deflation-still-a-threat-to-gold/9© Copyright 2012 Buy Gold and Silver Safely · All Rights Reserved )

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. $3,000 – $4,500 Gold a Possibility With Continuing Growth of Fed’s Balance Sheet

Since 1999 the gold price has moved in concert with the growth in the US Federal Reserve Balance Sheet including the recent correction in both during the past three years. Accordingly, the following objective analysis forecasts the gold price out to 2016 based solely on historical Central Bank data. Read More »

2. Silver: $15 or $150? Gold: $1,000 or $10,000? 12 Forecasters Have Their Say

The internet is awash with analysts who believe that gold is going UP to $10,000 or DOWN to $1,000 and that silver is going DOWN to $15 or UP to $300. They grab a lot of attention in the media which must soothe their egos but are their prognostications worth paying attention to or are they just a lot of hot air? This site has decided to call their number. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Happy Thanksgiving Day to all those that celebrate it!

I believe that we are seeing a global effort to use paper trading (aka Naked Shorting) to move the PM prices downward which is allowing the really large investors and the Countries they control to acquire physical PM’s at low prices.

Lets use China as an example, they hold tons of Gold so they can easily use naked shorting, since if they get “caught” they can always simply give up some of their physical Gold. This allows them to use their physical PM’s as “leverage” to move PM’s to their own advantage.

In another example, they could decide to “dump” enough US$ to make up for any loses they have, which would then probably make the prices of PM go up (as compared to the US$).

Sooner or later, some combination of events will cause physical PM’s value to start increasing rapidly and when that happens all those still holding paper PM’s will be unhappy to say the least.

Also posted :

https://munknee.com/noonan-rallies-gold-silver-dont-suggest-change-downward-trends-yet/