Goldman Sachs’ 2014 forecast that gold will drop $1,050 by the end of the year (based on the “powerhouse” U.S. economy picking up speed and accelerating growth) would make perfect sense to someone who recently had had a frontal lobotomy or to the 95-99% group of Americans who believe everything coming from the Boob Tube.Why? Because Goldman has more skin in the game to delude Americans of the value of gold – for throwing the paper price of gold under the bus – and below are 2 such reasons for doing so:

U.S. economy picking up speed and accelerating growth) would make perfect sense to someone who recently had had a frontal lobotomy or to the 95-99% group of Americans who believe everything coming from the Boob Tube.Why? Because Goldman has more skin in the game to delude Americans of the value of gold – for throwing the paper price of gold under the bus – and below are 2 such reasons for doing so:

So says Steve St. Angelo (srsrocco.com) in edited excerpts from his original article* entitled Goldman Sachs Is Highly Motivated To Low-Ball The Price Of Gold.

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and the FREE Market Intelligence Report newsletter (sample here; register here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Goldman’s forecast is not for the well-educated precious metal investors that they realize don’t believe a word coming from their talking heads but is, instead, designed and targeted at Americans who still believe in the Greatest Fiat Ponzi Scheme in history, Below are 2 such reasons for doing so:

1. Extremely Low Assets to Derivatives Ratio

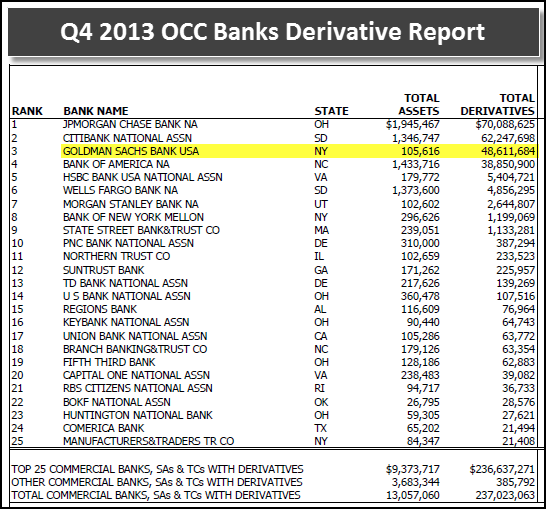

Goldman Sachs has serious motivation for throwing the paper price of gold under the bus. Why? Because Goldman is by far the weakest and most vulnerable bank when it comes to its Assets to Derivatives ratio. Below is a table showing the most recent break-down of Derivatives holdings by the top 25 U.S. Commercial Banks from the OCC’s Q4 2013 Report on Bank Trading and Derivatives Activity:

Let’s focus on the top 4 banks. Notice that, while Goldman has $48.6 trillion in derivatives on its books, it only has $105 billion in assets to back it up. Dividing each of the top 4 U.S. banks assets to derivative holdings, we have the following percentages:

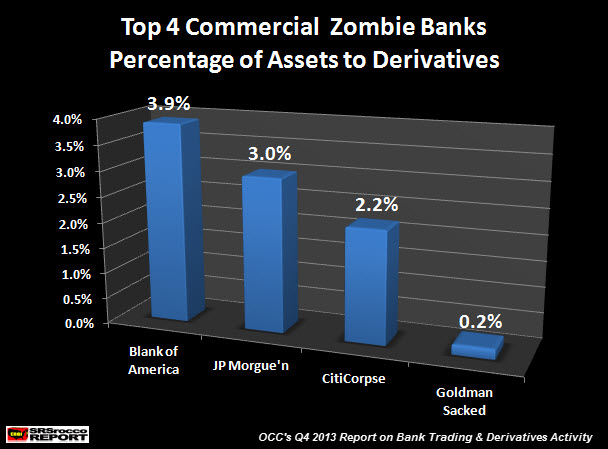

Starting with the best of the worst Zombie Banks, Blank of America has a 3.9% asset to derivatives ratio, while JP Morgue’n comes in second with 3%, Citicorpse follows third at 2.2% and Goldman Sacked places dead last with a pathetic 0.2% in assets to back up its $48.6 trillion in notional derivatives.

I find it simply hilarious that the bank with the worst asset to derivative ratio has the gall to throw out a STINK BID of $1,050 gold but we really can’t blame them as they have the most to lose if things were to get out of control in the markets.

2. Extremely High % of Interest Rate Swaps

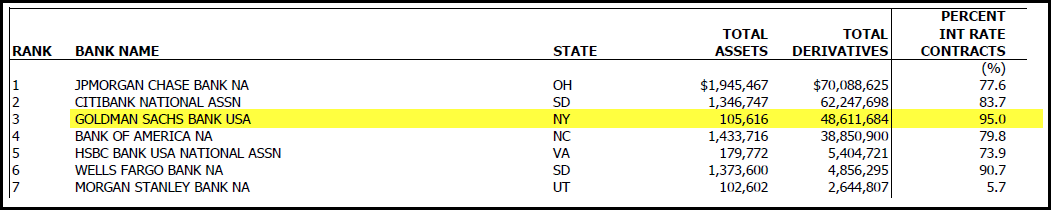

Another reason Goldman has more SKIN in the game to delude Americans of the value of gold is their exposure to the Interest Rate Swap market. Out of the top 7 U.S. Banks, Goldman Sacked holds the highest percentage of Interest Rate Swaps:

With 95% of its derivatives invested in Interest Rate Contracts Goldman also needs the Fed to keep interest rates low. If interest rates were to rise substantially, Goldman would be on the losing end of the trade.

Conclusion

The global financial system is leveraged more than ever. Leverage is great on the way up, but certainly a BEE-OTCH on the way down, so we precious metal investors need to understand that these banks are forced to LIE, CHEAT and STEAL even more as the leverage on their balance sheets becomes greater…. especially GOLDMAN SACKED.

Lastly, to all the PRECIOUS METAL GADFLY’s who enjoy going around to all the sites sharing their wonderful wisdom that gold and silver are lousy investments…. please continue to do so. We all enjoy a good laugh once in a while.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://srsroccoreport.com/goldman-sachs-motivation-to-low-ball-the-price-of-gold/goldman-sachs-motivation-to-low-ball-the-price-of-gold/ (© 2014 SRSrocco Report. All rights reserved.)

Related Articles:

1. Derivatives: Their Origin, Evolvement and Eventual Corruption (Got Gold!)

The term “derivative” has become a dirty, if not evil word. So much of what ails our global financial system has been laid-at-the-feet of this misunderstood, mis-characterized term – derivatives. The purpose of this paper is to outline the origin, growth and ultimately the corruption of the derivatives market – and explain how something originally designed to provide economic utility has morphed into a tool of abusive, manipulative economic tyranny. Words: 3355 Read More »

2. Will Rising Interest Rates Ignite the Derivatives Time Bomb?

Of the $200+ trillion in derivatives on US banks’ balance sheets, 85% are based on interest rates and for that reason I cannot take any of the Fed’s mumblings about raising interest rates seriously at all. Remember, most if not all, of the bailout money has gone to US banks in order to help them raise capital. So why would the Fed make a move that could potentially destroy these firms’ equity and essentially undoing all of its previous efforts? That being said I still see derivatives as a trillion dollar ticking time bomb with a short fuse. Words: 506 Read More »

Only when derivatives are discussed by one of the ‘Real Housewives of Atlanta’ posing nude in bed with one of the cast members of ‘Duck Dynasty’ will derivatives receive the attention they deserve. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money